Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the same question !! As ..The DA B OR Oe On the www. wer! QA HO OC All-tax cost of debt Personal Finance Problem

all the same question !!

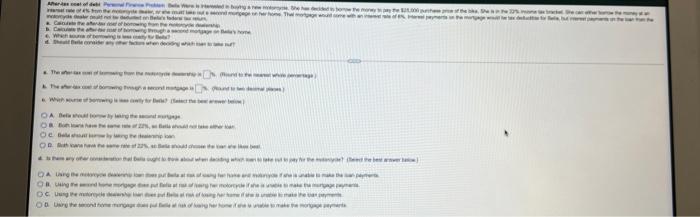

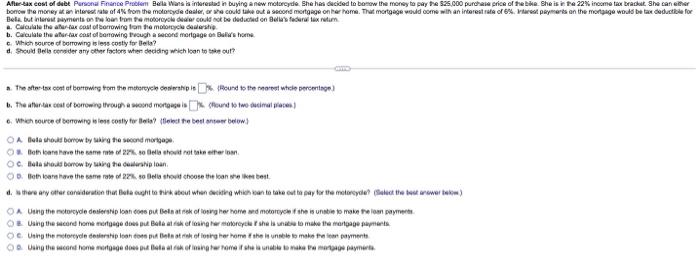

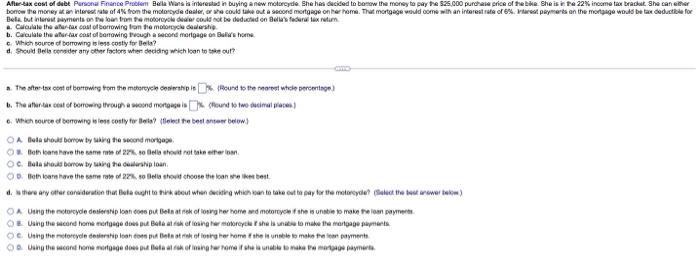

As ..The DA B OR Oe On the www. wer! QA HO OC All-tax cost of debt Personal Finance Problem Bela Was is interested in buying a new motorcyde. She has decided to bmw the money to pay the 325.000 purchase price of the be. She is in the 22% income tax bracket She cancer borow the money in interest rate of 4% from the motoryde deler, or he could take out a second mortgage on her home. The mortgage would come with an interest rate of 6% payments on the mortgage would be tax deducted for Bela but internaments on the bar from the motor de could do te deducted on weder tax return .. Calculate the aller cox cost of borrowing on the motorcycles 6. Calculate the startar cast of bamowing touched mortgage ca Bele home Which source of borrowing is los costly for Vela? d. Should Bell consider any other factors who decide which loan to take out? The state cont of borrowing from the motorych nichts found to the more whicle permitan The words out of tomower ou soond mortgage Caround wo wo dime) 6. Which ouren of bonown ecolytroba (lect the botter below) O A hela hukborrow by ng the second mortgage Os Bolange the same 22. 0 la hot rottinetter OC. et bowow bywing the Grilon 0 Bath and how the same 22% to ello hot choose the loan the like best hay other consideration that Bala cught tok about when it wie kante tole the pay tor the materialet the best werew) OA Utenorcycle detieni loan como puede askoftorghe home med motorcycle ble to main on Day O Using the second home mortgage des Ballering er trycker shell to make the martesans Oc Using the forcycle desplantatiofiorg her home the insbe to make the payments Quing the condomerge de lange the woman All-tax cost of debt Personal Finance Problem Bela Was is interested in buying a new motorcyde. She has decided to bmw the money to pay the 325.000 purchase price of the be. She is in the 22% income tax bracket She cancer borow the money in interest rate of 4% from the motoryde deler, or he could take out a second mortgage on her home. The mortgage would come with an interest rate of 6% payments on the mortgage would be tax deducted for Bela but internaments on the bar from the motor de could do te deducted on weder tax return .. Calculate the aller cox cost of borrowing on the motorcycles 6. Calculate the startar cast of bamowing touched mortgage ca Bele home Which source of borrowing is los costly for Vela? d. Should Bell consider any other factors who decide which loan to take out? The state cont of borrowing from the motorych nichts found to the more whicle permitan The words out of tomower ou soond mortgage Caround wo wo dime) 6. Which ouren of bonown ecolytroba (lect the botter below) O A hela hukborrow by ng the second mortgage Os Bolange the same 22. 0 la hot rottinetter OC. et bowow bywing the Grilon 0 Bath and how the same 22% to ello hot choose the loan the like best hay other consideration that Bala cught tok about when it wie kante tole the pay tor the materialet the best werew) OA Utenorcycle detieni loan como puede askoftorghe home med motorcycle ble to main on Day O Using the second home mortgage des Ballering er trycker shell to make the martesans Oc Using the forcycle desplantatiofiorg her home the insbe to make the payments Quing the condomerge de lange the woman Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started