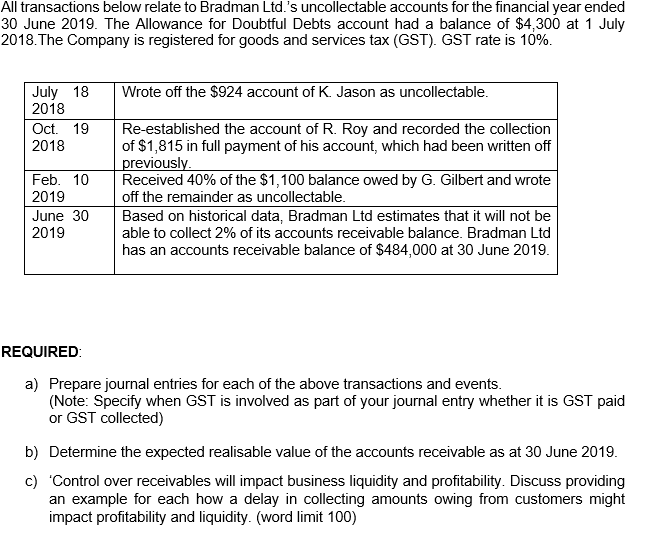

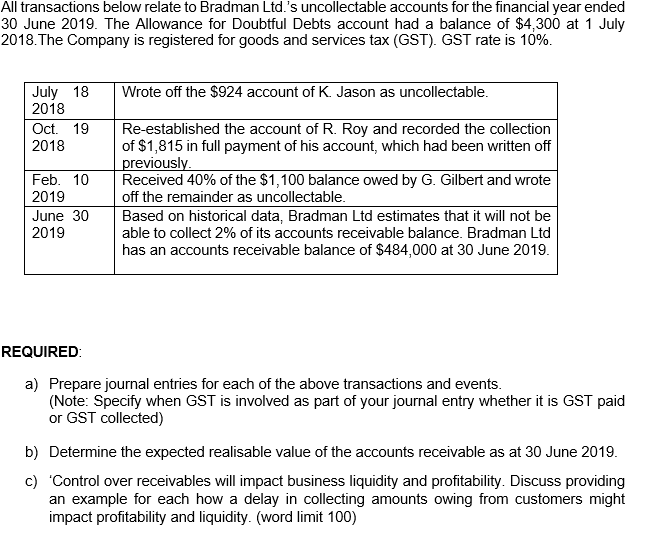

All transactions below relate to Bradman Ltd.'s uncollectable accounts for the financial year ended 30 June 2019. The Allowance for Doubtful Debts account had a balance of $4,300 at 1 July 2018. The Company is registered for goods and services tax (GST). GST rate is 10%. Wrote off the $924 account of K. Jason as uncollectable. July 18 2018 Oct. 19 2018 Feb. 10 2019 June 30 2019 Re-established the account of R. Roy and recorded the collection of $1,815 in full payment of his account, which had been written off previously Received 40% of the $1,100 balance owed by G. Gilbert and wrote off the remainder as uncollectable. Based on historical data, Bradman Ltd estimates that it will not be able to collect 2% of its accounts receivable balance. Bradman Ltd has an accounts receivable balance of $484,000 at 30 June 2019. REQUIRED a) Prepare journal entries for each of the above transactions and events. (Note: Specify when GST is involved as part of your journal entry whether it is GST paid or GST collected) b) Determine the expected realisable value of the accounts receivable as at 30 June 2019. c) 'Control over receivables will impact business liquidity and profitability. Discuss providing an example for each how a delay in collecting amounts owing from customers might impact profitability and liquidity. (word limit 100) All transactions below relate to Bradman Ltd.'s uncollectable accounts for the financial year ended 30 June 2019. The Allowance for Doubtful Debts account had a balance of $4,300 at 1 July 2018. The Company is registered for goods and services tax (GST). GST rate is 10%. Wrote off the $924 account of K. Jason as uncollectable. July 18 2018 Oct. 19 2018 Feb. 10 2019 June 30 2019 Re-established the account of R. Roy and recorded the collection of $1,815 in full payment of his account, which had been written off previously Received 40% of the $1,100 balance owed by G. Gilbert and wrote off the remainder as uncollectable. Based on historical data, Bradman Ltd estimates that it will not be able to collect 2% of its accounts receivable balance. Bradman Ltd has an accounts receivable balance of $484,000 at 30 June 2019. REQUIRED a) Prepare journal entries for each of the above transactions and events. (Note: Specify when GST is involved as part of your journal entry whether it is GST paid or GST collected) b) Determine the expected realisable value of the accounts receivable as at 30 June 2019. c) 'Control over receivables will impact business liquidity and profitability. Discuss providing an example for each how a delay in collecting amounts owing from customers might impact profitability and liquidity. (word limit 100)