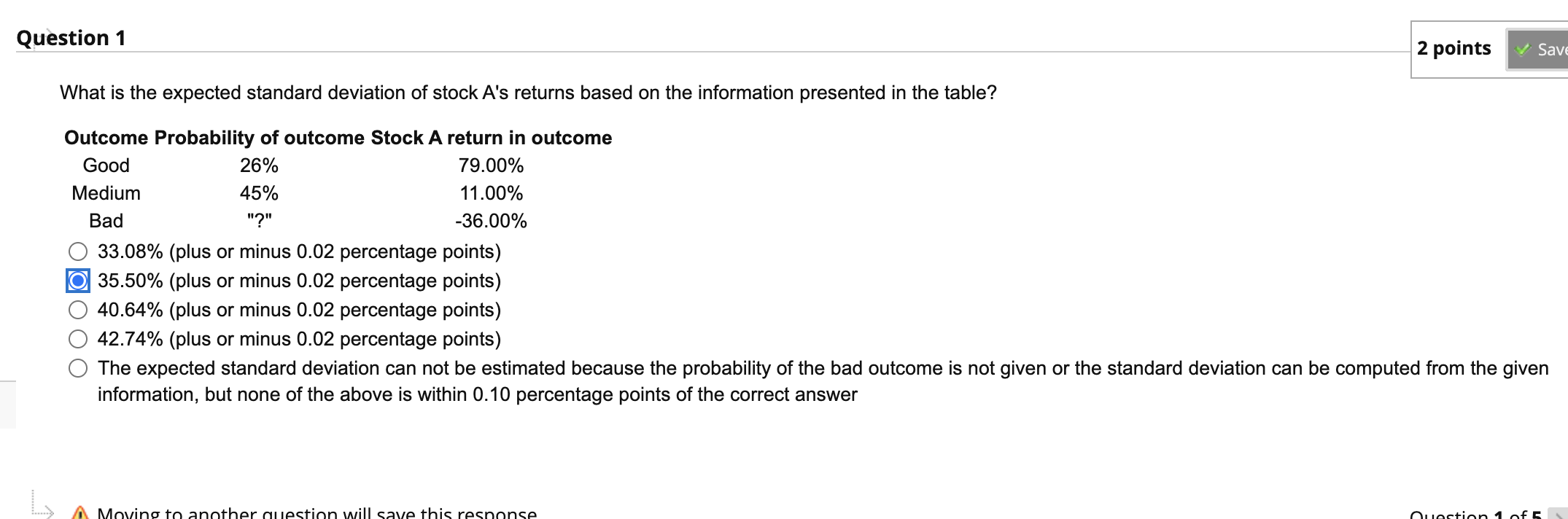

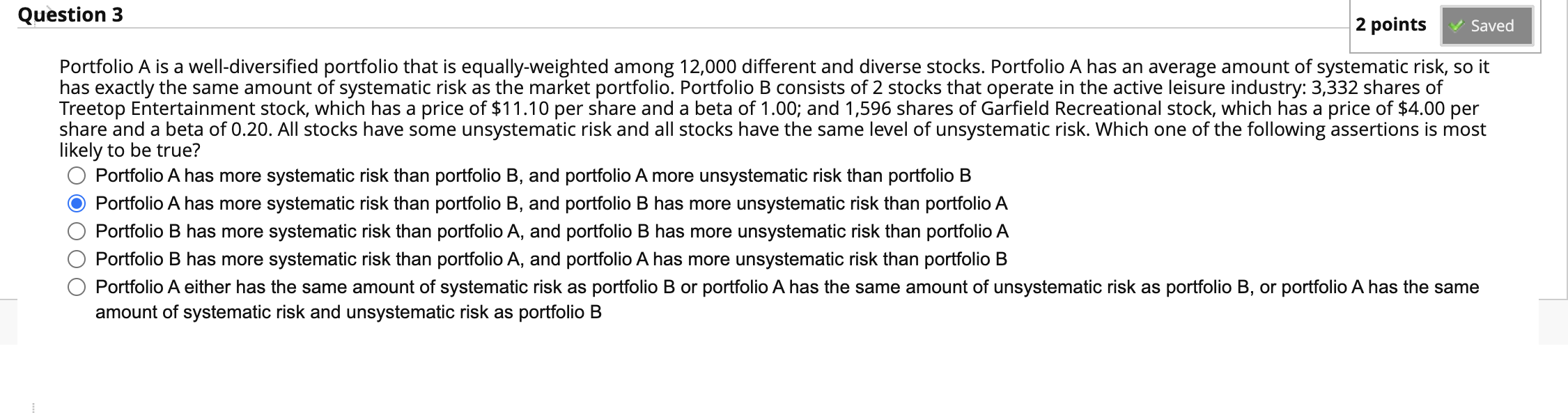

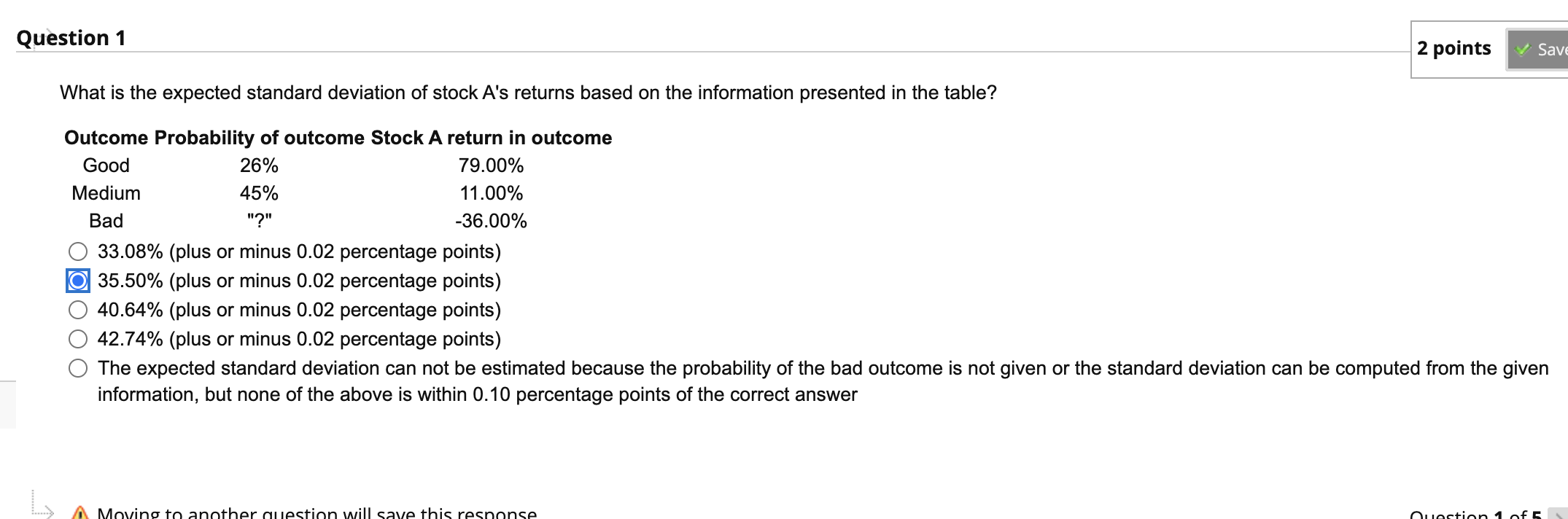

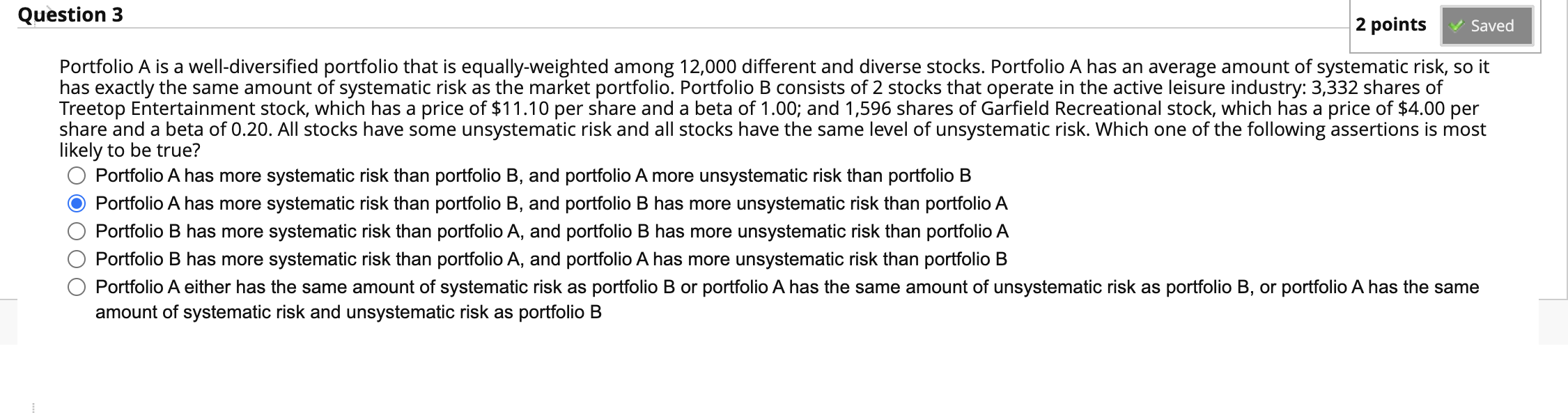

Question 1 2 points Save What is the expected standard deviation of stock A's returns based on the information presented in the table? Outcome Probability of outcome Stock A return in outcome Good 26% 79.00% Medium 45% 11.00% Bad "?" -36.00% 33.08% (plus or minus 0.02 percentage points) O 35.50% (plus or minus 0.02 percentage points) 40.64% (plus or minus 0.02 percentage points) 42.74% (plus or minus 0.02 percentage points) The expected standard deviation can not be estimated because the probability of the bad outcome is not given or the standard deviation can be computed from the given information, but none of the above is within 0.10 percentage points of the correct answer A Moving to another question will save this response Ouestion 1 of 5 Question 3 2 points Saved Portfolio A is a well-diversified portfolio that is equally-weighted among 12,000 different and diverse stocks. Portfolio A has an average amount of systematic risk, so it has exactly the same amount of systematic risk as the market portfolio. Portfolio B consists of 2 stocks that operate in the active leisure industry: 3,332 shares of Treetop Entertainment stock, which has a price of $11.10 per share and a beta of 1.00; and 1,596 shares of Garfield Recreational stock, which has a price of $4.00 per share and a beta of 0.20. All stocks have some unsystematic risk and all stocks have the same level of unsystematic risk. Which one of the following assertions is most likely to be true? Portfolio A has more systematic risk than portfolio B, and portfolio A more unsystematic risk than portfolio B Portfolio A has more systematic risk than portfolio B, and portfolio B has more unsystematic risk than portfolio A Portfolio B has more systematic risk than portfolio A, and portfolio B has more unsystematic risk than portfolio A Portfolio B has more systematic risk than portfolio A, and portfolio A has more unsystematic risk than portfolio B Portfolio A either has the same amount of systematic risk as portfolio B or portfolio A has the same amount of unsystematic risk as portfolio B, or portfolio A has the same amount of systematic risk and unsystematic risk as portfolio B Moving to another question will save the response Question to Question 1 2 points What is the expected standard deviation of stock Ashuro based on the information presented in the title? Outcome Probability of outcome Stock A return in outcome Good 2% 70.00% 45 11 00 Bad 500 30 or mis 02 percentage points) 3560 plus minus 0.02 percentage points) 40% por minus 2 percentage point 424 us on 002 percentage points) The expected standard deviation cannot be estimated because the probability of the bad outcome is not given the standard deviation can be computed from the given information, but none of the above is in 0.10 percentage points of the correctant Question 2 points Portfolio As a well diversified portfolio that is equally weighted among 12.000 different and diverse stocks Portfolio Ahas an average amount of systematisk soit is exactly the same amount of systematic risk at the market portfolio Portfolio 3 consists of stocks that operate in the active leisure industry 13 shares of Treetop Entertainment stock which a price of $11.10 per share and a bea of 100, and 1,595 shares of Garfield Recreational stock, which has a price of 54.00 per share and a bota of 0.20. Allstads have come unsystematic and all stoces have the same level of systematic risk. Which one of the following assertion is most kely to be true Portfol Aus more than portfolio and porto Amore amethanol Portfolio Amore water than portal and portfolio Bhas more som skapt Portsmore than portfolio A and portfolio Barro Portillo has more than portfolio A and portfolio Amore than Porto Athen the mount of systematic risk portfolio portfolio Ahos the same amount of more or portfolio Aste amount of systems and relations portfolio