Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All updated information appears to be visible! Middleton madactures coffee mugs that it sols to other companies for customizing with their own logos Click the

All updated information appears to be visible!

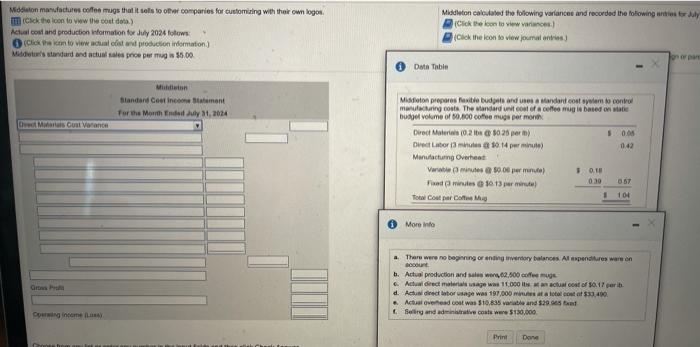

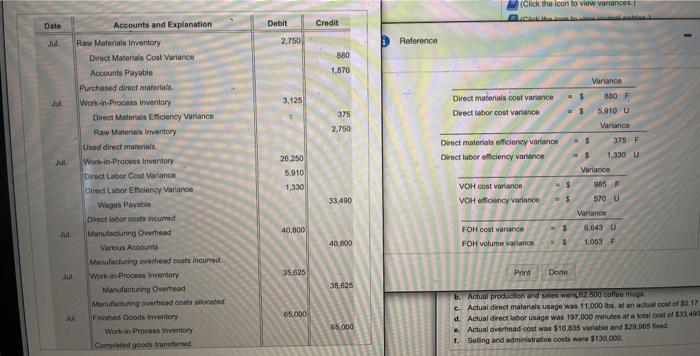

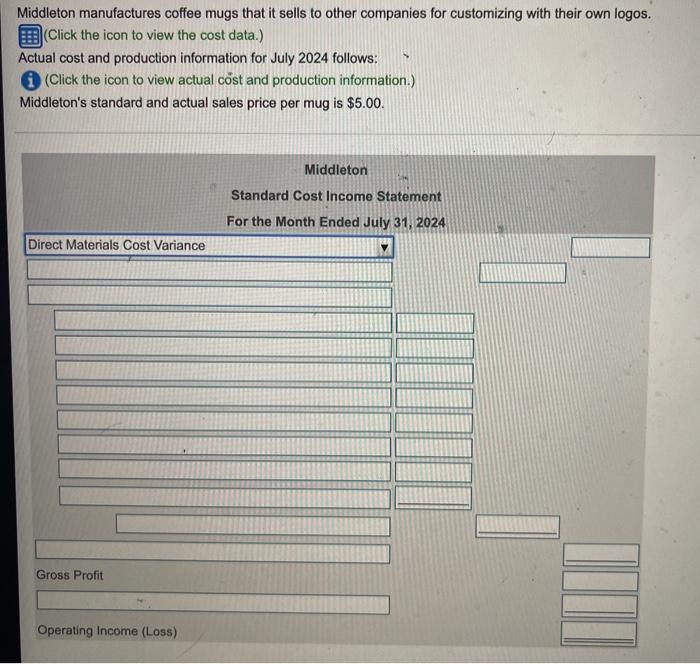

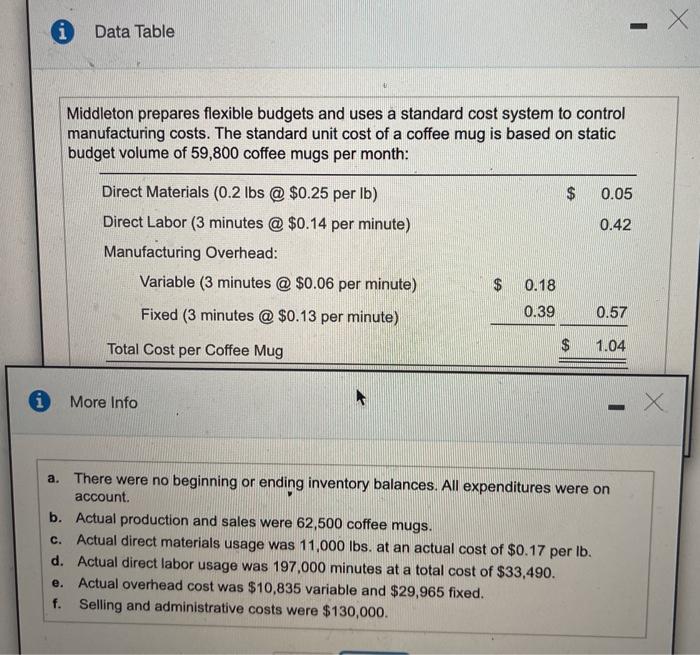

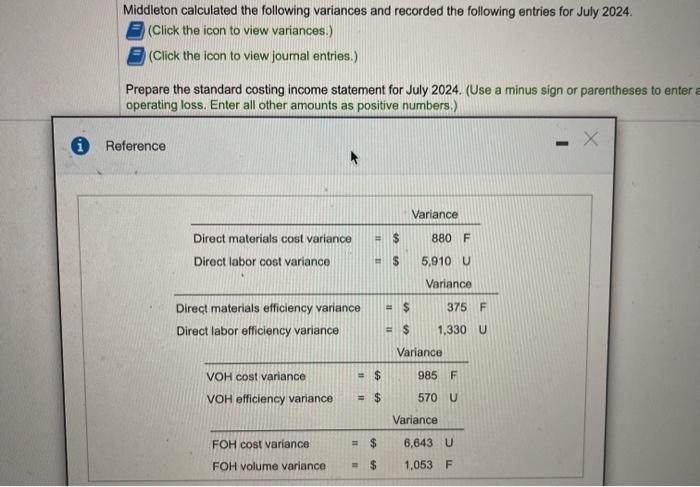

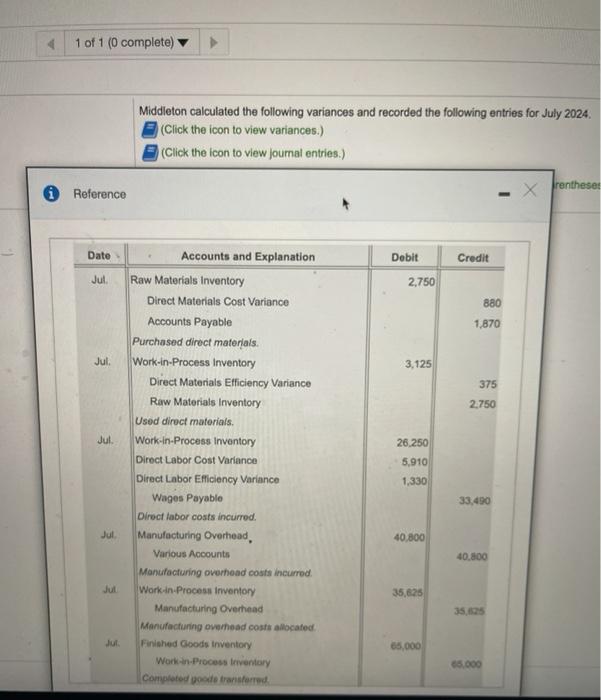

Middleton madactures coffee mugs that it sols to other companies for customizing with their own logos Click the loon to www condo) Actual cost and production formation for July 2024 follows: (click then to view list and production Indommation Midt's standard and actuales price per mug is 55.00 Middleton called the following variances and recorded the following artists July Click the loon to view varia Click the icon to view jumalan Data Table Milan Blandard Coot income taiment For the Month July 21, 2014 DM Cost Vranon Middleton prepares flexible budpa and res a andort cost slem to control manufacturing costs. The Mandard coat of a coffee mug is based on a bude volume of 60.000 cothoe mugs per month Direct Mater (0.21 0.21) 50.08 Decorate 10.14 pm) 0:42 Manufacturing Overhet Varmes 0.00 per mu BOTH minus 1013 010 Tool Contact 1 104 More info There were no bang orenting intory balances. Alexpenditures were on account: b. Actual production and 2.500 offee mugs Actueet mal wage w11.00 actual cost of 10.17 geri d. Acidetorage was 197,000 a total cost of 532.400 Actus ved cost was $10.035 and 529 Selling and drive coats were $130,000 Print Done (Click the loon to view variances Sillaala Date Debit Credit 2.750 Reference 880 1,870 3.125 Direct materials cost variance Direct labor cost variance 375 Variance 880 F 5.910 Variance 375 1,330 U 2.750 Direct materials officiency var Direct labor efficiency variance Jul Accounts and Explanation Raw Materials Inventory Direct Materials Cost Variance Accounts Payable Purchased direct materials Work-in-Process Inventory Direct Materials Emiciency Variance Raw Materials Inventory Lood direct material Work-in-Process Invertory Direct Labor Cast Variance Direct Labor Eficiency Variance Wages Payable Direct labor costs incurred Manufacturing Overhead Vanous Accounts Manufacturing overhead costs incurred Work in Process Inwentary Manufacturing Overhead Manufacturing overhead coata allocated Finished Goods inventory Work in Processory Corted goods transferred 26.250 5.910 1.330 Variance S VOH cost variance VOH elency varianon 33 490 985 F 570 U Variance 6.6430 1.053 40,000 FOH cost variance FOH volume variance 40.800 35,625 Print Done 35.625 65.000 b. Actual production and went 62,800 coffee mugs c. Actual direct materials usage was 11,000 lbs. at an actual cost of $0.17 d. Actual direct labor usage was 197,000 minutes at a total cost of $33,490 ..Actual Overhead cost was 510,835 variable and 520.065 feed 1. Saling and administrative costs were $130.000 65,000 Middleton manufactures coffee mugs that it sells to other companies for customizing with their own logos. (Click the icon to view the cost data.) Actual cost and production information for July 2024 follows: (Click the icon to view actual cost and production information.) Middleton's standard and actual sales price per mug is $5.00. Middleton Standard Cost Income Statement For the Month Ended July 31, 2024 Direct Materials Cost Variance III Gross Profit Operating Income (Loss) - Data Table Middleton prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budget volume of 59,800 coffee mugs per month: $ 0.05 0.42 Direct Materials (0.2 lbs @ $0.25 per lb) Direct Labor (3 minutes @ $0.14 per minute) Manufacturing Overhead: Variable (3 minutes @ $0.06 per minute) Fixed (3 minutes @ $0.13 per minute) $ $ 0.18 0.39 0.57 Total Cost per Coffee Mug $ 1.04 1 More Info a. There were no beginning or ending inventory balances. All expenditures were on account b. Actual production and sales were 62,500 coffee mugs. c. Actual direct materials usage was 11,000 lbs. at an actual cost of $0.17 per lb. d. Actual direct labor usage was 197,000 minutes at a total cost of $33,490. e. Actual overhead cost was $10,835 variable and $29,965 fixed. f. Selling and administrative costs were $130,000. Middleton calculated the following variances and recorded the following entries for July 2024. (Click the icon to view variances.) (Click the icon to view journal entries.) Prepare the standard costing income statement for July 2024. (Use a minus sign or parentheses to enter a operating loss. Enter all other amounts as positive numbers.) 0 Reference X Variance Direct materials cost variance $ 880 F Direct labor cost variance $ 5,910U Variance 375 F Direct materials efficiency variance Direct labor efficiency variance $ 1,330 U Variance VOH cost variance $ 985 F VOH efficiency variance $ 570 U Variance FOH cost variance = $ 6,643 U FOH volume variance $ 1,053 F 1 of 1 (0 complete) Middleton calculated the following variances and recorded the following entries for July 2024. (Click the icon to view variances.) (Click the icon to view journal entries.) 1 Reference X frentheses Date Debit Credit Jul 2,750 880 1,870 Jul 3.125 375 2.750 26.250 Accounts and Explanation Raw Materials Inventory Direct Materials Cost Variance Accounts Payable Purchased direct materials Work-in-Process Inventory Direct Materials Efficiency Variance Raw Materials Inventory Used direct materials Work-in-Process Inventory Direct Labor Cost Variance Direct Labor Efficiency Variance Wages Payable Direct labor costs incurred Manufacturing Overhead Various Accounts Manufacturing overhond costs incurred. Work in Process inventory Manufacturing Overhead Manufacturing overhead costs allocated Finished Goods Inventory Work-in-Process inventory Completed pode transferred 5.910 1,330 33,490 40.800 40.800 Ju 35,625 Jul 65,000 5.000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started