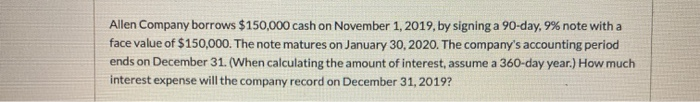

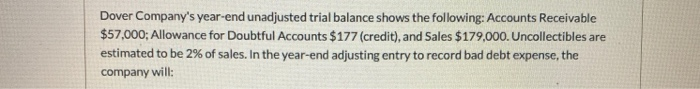

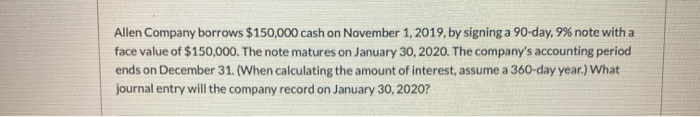

Allen Company borrows $150,000 cash on November 1, 2019, by signing a 90-day, 9% note with a face value of $150,000. The note matures on January 30, 2020. The company's accounting period ends on December 31. (When calculating the amount of interest, assume a 360-day year.) How much interest expense will the company record on December 31, 2019? Dover Company's year-end unadjusted trial balance shows the following: Accounts Receivable $57,000; Allowance for Doubtful Accounts $177 (credit), and Sales $179,000. Uncollectibles are estimated to be 2% of sales. In the year-end adjusting entry to record bad debt expense, the company will: Allen Company borrows $150,000 cash on November 1, 2019, by signing a 90-day, 9% note with a face value of $150,000. The note matures on January 30, 2020. The company's accounting period ends on December 31. (When calculating the amount of Interest, assume a 360-day year.) What journal entry will the company record on January 30, 2020? Allen Company borrows $150,000 cash on November 1, 2019, by signing a 90-day, 9% note with a face value of $150,000. The note matures on January 30, 2020. The company's accounting period ends on December 31. (When calculating the amount of interest, assume a 360-day year.) How much interest expense will the company record on December 31, 2019? Dover Company's year-end unadjusted trial balance shows the following: Accounts Receivable $57,000; Allowance for Doubtful Accounts $177 (credit), and Sales $179,000. Uncollectibles are estimated to be 2% of sales. In the year-end adjusting entry to record bad debt expense, the company will: Allen Company borrows $150,000 cash on November 1, 2019, by signing a 90-day, 9% note with a face value of $150,000. The note matures on January 30, 2020. The company's accounting period ends on December 31. (When calculating the amount of Interest, assume a 360-day year.) What journal entry will the company record on January 30, 2020