Answered step by step

Verified Expert Solution

Question

1 Approved Answer

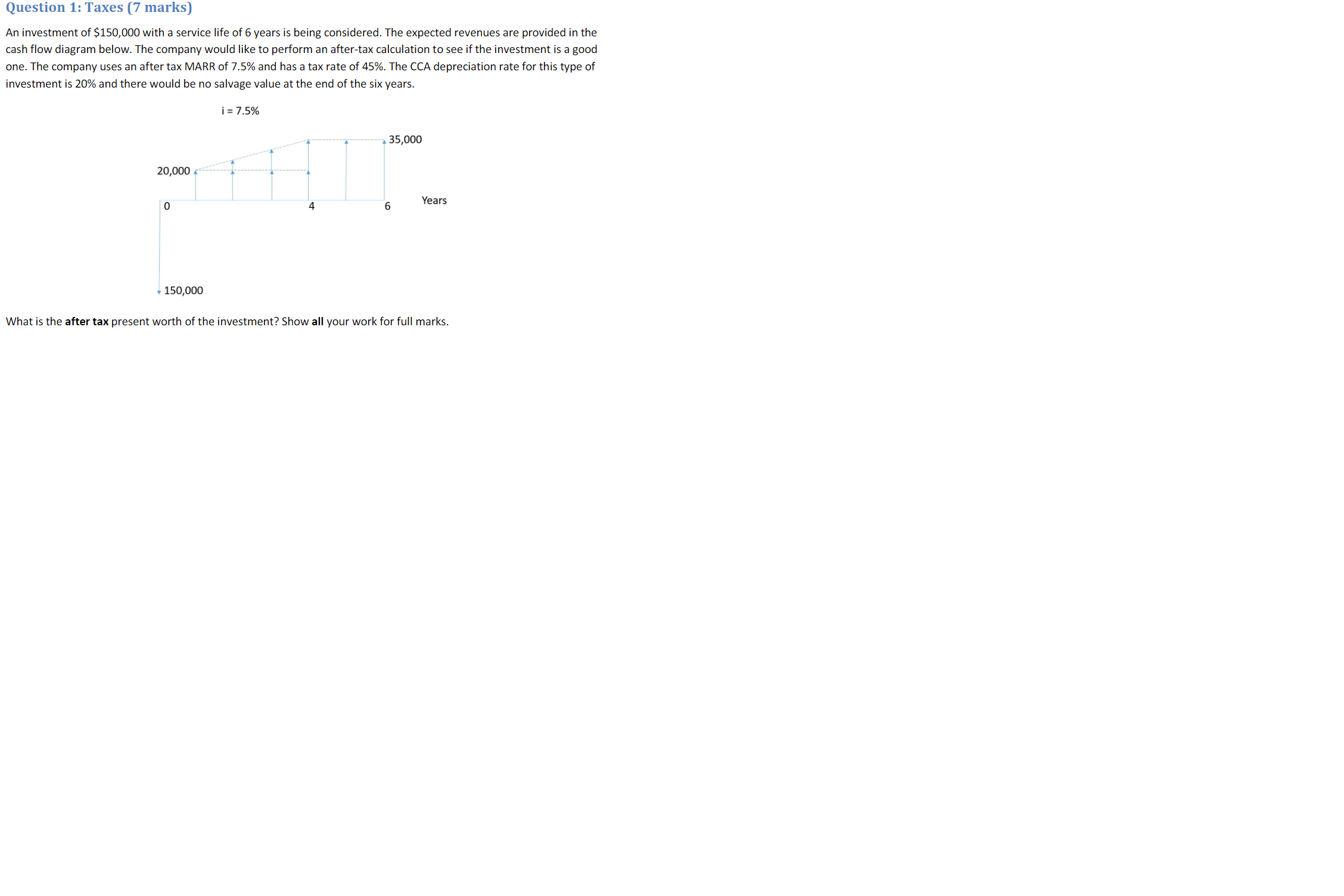

An investment of $150,000 with a service life of 6 years is being considered. The expected revenues are provided in the cash flow diagram below.

An investment of $150,000 with a service life of 6 years is being considered. The expected revenues are provided in the cash flow diagram below. The company would like to perform an after-tax calculation to see if the investment is a good one. The company uses an after tax MARR of 7.5% and has a tax rate of 45%. The CCA depreciation rate for this type of investment is 20% and there would be no salvage value at the end of the six years. What is the after tax present worth of the investment? Show all your work for full marks

An investment of $150,000 with a service life of 6 years is being considered. The expected revenues are provided in the cash flow diagram below. The company would like to perform an after-tax calculation to see if the investment is a good one. The company uses an after tax MARR of 7.5% and has a tax rate of 45%. The CCA depreciation rate for this type of investment is 20% and there would be no salvage value at the end of the six years. What is the after tax present worth of the investment? Show all your work for full marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started