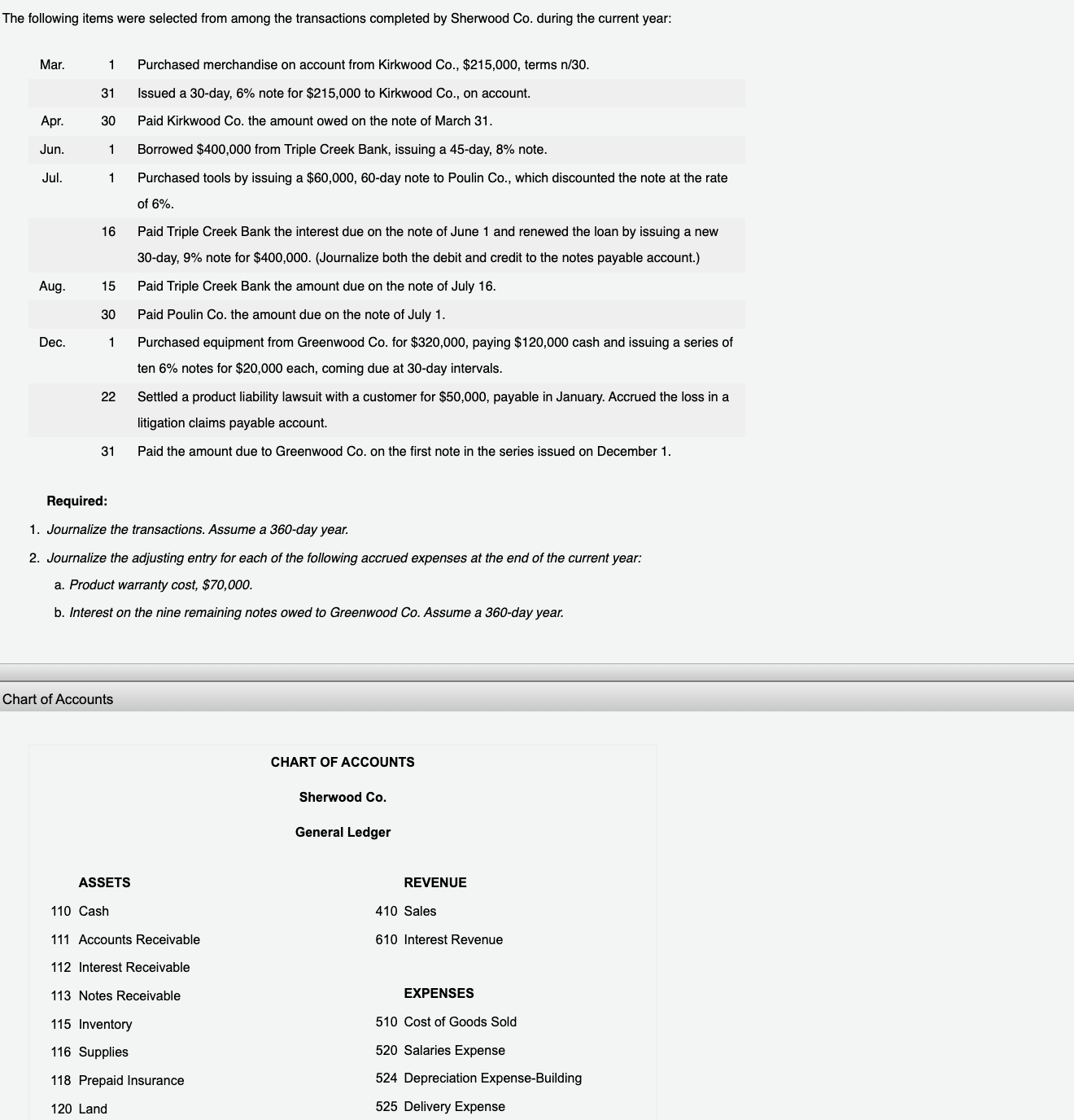

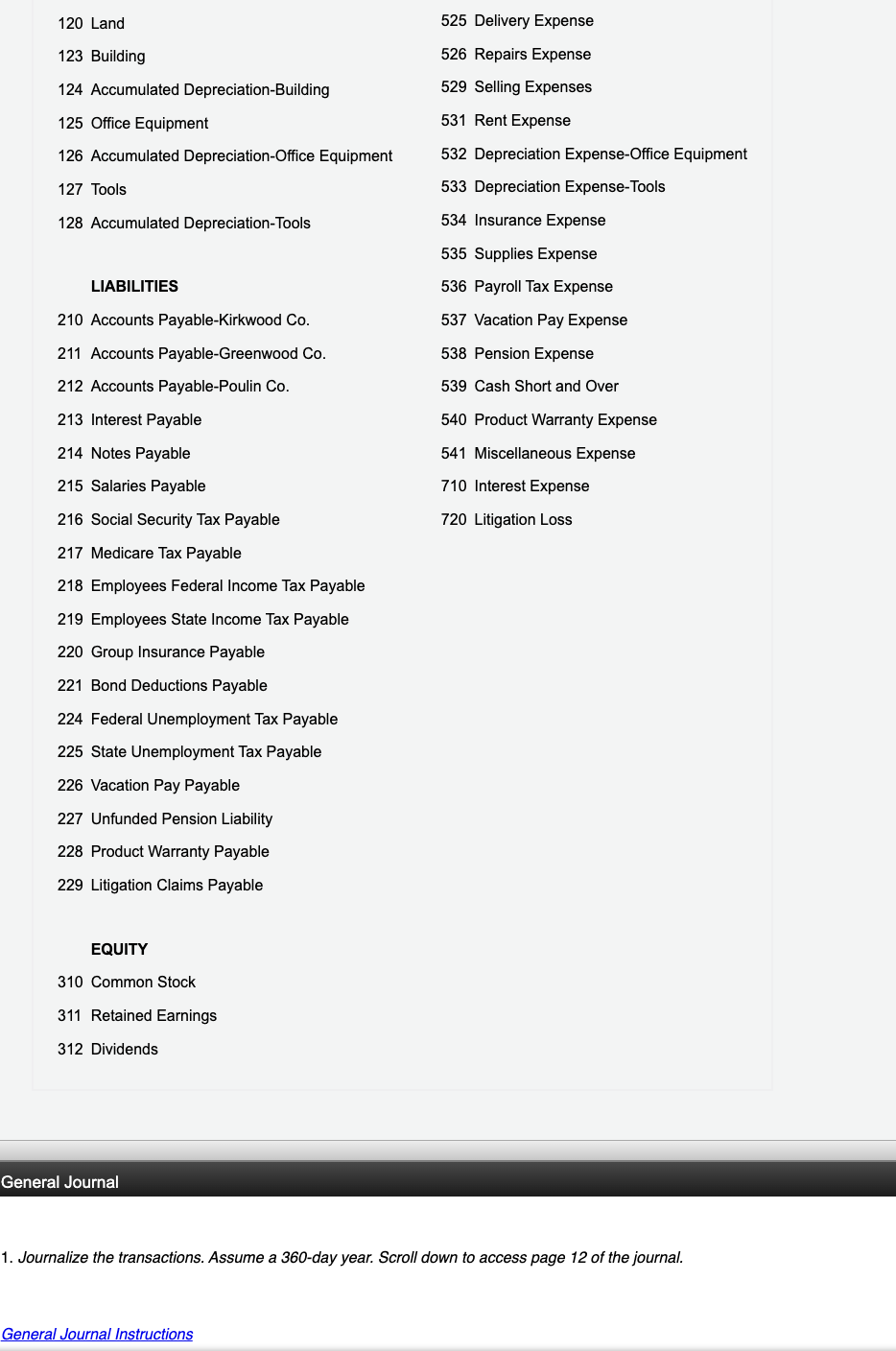

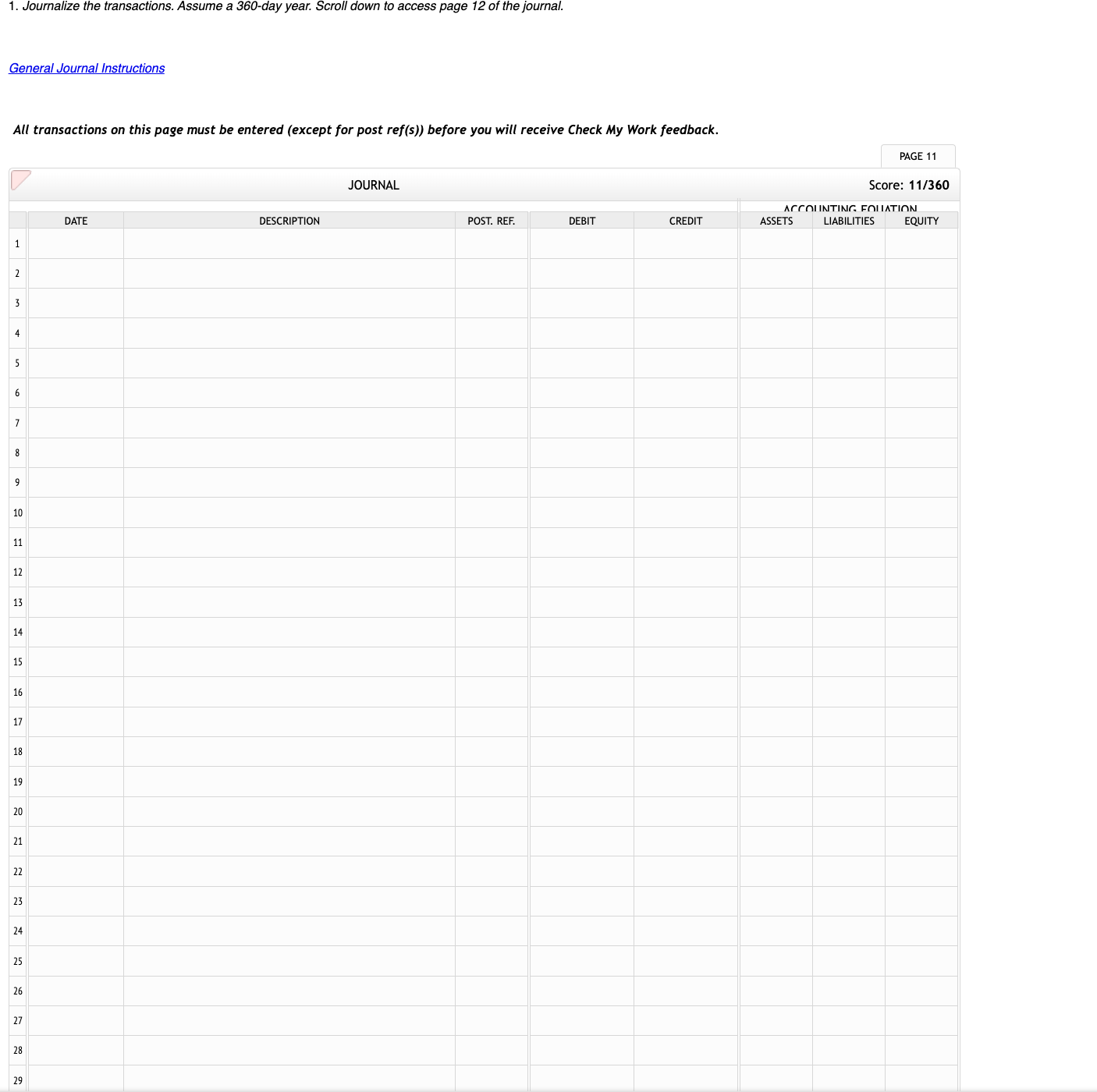

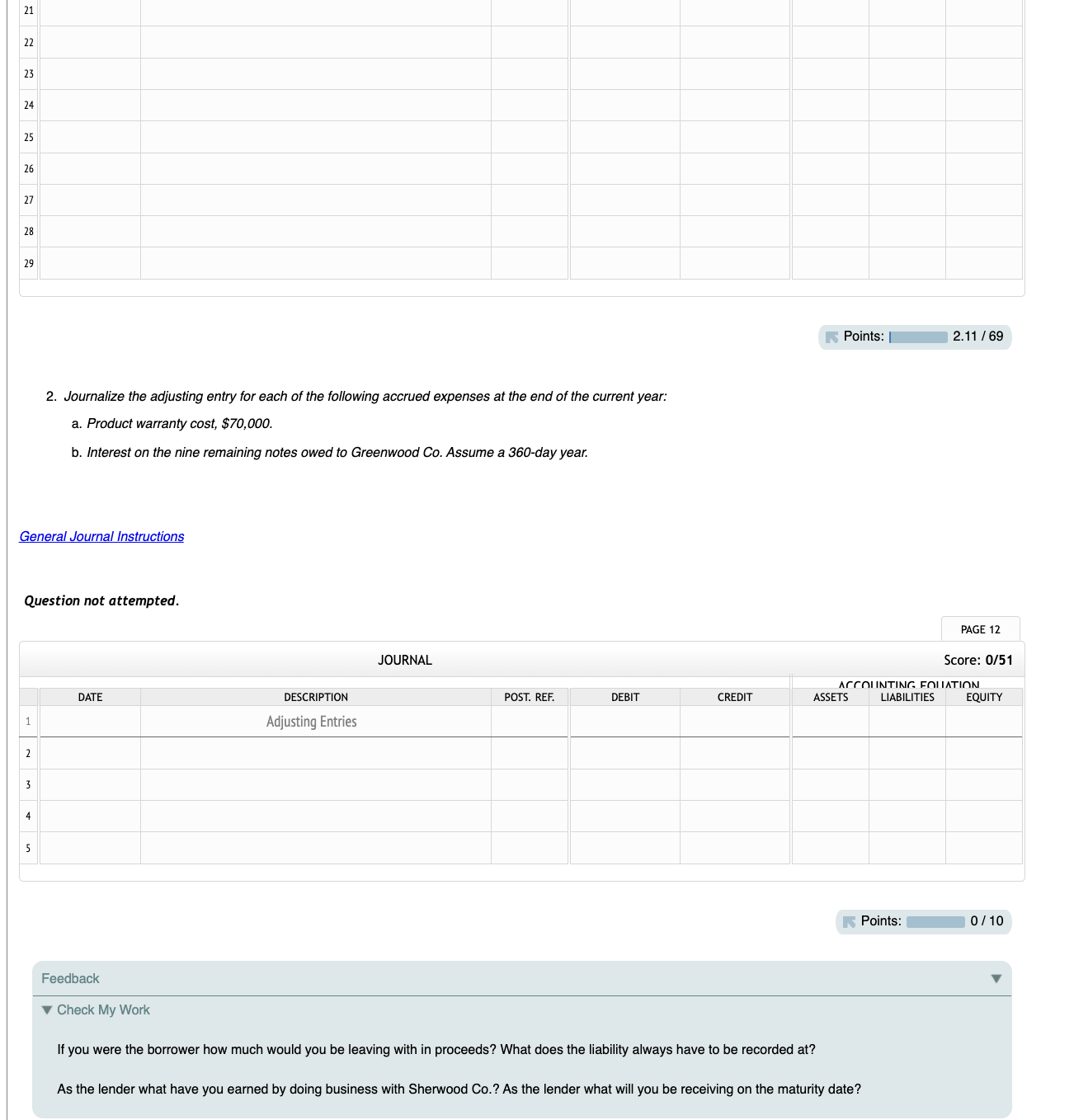

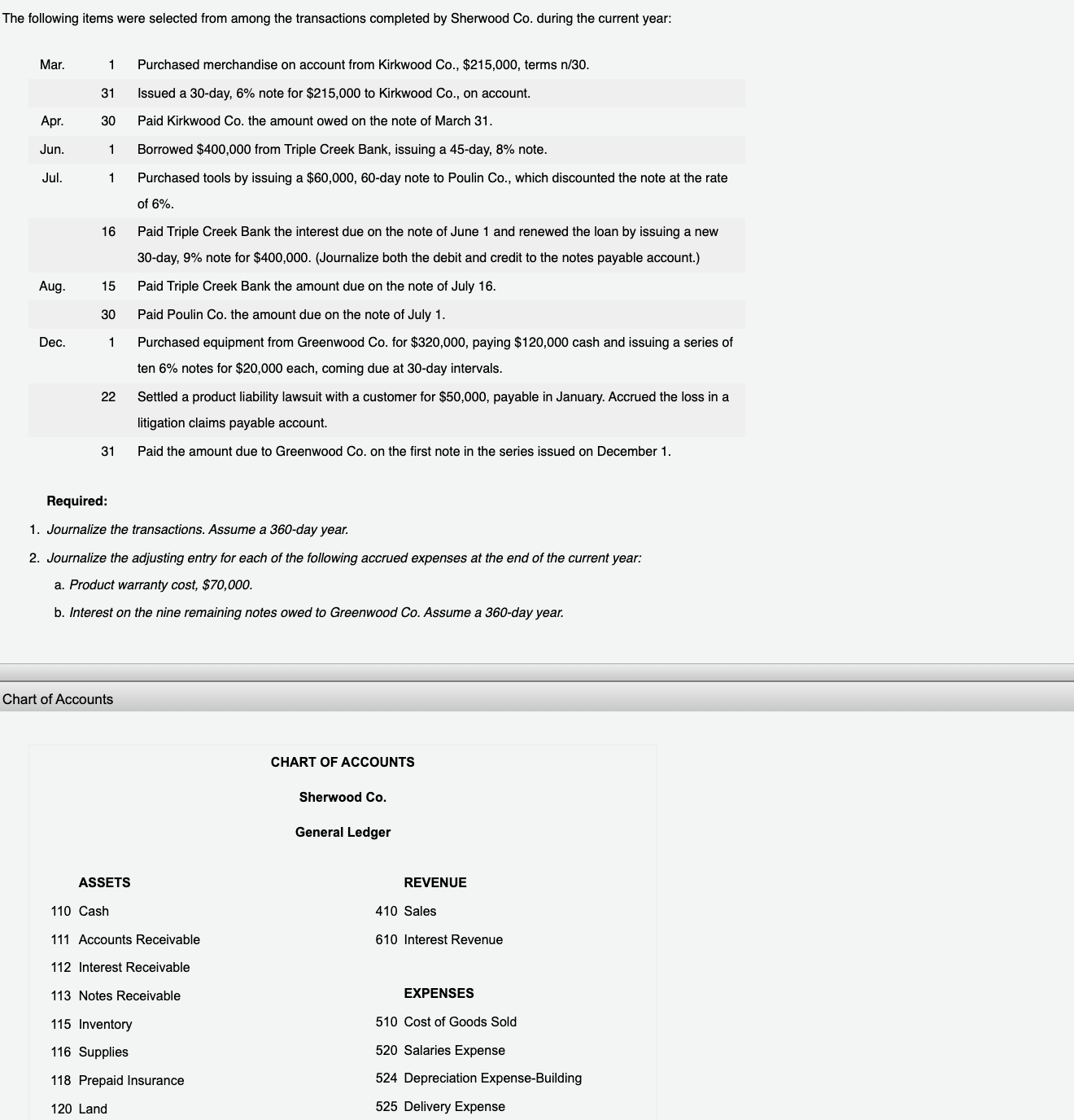

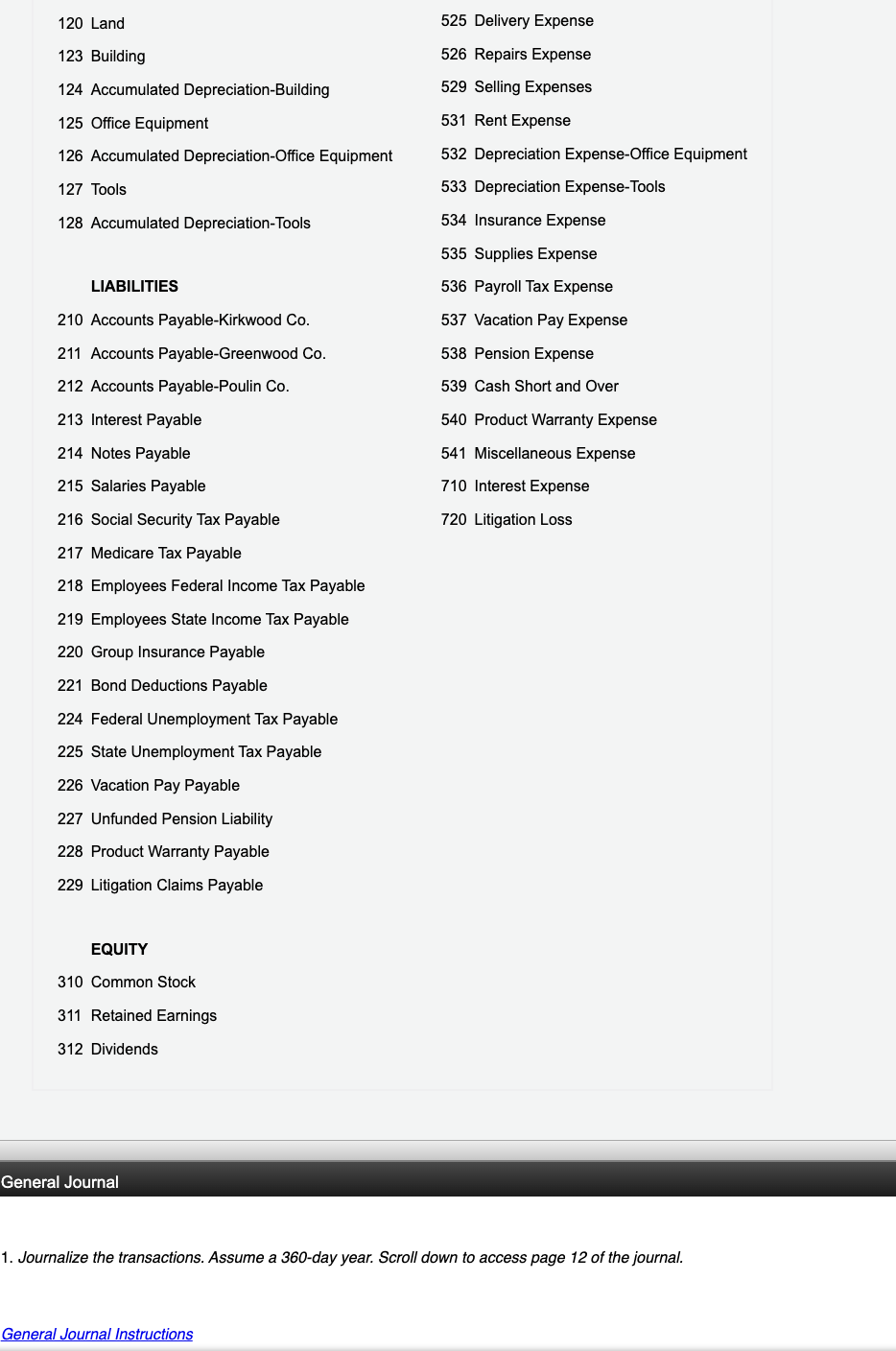

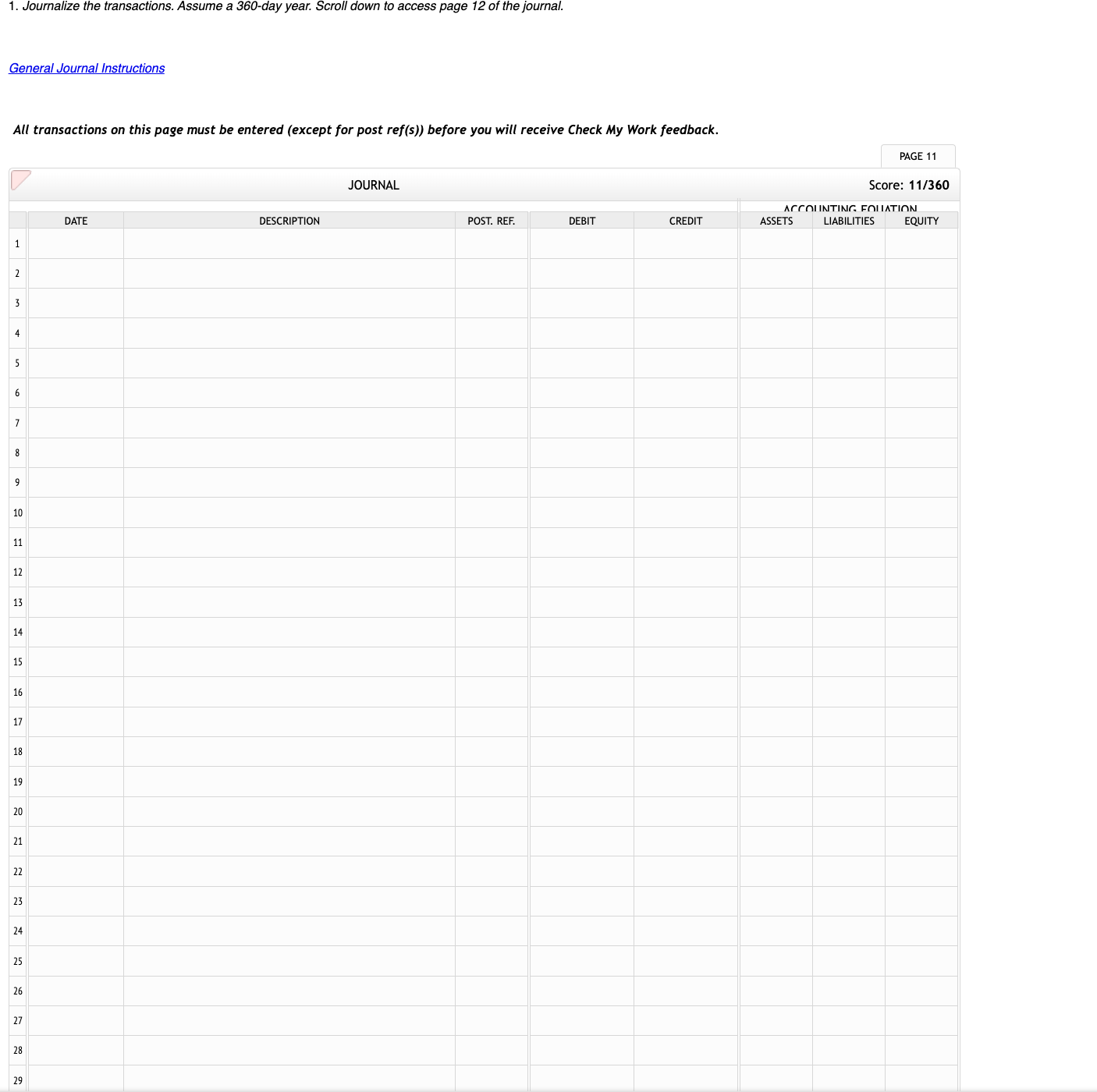

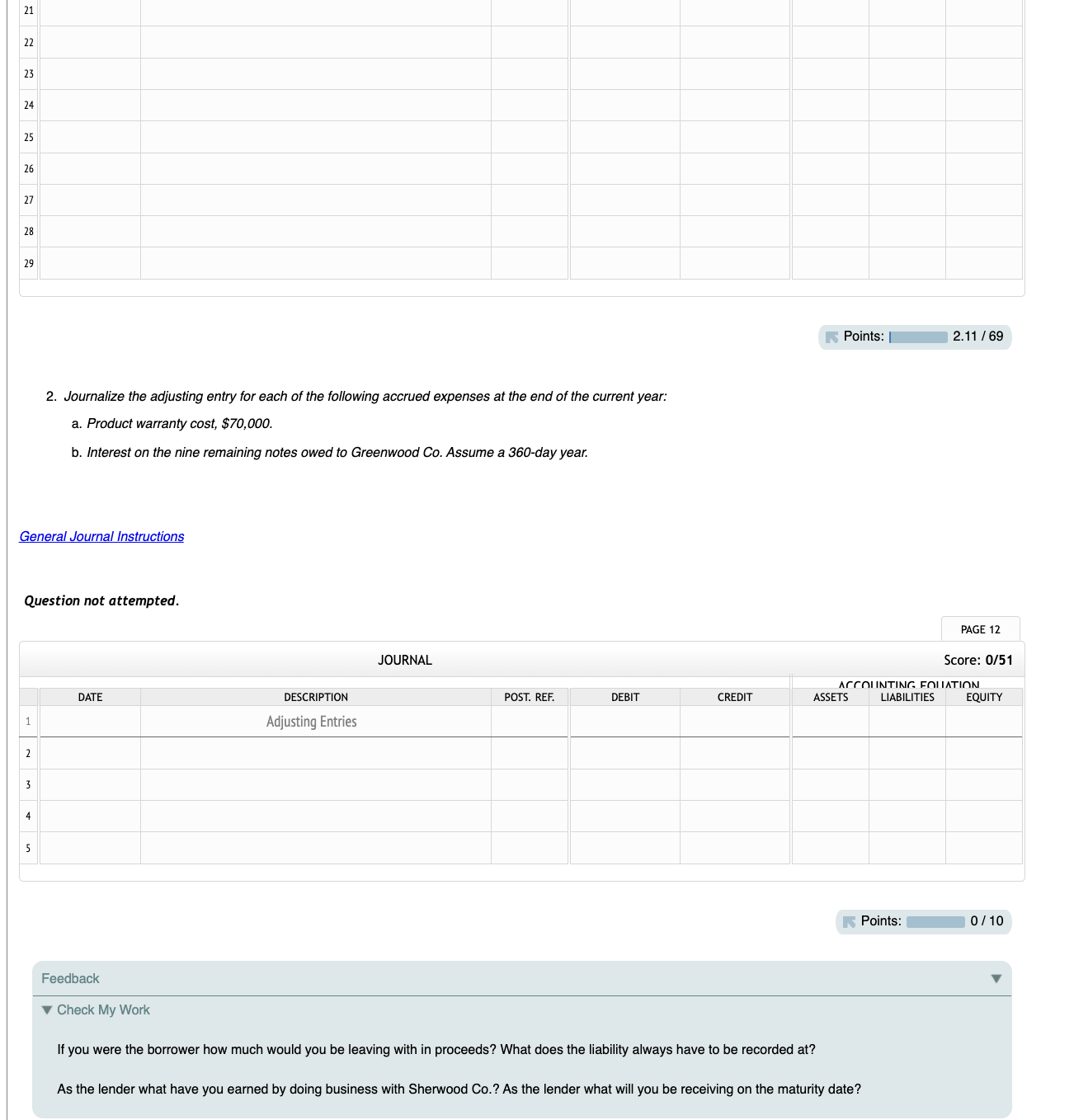

All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year: a. Product warranty cost, $70,000. b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year. Question not attempted. Points Feedback Check My Work If you were the borrower how much would you be leaving with in proceeds? What does the liability always have to be recorded at? As the lender what have you earned by doing business with Sherwood Co.? As the lender what will you be receiving on the maturity date? 1. Journalize the transactions. Assume a 360-day year. Scroll down to access page 12 of the journal. The following items were selected from among the transactions completed by Sherwood co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $215,000, terms n/30. 31 Issued a 30-day, 6% note for $215,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $400,000 from Triple Creek Bank, issuing a 45 -day, 8% note. Jul. 1 Purchased tools by issuing a $60,000,60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 9% note for $400,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $320,000, paying $120,000 cash and issuing a series of ten 6% notes for $20,000 each, coming due at 30 -day intervals. 22 Settled a product liability lawsuit with a customer for $50,000, payable in January. Accrued the loss in a litigation claims payable account. 31 Paid the amount due to Greenwood Co. on the first note in the series issued on December 1. Required: 1. Journalize the transactions. Assume a 360-day year. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year: a. Product warranty cost, $70,000. b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year. Chart of Accounts