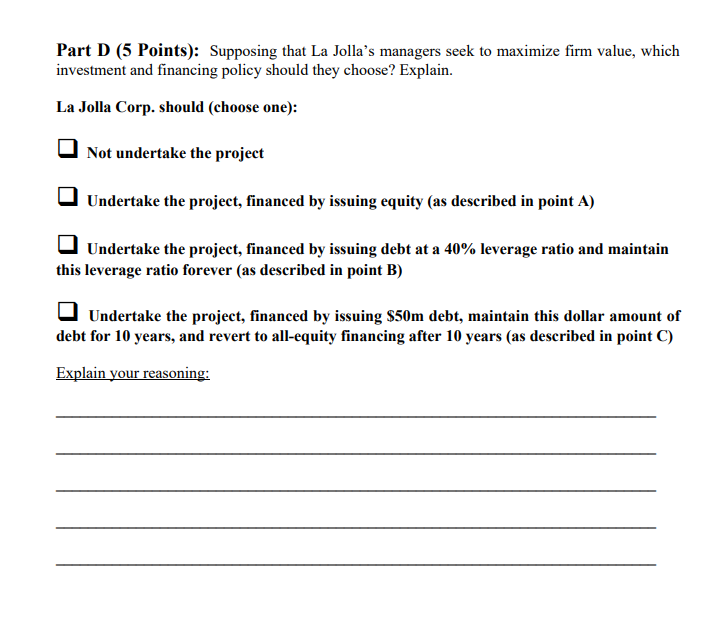

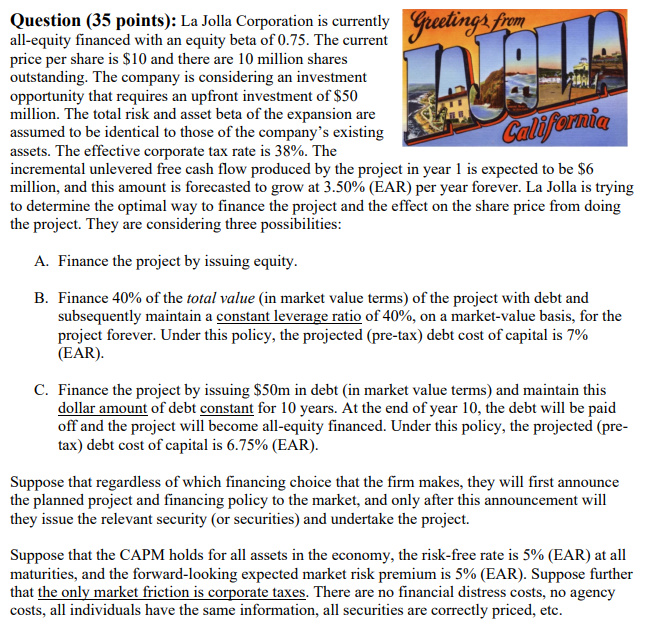

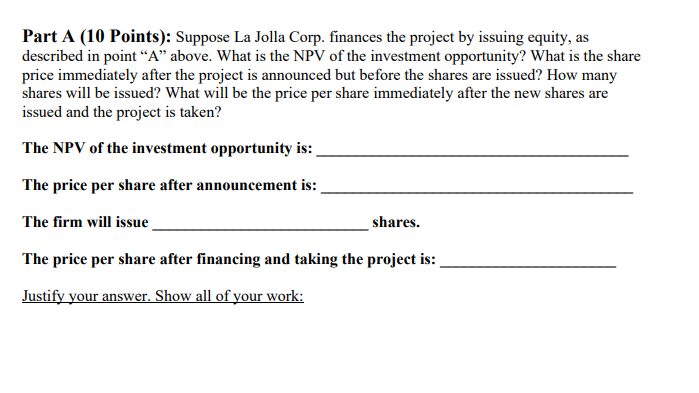

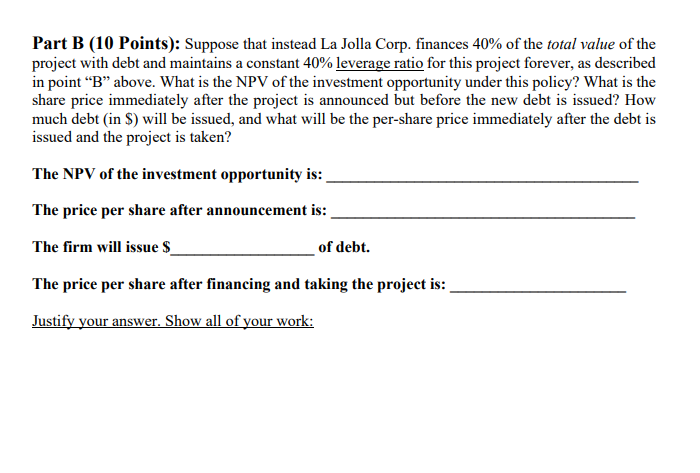

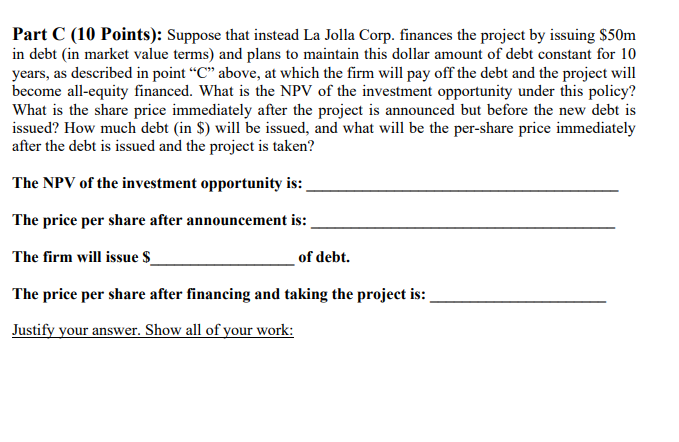

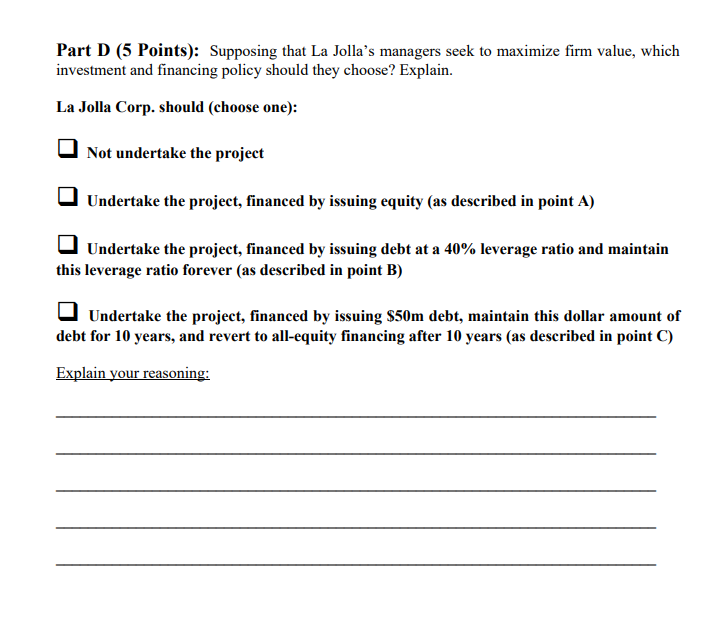

all-equity financed with an equity beta of 0.75 . The current price per share is $10 and there are 10 million shares outstanding. The company is considering an investment opportunity that requires an upfront investment of $50 million. The total risk and asset beta of the expansion are assumed to be identical to those of the company's existing assets. The effective corporate tax rate is 38%. The incremental unlevered free cash flow produced by the project in year 1 is expected to be $6 million, and this amount is forecasted to grow at 3.50% (EAR) per year forever. La Jolla is trying to determine the optimal way to finance the project and the effect on the share price from doing the project. They are considering three possibilities: A. Finance the project by issuing equity. B. Finance 40% of the total value (in market value terms) of the project with debt and subsequently maintain a constant leverage ratio of 40%, on a market-value basis, for the project forever. Under this policy, the projected (pre-tax) debt cost of capital is 7% (EAR). C. Finance the project by issuing $50m in debt (in market value terms) and maintain this dollar amount of debt constant for 10 years. At the end of year 10 , the debt will be paid off and the project will become all-equity financed. Under this policy, the projected (pretax) debt cost of capital is 6.75% (EAR). Suppose that regardless of which financing choice that the firm makes, they will first announce the planned project and financing policy to the market, and only after this announcement will they issue the relevant security (or securities) and undertake the project. Suppose that the CAPM holds for all assets in the economy, the risk-free rate is 5% (EAR) at all maturities, and the forward-looking expected market risk premium is 5\% (EAR). Suppose further that the only market friction is corporate taxes. There are no financial distress costs, no agency costs, all individuals have the same information, all securities are correctly priced, etc. Part A (10 Points): Suppose La Jolla Corp. finances the project by issuing equity, as described in point "A" above. What is the NPV of the investment opportunity? What is the share price immediately after the project is announced but before the shares are issued? How many shares will be issued? What will be the price per share immediately after the new shares are issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue shares. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part B (10 Points): Suppose that instead La Jolla Corp. finances 40% of the total value of the project with debt and maintains a constant 40% leverage ratio for this project forever, as described in point " B " above. What is the NPV of the investment opportunity under this policy? What is the share price immediately after the project is announced but before the new debt is issued? How much debt (in \$) will be issued, and what will be the per-share price immediately after the debt is issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue $ of debt. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part C (10 Points): Suppose that instead La Jolla Corp. finances the project by issuing $50m in debt (in market value terms) and plans to maintain this dollar amount of debt constant for 10 years, as described in point "C" above, at which the firm will pay off the debt and the project will become all-equity financed. What is the NPV of the investment opportunity under this policy? What is the share price immediately after the project is announced but before the new debt is issued? How much debt (in \$) will be issued, and what will be the per-share price immediately after the debt is issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue $ of debt. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part D (5 Points): Supposing that La Jolla's managers seek to maximize firm value, which investment and financing policy should they choose? Explain. La Jolla Corp. should (choose one): Not undertake the project Undertake the project, financed by issuing equity (as described in point A) Undertake the project, financed by issuing debt at a 40% leverage ratio and maintain this leverage ratio forever (as described in point B ) Undertake the project, financed by issuing $50m debt, maintain this dollar amount of debt for 10 years, and revert to all-equity financing after 10 years (as described in point C ) Explain your reasoning: all-equity financed with an equity beta of 0.75 . The current price per share is $10 and there are 10 million shares outstanding. The company is considering an investment opportunity that requires an upfront investment of $50 million. The total risk and asset beta of the expansion are assumed to be identical to those of the company's existing assets. The effective corporate tax rate is 38%. The incremental unlevered free cash flow produced by the project in year 1 is expected to be $6 million, and this amount is forecasted to grow at 3.50% (EAR) per year forever. La Jolla is trying to determine the optimal way to finance the project and the effect on the share price from doing the project. They are considering three possibilities: A. Finance the project by issuing equity. B. Finance 40% of the total value (in market value terms) of the project with debt and subsequently maintain a constant leverage ratio of 40%, on a market-value basis, for the project forever. Under this policy, the projected (pre-tax) debt cost of capital is 7% (EAR). C. Finance the project by issuing $50m in debt (in market value terms) and maintain this dollar amount of debt constant for 10 years. At the end of year 10 , the debt will be paid off and the project will become all-equity financed. Under this policy, the projected (pretax) debt cost of capital is 6.75% (EAR). Suppose that regardless of which financing choice that the firm makes, they will first announce the planned project and financing policy to the market, and only after this announcement will they issue the relevant security (or securities) and undertake the project. Suppose that the CAPM holds for all assets in the economy, the risk-free rate is 5% (EAR) at all maturities, and the forward-looking expected market risk premium is 5\% (EAR). Suppose further that the only market friction is corporate taxes. There are no financial distress costs, no agency costs, all individuals have the same information, all securities are correctly priced, etc. Part A (10 Points): Suppose La Jolla Corp. finances the project by issuing equity, as described in point "A" above. What is the NPV of the investment opportunity? What is the share price immediately after the project is announced but before the shares are issued? How many shares will be issued? What will be the price per share immediately after the new shares are issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue shares. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part B (10 Points): Suppose that instead La Jolla Corp. finances 40% of the total value of the project with debt and maintains a constant 40% leverage ratio for this project forever, as described in point " B " above. What is the NPV of the investment opportunity under this policy? What is the share price immediately after the project is announced but before the new debt is issued? How much debt (in \$) will be issued, and what will be the per-share price immediately after the debt is issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue $ of debt. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part C (10 Points): Suppose that instead La Jolla Corp. finances the project by issuing $50m in debt (in market value terms) and plans to maintain this dollar amount of debt constant for 10 years, as described in point "C" above, at which the firm will pay off the debt and the project will become all-equity financed. What is the NPV of the investment opportunity under this policy? What is the share price immediately after the project is announced but before the new debt is issued? How much debt (in \$) will be issued, and what will be the per-share price immediately after the debt is issued and the project is taken? The NPV of the investment opportunity is: The price per share after announcement is: The firm will issue $ of debt. The price per share after financing and taking the project is: Justify your answer. Show all of your work: Part D (5 Points): Supposing that La Jolla's managers seek to maximize firm value, which investment and financing policy should they choose? Explain. La Jolla Corp. should (choose one): Not undertake the project Undertake the project, financed by issuing equity (as described in point A) Undertake the project, financed by issuing debt at a 40% leverage ratio and maintain this leverage ratio forever (as described in point B ) Undertake the project, financed by issuing $50m debt, maintain this dollar amount of debt for 10 years, and revert to all-equity financing after 10 years (as described in point C ) Explain your reasoning