Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allendale Enterprises began operations on October 2, 2020, depositing $48,000 in the bank. During this first month of business, the following transactions occurred that affected

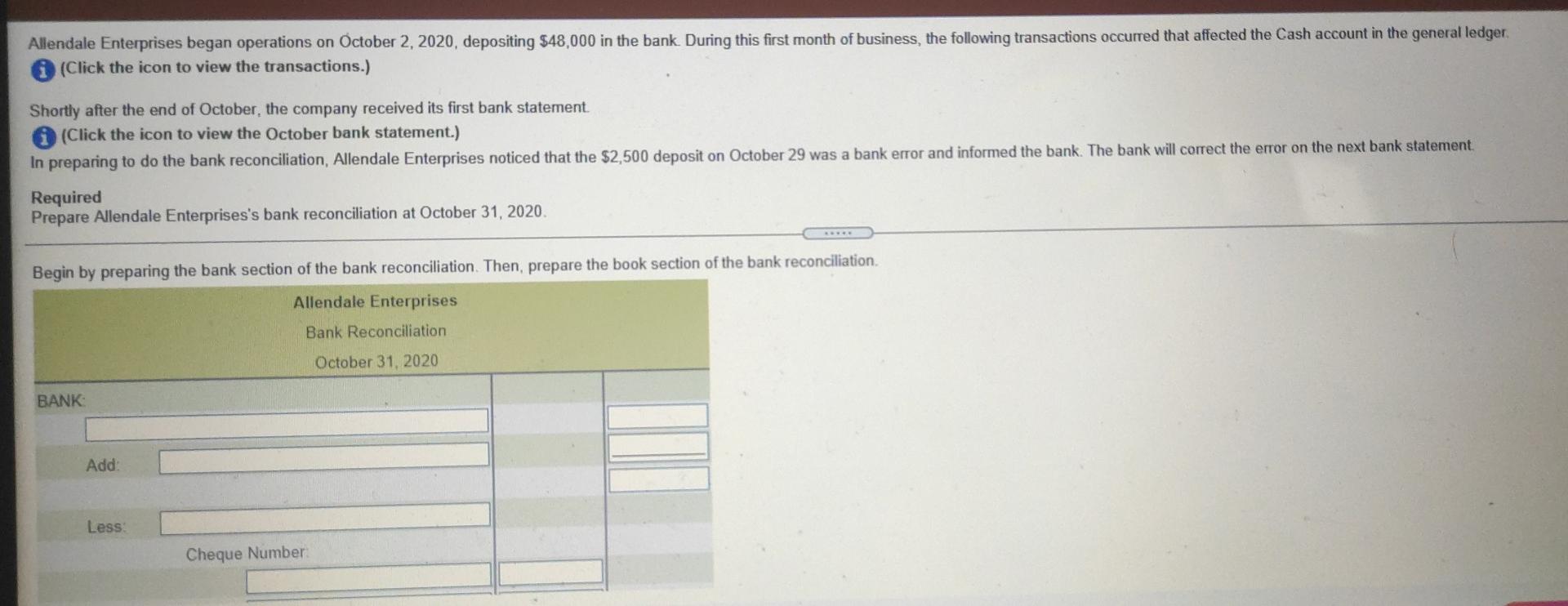

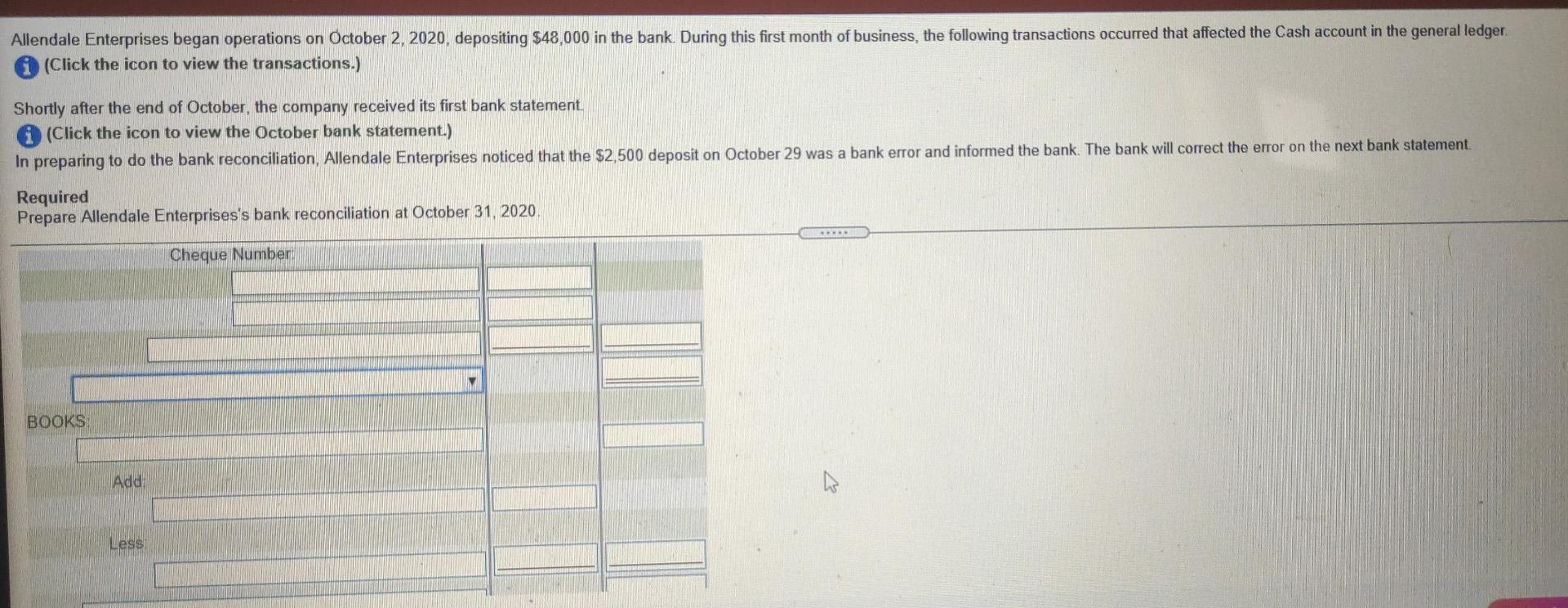

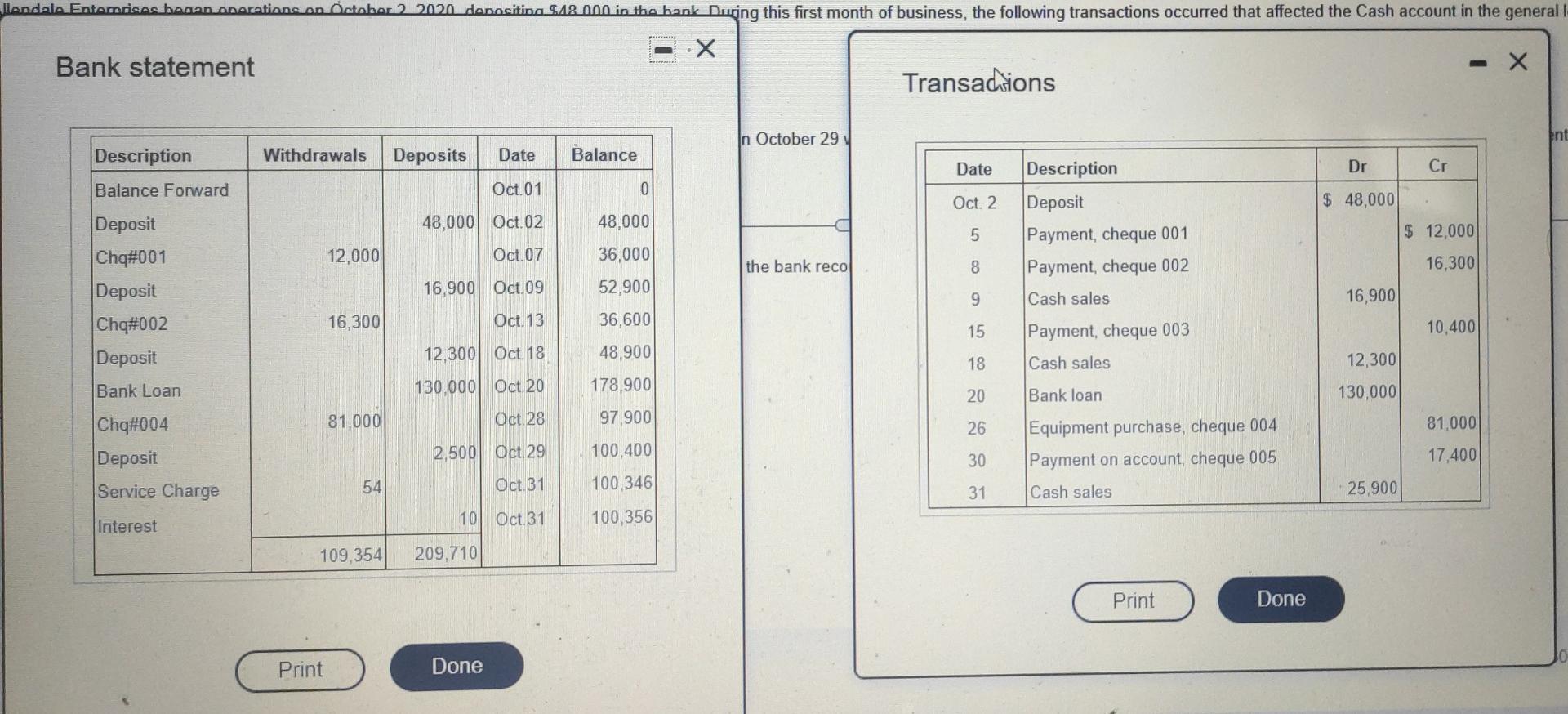

Allendale Enterprises began operations on October 2, 2020, depositing $48,000 in the bank. During this first month of business, the following transactions occurred that affected the Cash account in the general ledger (Click the icon to view the transactions.) Shortly after the end of October, the company received its first bank statement (Click the icon to view the October bank statement.) In preparing to do the bank reconciliation, Allendale Enterprises noticed that the $2,500 deposit on October 29 was a bank error and informed the bank. The bank will correct the error on the next bank statement Required Prepare Allendale Enterprises's bank reconciliation at October 31, 2020 Begin by preparing the bank section of the bank reconciliation. Then, prepare the book section of the bank reconciliation Allendale Enterprises Bank Reconciliation October 31, 2020 BANK Add: Less Cheque Number Allendale Enterprises began operations on October 2, 2020, depositing $48,000 in the bank. During this first month of business, the following transactions occurred that affected the Cash account in the general ledger (Click the icon to view the transactions.) Shortly after the end of October, the company received its first bank statement. (Click the icon to view the October bank statement.) In preparing to do the bank reconciliation, Allendale Enterprises noticed that the $2,500 deposit on October 29 was a bank error and informed the bank. The bank will correct the error on the next bank statement. Required Prepare Allendale Enterprises's bank reconciliation at October 31, 2020 Cheque Number BOOKS Add Less llendale Entamises began onorations on October 2 2020 donositina $12.000 in the bank During this first month of business, the following transactions occurred that affected the Cash account in the general Bank statement - X Transactions In October 29 Ent Withdrawals Deposits Date Balance Description Balance Forward Date Dr Cr Oct. 01 0 Oct. 2 $ 48,000 48,000 Oct.02 48,000 5 Description Deposit Payment, cheque 001 Payment, cheque 002 Cash sales $ 12,000 12,000 Oct.07 the bank reco 8 CO Deposit Chq#001 Deposit Chq#002 Deposit 16,300 16,900 Oct 09 36,000 52,900 36,600 48,900 9 16,900 16,300 Oct 13 15 Payment, cheque 003 10,400 12,300 Oct 18 18 Cash sales 12,300 Bank Loan 130.000 Oct 20 178,900 20 Bank loan 130,000 81,000 Oct.28 97,900 26 81,000 Cha#004 Deposit Service Charge 2,500 Oct 29 100,400 30 Equipment purchase, cheque 004 Payment on account, cheque 005 Cash sales 17,400 54 Oct 31 100,346 31 25,900 101 Oct. 31 100.356 Interest 109.354 209,710 Print Done Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started