All yellow boxes please !

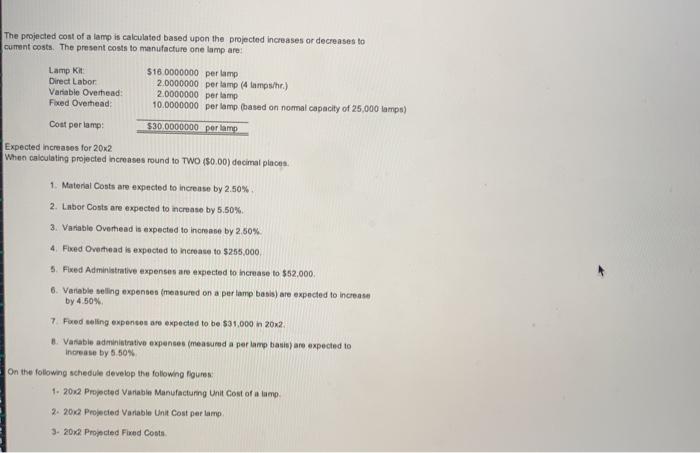

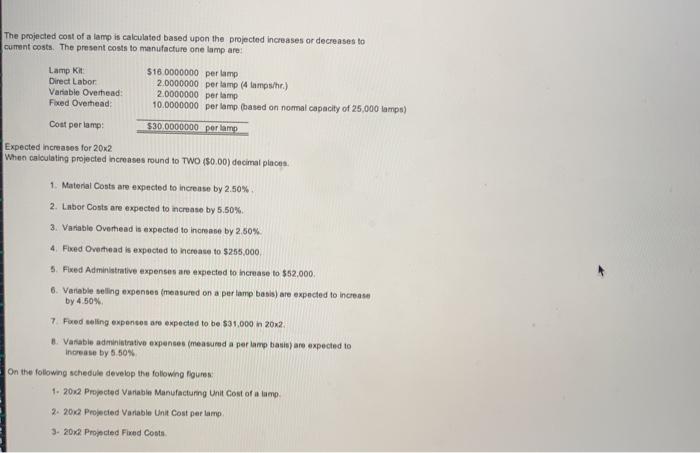

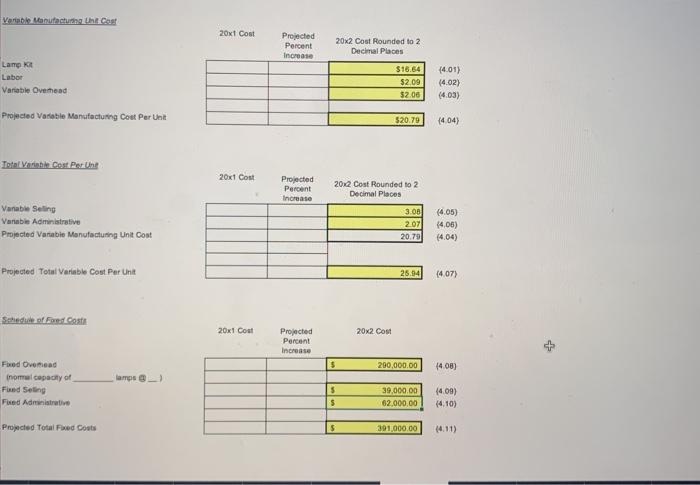

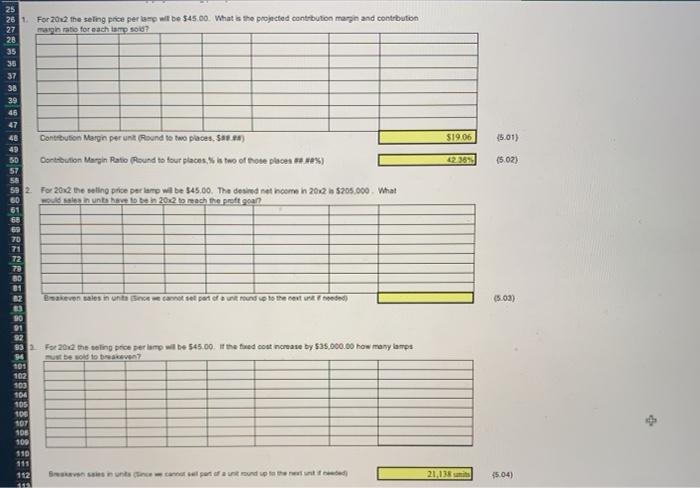

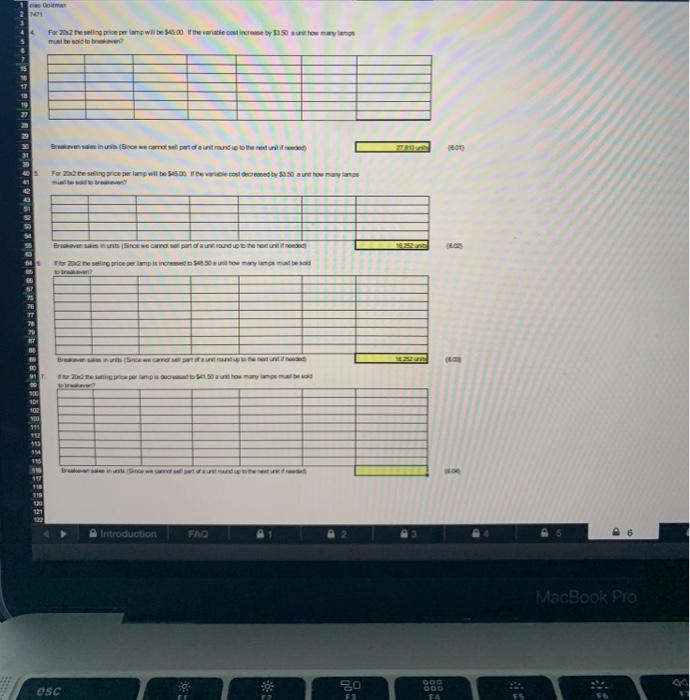

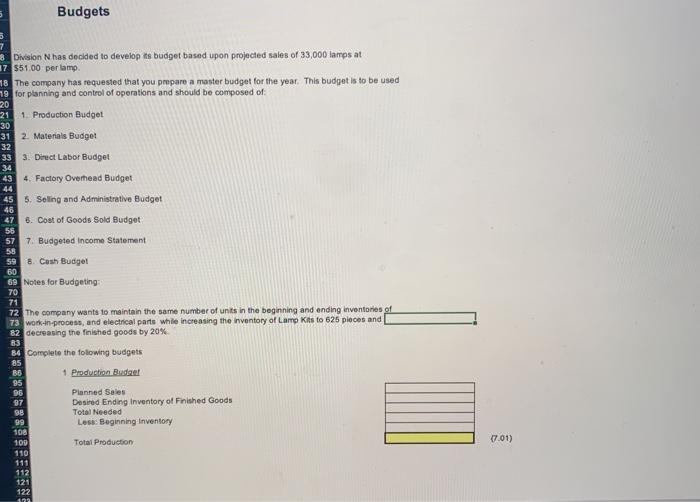

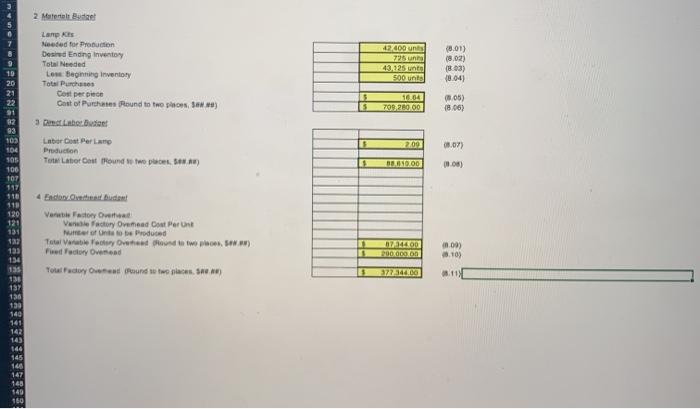

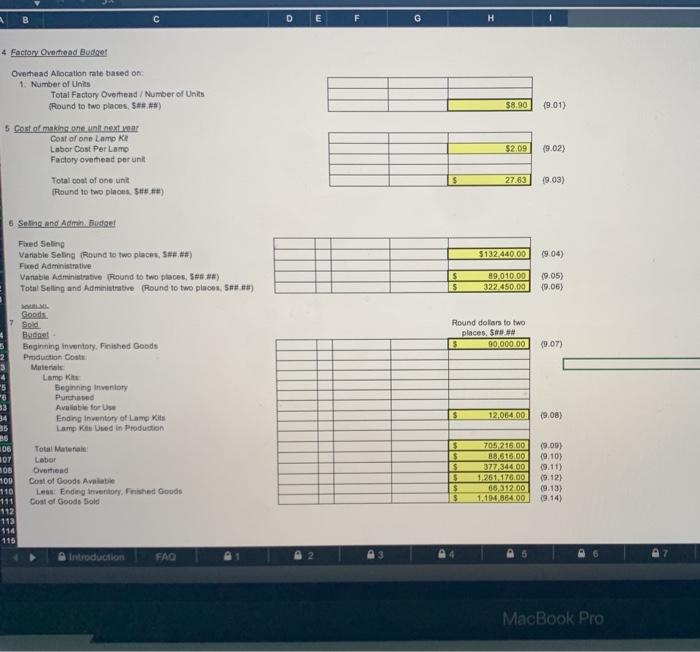

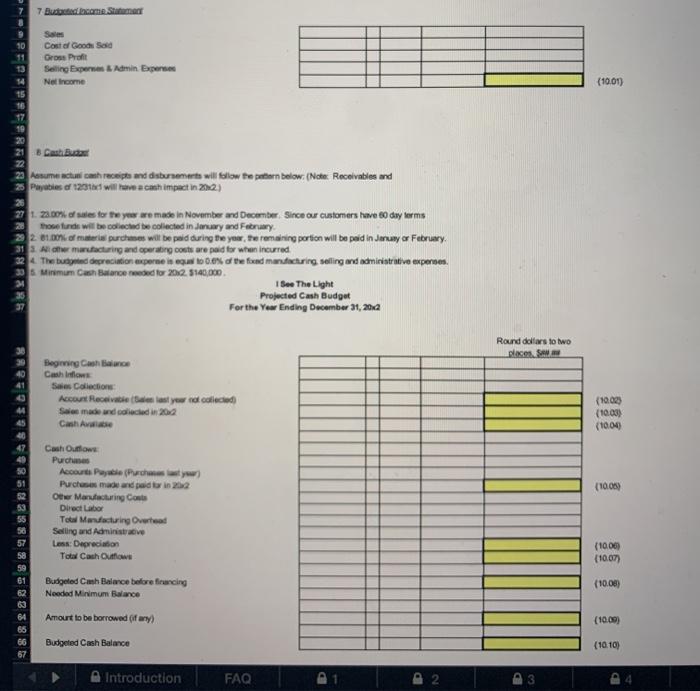

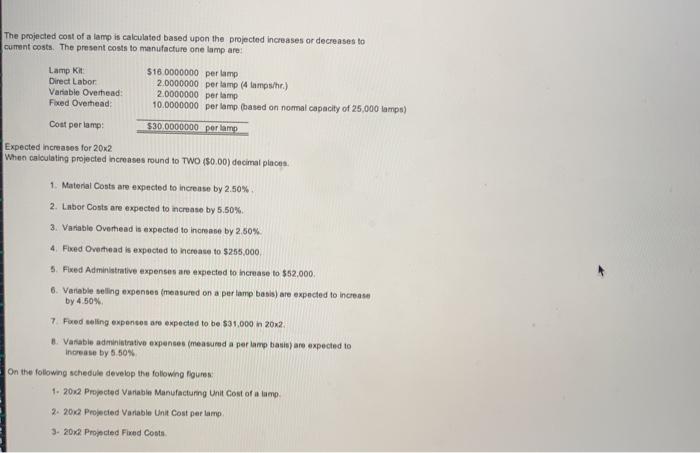

The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Lamp Kit $16.0000000 per lamp Direct Labor 2.0000000 per lamp (4 lamps/hr.) Variable Overhead: 2.0000000 per lamp Foed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 tampo Cost per lamp: 530 0000000 per lamp Expected increases for 20x2 When calculating projected increases round to TWO ($0.00) decimal places 1. Material Conts are expected to increase by 2.50% 2. Labor Conts are expected to increase by 5.50% 3. Variable Overhead is expected to increase by 2.50% 4. Fixed Overhead is expected to increase to $255,000 5. Fixed Administrative expenses are expected to increase to $62,000 6. Variable selling expenses (measured on a perlamp basis) are expected to increase by 4.50% 7. Fored telling expensos are expected to be $31.000 m 2012 Variable administrative expenses (measured a per amp batin) are expected to increase by 0.50% On the following schedule develop the following figures 1. 2012 Projected Variable Manufactumg Unit Cost of alump. 2. 2012 Projected Variable Unit Cost per lamp 3- 20x2 Projected Fored Costs Vor Manufacturing the cost 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places Lamp Labor Variable Overhead $16.64 $2.09 52.00 (4.01) (4.02) (4.03) Projected Variable Manufacturing Cost Per Unit 520.79 (404) Total Variable Cost Pet Unie 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places Variable Selling Variable Administrative Projected Varebio Manufacturing Unit Cont 3.08 207 20.79 (4.05) 14.06) (404) Projected Total Variable Coat Par Unit 25.94 (4.07) Schedule of Conte 20x1 Cost 20x2 Cost Projected Percent Increase $ 290,000.00 44.00) lamps_) Fred Overhead normal capacity of Fue Seting Fied Admistrative $ 39,000.00 62.000,00 $ (409) (4.10) Projected Total Fixed Costs $ 391.000.00 14.11) 25 261 For 2012 the seling price per il be $45.00. What the projected contribution man and contribution 27 mpin ratio for each tamps 28 35 37 38 39 46 48 $19.06 15.01) (502) Contibuson Margin per una round to two places SAT.28) 50 Cortsbution Margin Rato Round to four places, is no of those place ****%) 57 56 59 2 For 2012 the selling price per lamp wil be $45.00. The desired at home in 2012 $205.000. What 60 Asses in uns bein 2012 mach the profit gan 51 62 70 71 72 30 81 Bevon sales in una cantelor controls the cented (503) 90 91 92 932 For 2012, the saling price perimp will be 545.00. If the feed cost increase by $35,000.00 how many lamps 96 101 102 103 104 105 106 SOT 10 100 110 115 112 Stort of our path 21.138 4504) For 2014 tengo mo will be 56.00 the water by 35 yang in portant round ht Forbesc pe lang will be wel by 50:50 autoa Brava Srce care part dat het onded The price is made terhorn 990 100 YO 710 40 194 199 117 19 20 Tetroduction FAQ MacBook Pro so esc F Budgets 5 7 Division N has decided to develop its budget based upon projected sales of 33,000 lamps at 17 $51.00 per lamp m8 The company has requested that you prepare a master budget for the year. This budget is to be used 79 for planning and control of operations and should be composed of: 20 21 1. Production Budget 30 31 2. Materials Budget 32 33 3. Direct Labor Budget 34 43 4. Factory Overhead Budget 45 5. Selling and Administrative Budget 46 47 6. Cost of Goods Sold Budget 56 57 7. Budgeted Income Statement 55 59 8. Cash Budget 60 G9 Notes for Budgeting 70 71 72 The company wants to maintain the same number of units in the beginning and ending inventories of 73 work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 626 pieces and 82 decreasing the finished goods by 20% 83 84 Complete the folowing budgets 85 1 Production Budget 95 96 Planned Sales 97 Desired Ending Inventory of Finished Goods SB Total Needed 99 Lese: Beginning Inventory 108 100 Total Production 110 111 112 121 122 10 7.01) 2 Mente Lang Needed for Pro uction Desired Ending Inventory Total Needed Les Beginning inventory Total Purchase Cost per piece Chat of Purchase Pound to two pow.) 12/400 unts 725 43.125 unto 500 units (801) (8.02) (8.03) (8.04) 5 S 16.54 700 280.00 (105) 18.00) 9 10 20 21 22 91 22 93 103 104 105 100 TOT 3 im Labor Dutie 200 03.07) Labor Cost Per Lamp Production Total Later Cost Round Op. 52.) 1 800.00 Vente Factory Vene Factory Ovemed Cost Per Unt Number of to be produced Total Factory Owend to two places w.) Factory Owned Tout do Owound wo two. * 0714400 200,000.00 0.00) 3.10) 37230.00 03.11 110 110 120 121 131 123 133 134 135 130 199 136 199 140 141 142 143 144 145 166 147 148 $49 160 D F G H 4 Factory Overtrond Budget Overhead Allocation rate based on 1. Number of Units Total Factory Overhead/Number of Units {Round to two places, 5 $8.90 19.01) $2.09 (9.02) 5 Cost of makinsone und next year Cost of one Lamp RA Labor Cost Per Lamp Factory overhead per unit Total cost of one unit Round to two places. $#*) ES 27.63 19.03) 6 Seling and Admin Boston $132.440.00 (9.04) Fred Seling Variable Seling Round to two places, S) Fixed Administrative Variable Administrative found to two places, S) Total Selling and Administrative (Round to two places 5* *8) 5 5 89,010.00 322 450.00 (9.05) 19.05) Goods Round dollar to two places, S 5 90,000.00 (9.07) 2 Budget Beginning inventory. Finished Goods Production Cost Material Lamp Kite Beginning inventory Purchased Available for Use Ending Inventory of Lamp Kits Lam Kissed in Production 5 12.064.00 19.08) 35 36 106 107 08 100 Total Material Labor Overhead Cost of Goods Avotte Les Ending inventory Fished Goods Cost of Goods Sold $ S $ 25 S S 705 215.00 88.616.00 377 344 00 1251 175.00 66 312.00 1,194.064.00 (9.00) (9.10) 19.11) (9.12) (9.13) (9.14) 111 112 113 114 113 Introduction FAO MacBook Pro 7 Bustostecome Statement 3 (10.01) 10 Cost of Good Sod Gross Profit Selling Exper Admin Expense 54 Net Income 15 16 17 19 20 21 8 Cash Bu 28 23 Asuma actual chreceipts and disbursements will follow the partiern below: (Notes Receivables and 25 Payables of 1231 will use a cash impact in 202) 26 27 12.00 sates for the year we made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and Ferry 22. matelas purchases will be paid during the year, the remaining portion will be paid in Jerusay or February 31 Acer manufacturing and operating costs are paid for when incurred 22 The busted depreciation experne in gud toen of the fixed manducturing selling and administrative expenses. 33 s Minimum Cash Balance need to 20x2.5140,000 1 See The Light Projected Cash Budget 37 For the Year Ending December 31, 2012 M Round dollars to wo place. S Beginning Cash Bange Cushindows Sales Collection Account Receivable (Belasty collected Selemade and collected in 202 Cash Awe (1002 (10.03) (10.00 (10.05) 988 2898898828983456$0288 Cash Outlows Purchase Acoou Pa (Puchay) Purchases made and paid to in 2012 Other Manufacturing Costs Direct Labor Total Manufacturing Overhead Selling and Administrative Les Depreciation Total Cash Outfios (10.09 (10.07) (10.00 Budgeted Ch Balce before fruncing Needed Minimum Balance Amout to be borrowed of any) Budgeted Cash Balance 64 (10.00 (10.10) Introduction FA