Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All work must be shown on every facet of the solution. This includes an explanation of the methodology and equations (in pure form, not

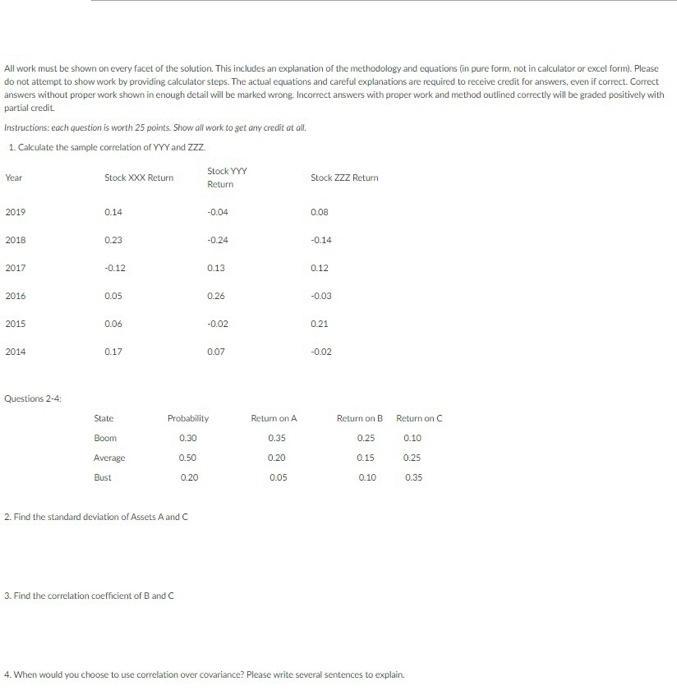

All work must be shown on every facet of the solution. This includes an explanation of the methodology and equations (in pure form, not in calculator or excel form). Please do not attempt to show work by providing calculator steps. The actual equations and careful explanations are required to receive credit for answers, even if correct. Correct answers without proper work shown in enough detail will be marked wrong. Incorrect answers with proper work and method outlined correctly will be graded positively with partial credit. Instructions: each question is worth 25 points. Show all work to get any credit at all. 1. Calculate the sample correlation of YYY and ZZZ. Year 2019 2018 2017 2016 2015 2014 Questions 2-4: Stock XXX Return 0.14 0.23 -0.12 0.05 0.06 0.17 State Boom Average Bust 0.20 2. Find the standard deviation of Assets A and C 3. Find the correlation coefficient of B and C Stock YYY Return -0.04 -0.24 0.13 0.26 Probability 0,30 0.50 -0.02 0.07 Return on A 0.35 0.20 0.05 Stock ZZZ Return 0.08 -0.14 0.12 -0.03 0.21 -0.02 Return on B 0.25 0.15 0.10 Return on C 0.10 0.25 4. When would you choose to use correlation over covariance? Please write several sentences to explain 0.35

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started