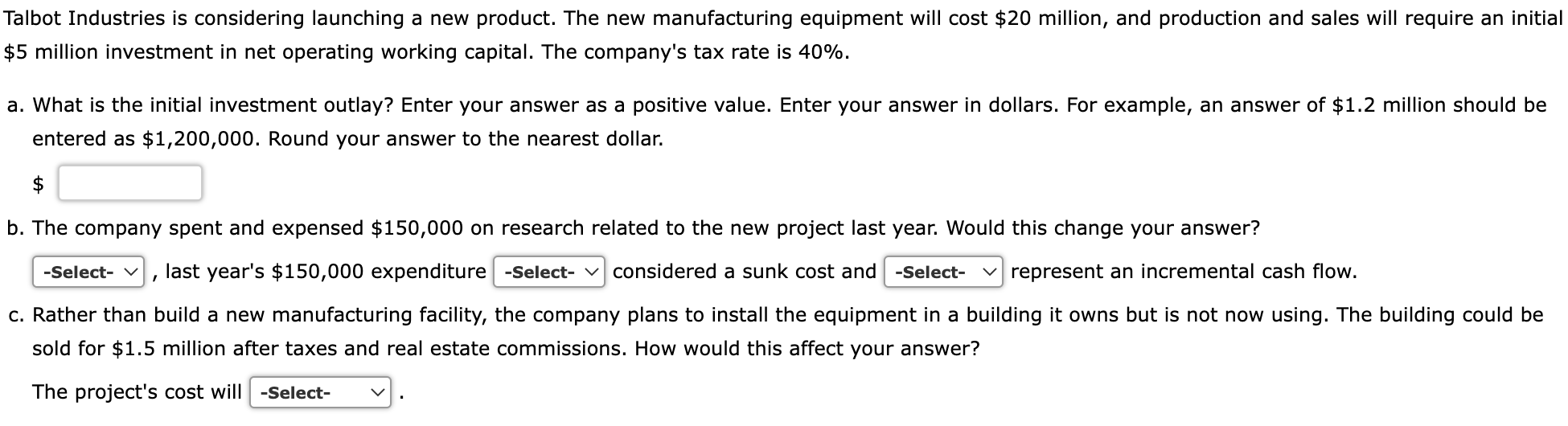

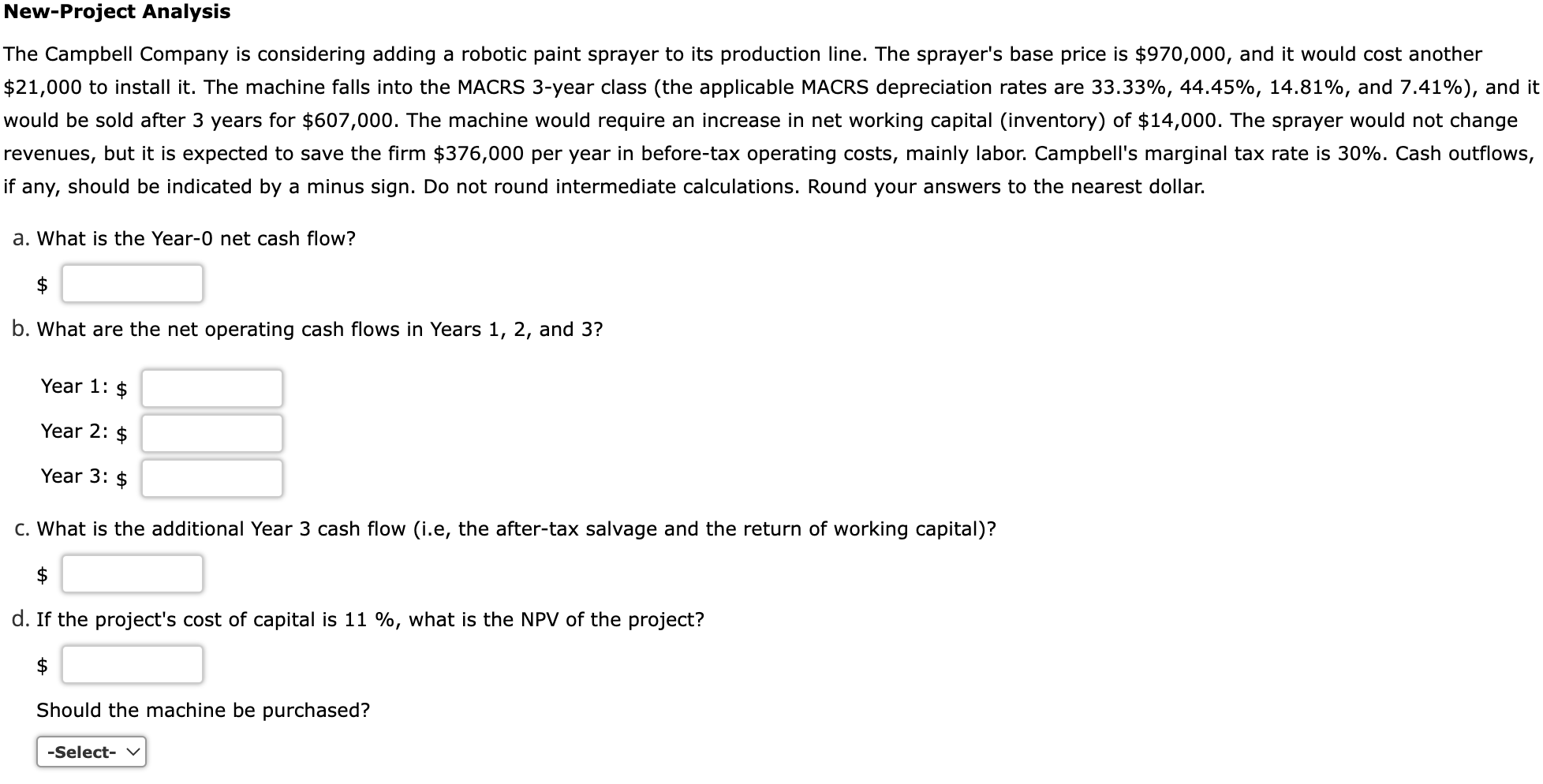

Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $13.2 million, of which 80% has been depreciated. The used equipment can be sold today for $4.4 million, and its tax rate is 40%. What is the equipment's after-tax net salvage value? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. Round your answer to the nearest dollar. $ Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $20 million, and production and sales will require an initial $5 million investment in net operating working capital. The company's tax rate is 40%. a. What is the initial investment outlay? Enter your answer as a positive value. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Round your answer to the nearest dollar. b. The company spent and expensed $150,000 on research related to the new project last year. Would this change your answer? -Select- v last year's $150,000 expenditure -Select- v considered a sunk cost and -Select- v represent an incremental cash flow. C. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. How would this affect your answer? The project's cost will -Select- New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $970,000, and it would cost another $21,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $607,000. The machine would require an increase in net working capital (inventory) of $14,000. The sprayer would not change revenues, but it is expected to save the firm $376,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 30%. Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. a. What is the Year-O net cash flow? $ b. What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ C. What is the additional Year 3 cash flow (i.e, the after-tax salvage and the return of working capital)? $ d. If the project's cost of capital is 11 %, what is the NPV of the project? $ Should the machine be purchased? -Select