Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all three questions please read the questions carefully Problem 3-10 The Tuff Wheels was getting ready to start its development project for a new product

all three questions please read the questions carefully

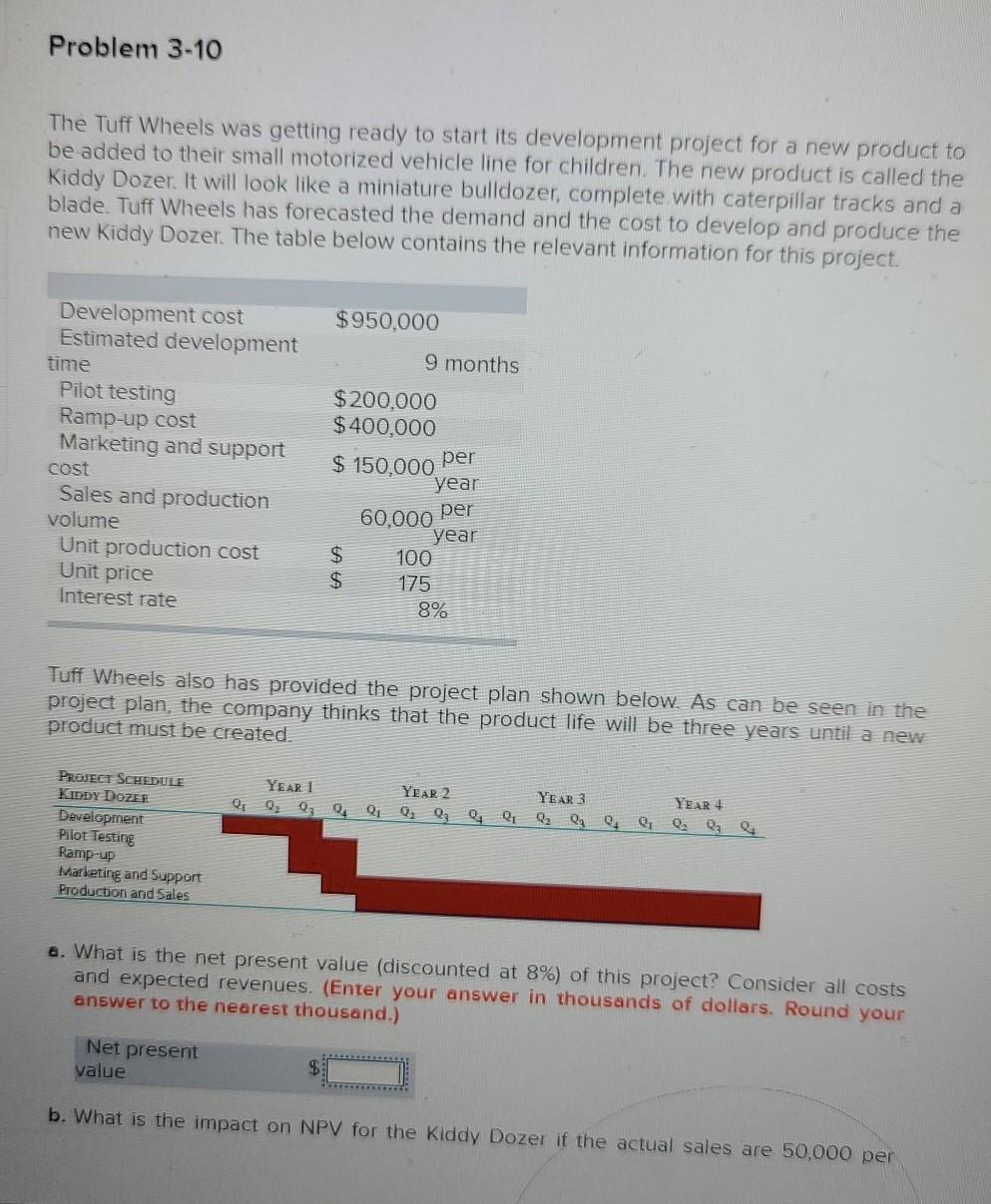

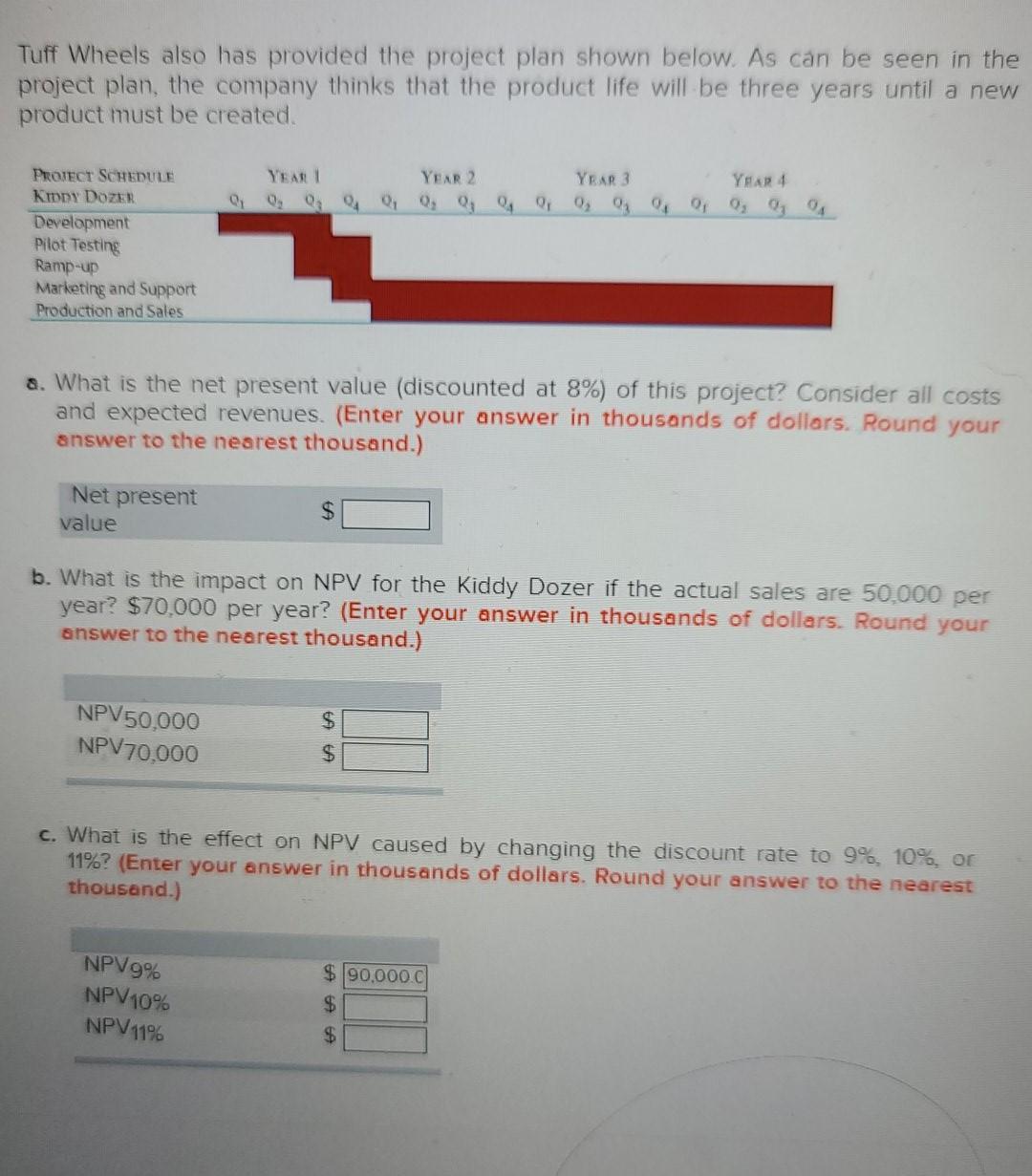

Problem 3-10 The Tuff Wheels was getting ready to start its development project for a new product to be added to their small motorized vehicle line for children. The new product is called the Kiddy Dozer. It will look like a miniature bulldozer, complete with caterpillar tracks and a blade. Tuff Wheels has forecasted the demand and the cost to develop and produce the new Kiddy Dozer. The table below contains the relevant information for this project. $950,000 9 months Development cost Estimated development time Pilot testing Ramp-up cost Marketing and support cost Sales and production volume Unit production cost Unit price Interest rate $200,000 $400,000 $ 150,000 per year 60,000 per year $ 100 $ 175 8% Tuff Wheels also has provided the project plan shown below. As can be seen in the project plan, the company thinks that the product life will be three years until a new product must be created. YEAR 1 YEAR 2 YEAR 3 Q 09 YEAR + PROJECT SCHEDULE KIDDY DOZEE Development Pilot Testing Ramp-up Marketing and Support Production and Sales a. What is the net present value (discounted at 8%) of this project? Consider all costs and expected revenues. (Enter your answer in thousands of dollars. Round your answer to the nearest thousand.) Net present value b. What is the impact on NPV for the Kiddy Dozer if the actual sales are 50,000 per Tuff Wheels also has provided the project plan shown below. As can be seen in the project plan, the company thinks that the product life will be three years until a new product must be created. YEAR 1 YEAR 2 YEAR 3 YHAR 4 PROJECT SCHEDULE KIDDY DOZER Development Pilot Testing Ramp-up Marketing and Support Production and Sales a. What is the net present value (discounted at 8%) of this project? Consider all costs and expected revenues. (Enter your answer in thousands of dollars. Round your answer to the nearest thousand.) Net present value $ b. What is the impact on NPV for the kiddy Dozer if the actual sales are 50.000 per year? $70,000 per year? (Enter your answer in thousands of dollars. Round your answer to the nearest thousand.) $ S NPV50,000 NPV70,000 $ c. What is the effect on NPV caused by changing the discount rate to 9%, 10% or 11%? (Enter your answer in thousands of dollars. Round your answer to the nearest thousand.) NPV9% NPV10% NPV11% $ 90,000.C $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started