Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all this questions should answered by with their EXCEL FORMULA. The city of Erstville is faced with a severe budget shortage. Seeking a long-term solution,

all this questions should answered by with their EXCEL FORMULA.

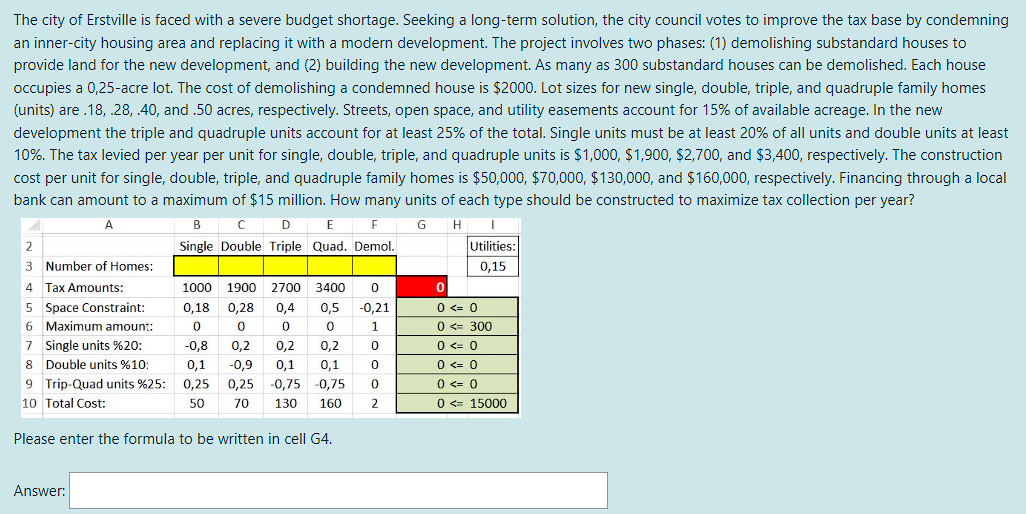

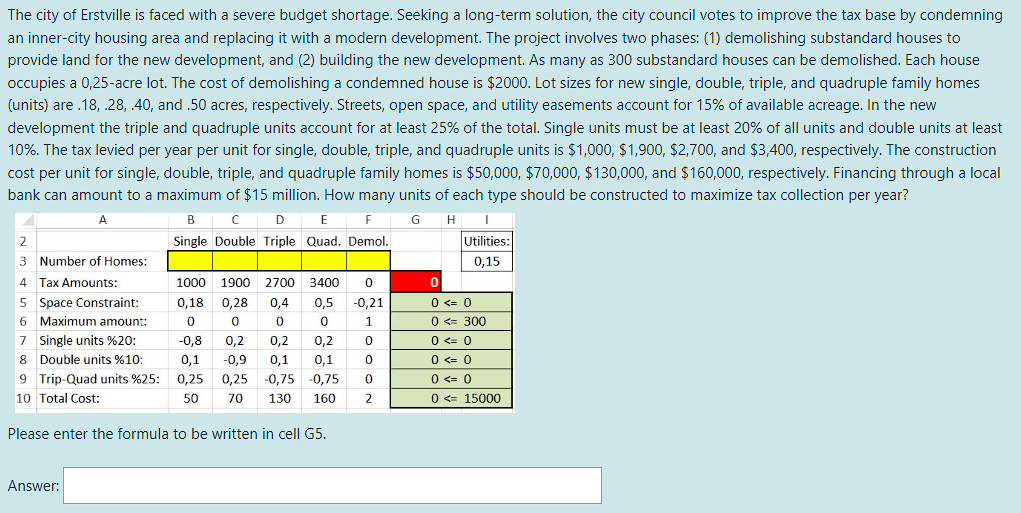

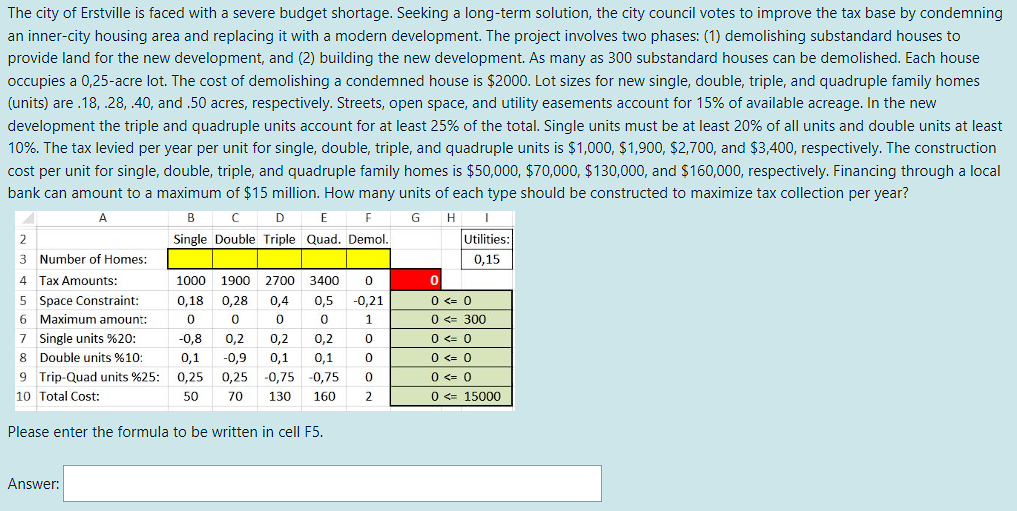

The city of Erstville is faced with a severe budget shortage. Seeking a long-term solution, the city council votes to improve the tax base by condemning an inner-city housing area and replacing it with a modern development. The project involves two phases: (1) demolishing substandard houses to provide land for the new development, and (2) building the new development. As many as 300 substandard houses can be demolished. Each house occupies a 0,25-acre lot. The cost of demolishing a condemned house is $2000. Lot sizes for new single, double, triple, and quadruple family homes (units) are . 18,.28,.40, and .50 acres, respectively. Streets, open space, and utility easements account for 15% of available acreage. In the new development the triple and quadruple units account for at least 25% of the total. Single units must be at least 20% of all units and double units at least 10%. The tax levied per year per unit for single, double, triple, and quadruple units is $1,000,$1,900,$2,700, and $3,400, respectively. The construction cost per unit for single, double, triple, and quadruple family homes is $50,000,$70,000,$130,000, and $160,000, respectively. Financing through a local bank can amount to a maximum of $15 million. How many units of each type should be constructed to maximize tax collection per year? Please enter the formula to be written in cell G4. The city of Erstville is faced with a severe budget shortage. Seeking a long-term solution, the city council votes to improve the tax base by condemning an inner-city housing area and replacing it with a modern development. The project involves two phases: (1) demolishing substandard houses to provide land for the new development, and (2) building the new development. As many as 300 substandard houses can be demolished. Each house occupies a 0,25-acre lot. The cost of demolishing a condemned house is $2000. Lot sizes for new single, double, triple, and quadruple family homes (units) are .18, .28, .40, and .50 acres, respectively. Streets, open space, and utility easements account for 15% of available acreage. In the new development the triple and quadruple units account for at least 25% of the total. Single units must be at least 20% of all units and double units at least 10%. The tax levied per year per unit for single, double, triple, and quadruple units is $1,000,$1,900,$2,700, and $3,400, respectively. The construction cost per unit for single, double, triple, and quadruple family homes is $50,000,$70,000,$130,000, and $160,000, respectively. Financing through a local bank can amount to a maximum of $15 million. How many units of each type should be constructed to maximize tax collection per year? Please enter the formula to be written in cell G5. The city of Erstville is faced with a severe budget shortage. Seeking a long-term solution, the city council votes to improve the tax base by condemning an inner-city housing area and replacing it with a modern development. The project involves two phases: (1) demolishing substandard houses to provide land for the new development, and (2) building the new development. As many as 300 substandard houses can be demolished. Each house occupies a 0,25-acre lot. The cost of demolishing a condemned house is $2000. Lot sizes for new single, double, triple, and quadruple family homes (units) are .18, .28, .40, and .50 acres, respectively. Streets, open space, and utility easements account for 15% of available acreage. In the new development the triple and quadruple units account for at least 25% of the total. Single units must be at least 20% of all units and double units at least 10%. The tax levied per year per unit for single, double, triple, and quadruple units is $1,000,$1,900,$2,700, and $3,400, respectively. The construction cost per unit for single, double, triple, and quadruple family homes is $50,000,$70,000,$130,000, and $160,000, respectively. Financing through a local bank can amount to a maximum of $15 million. How many units of each type should be constructed to maximize tax collection per year? Please enter the formula to be written in cell F5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started