Answered step by step

Verified Expert Solution

Question

1 Approved Answer

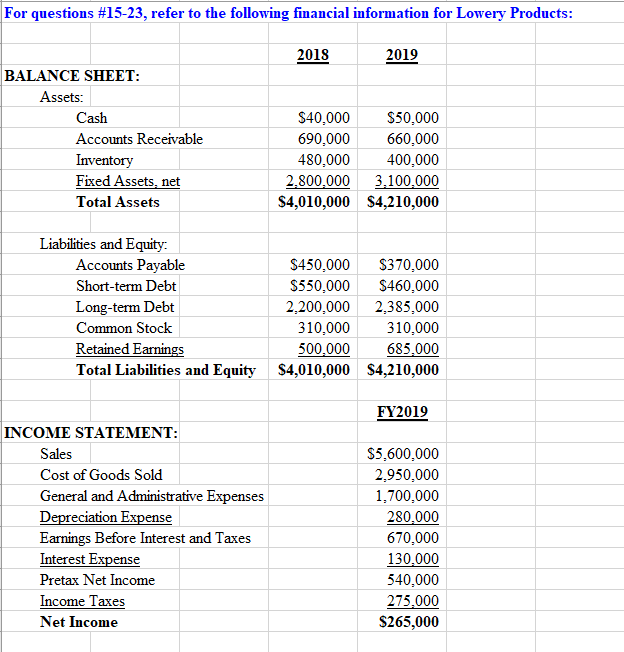

All work must be shown to receive credit, please use excel where applicable. For questions #15-23, refer to the following financial information for Lowery Products:

All work must be shown to receive credit, please use excel where applicable.

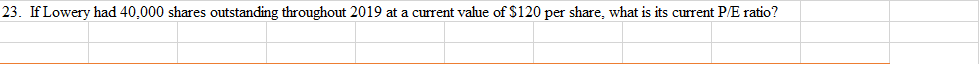

For questions #15-23, refer to the following financial information for Lowery Products: 2018 2019 BALANCE SHEET: Assets: Cash Accounts Receivable Inventory Fixed Assets, net Total Assets $40.000 690,000 480.000 2.800.000 $4,010,000 $50,000 660,000 400.000 3.100.000 $4,210,000 Liabilities and Equity: Accounts Payable Short-term Debt Long-term Debt Common Stock Retained Earnings Total Liabilities and Equity $450,000 $550.000 2.200.000 310,000 500.000 $4,010,000 $370,000 $460.000 2.385.000 310,000 685,000 $4,210,000 FY2019 INCOME STATEMENT: Sales Cost of Goods Sold General and Administrative Expenses Depreciation Expense Earnings Before Interest and Taxes Interest Expense Pretax Net Income Income Taxes Net Income $5,600,000 2.950,000 1,700,000 280.000 670,000 130.000 540,000 275.000 $265,000 23. If Lowery had 40,000 shares outstanding throughout 2019 at a current value of $120 per share, what is its current P/E ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started