Question

Alliance Manufacturing, Co. is a manufacturer of aluminum cans. Their products are used by food processing plants for canned goods, beverages, and other aluminum needs.

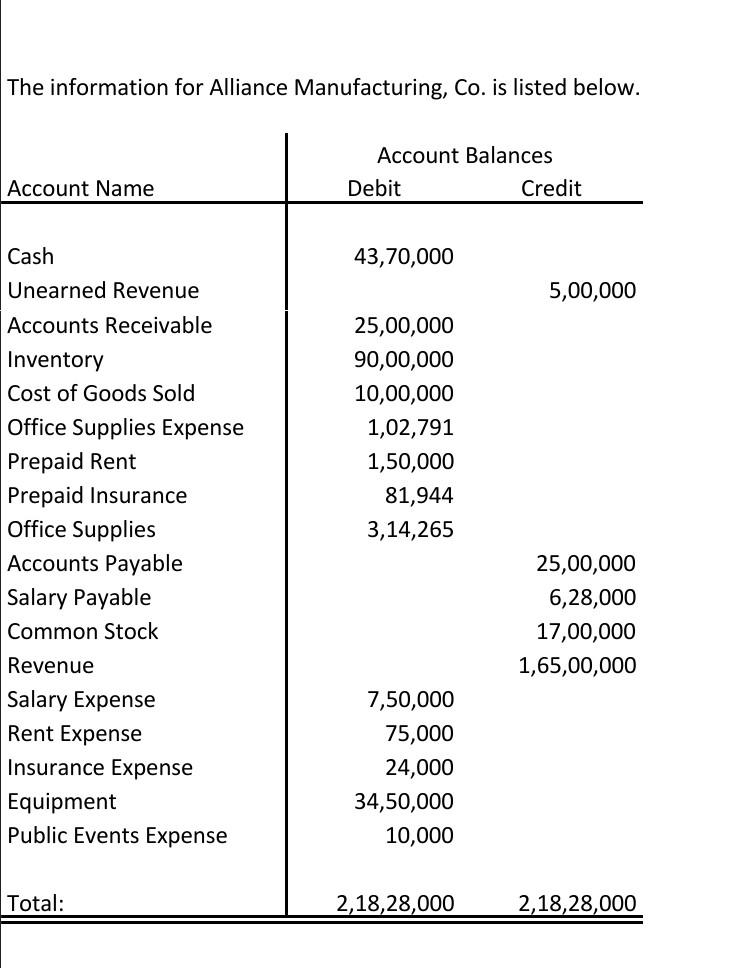

Alliance Manufacturing, Co. is a manufacturer of aluminum cans. Their products are used by food processing plants for canned goods, beverages, and other aluminum needs. The company manufactures their products and sells them to these food processing plants for packaging. As a manufacturing company, Alliance Manufacturing, Co. must include their cost of goods sold when accounting for sales, as well as report this figure in their income statement. You have worked at Alliance Manufacturing, Co. for the past few months in the accounting department. When you arrived for work this morning, you had an email from your supervisor stating that the journal entries for the cost of goods sold (aka COGS) were not made for the past quarter. As a result, the income statement needs to be corrected to account for these costs. Your supervisor wants you to review the transactions for the previous quarter and make the appropriate journal entries to account for the COGS. To keep the figures simple, assume that the sale price is equivalent to the price of inventory and COGS. In addition to the assignment provided by your supervisor, you have your regular duties to complete. The bank statements for this month have arrived, and it is your job to reconcile the bank statements to the accounts in Alliance Manufacturing, Co., Inc's books. So much for having an easy day at work! The information for Alliance Manufacturing, Co. is listed below.

Transactional Information: 1. Campbell's Soup, Company purchased $ 3,00,000 in various can sizes to cover their needs for the upcoming manufacturing needs. 2. The company entered into a contract to sell $ 5,25,000 of goods to an adult beverage manufacturer. The inventory has not yet been delivered. 3.Coca-Cola purchased beverage cans for the amount of $4,00,000 . 4. The purchasing agent for the Campbell Soup Company ordered the wrong type of can. They returned $1,25,000 worth of product. The items were put back in inventory for resale. 5. A chain restaurant purchased goods for $2,50,000 for their production for food distribution. Using the period information provided for Alliance Manufacturing, Co., Inc, prepare the required journal entries to adjust for COGS and inventory. Use the information to create an updated income statement for the company. Then use the bank statement information to reconcile the book balances for all accounts for the company. A tab for each step of the process has been included and labeled within this Excel document. Use the templates provided on each tab to record your information.

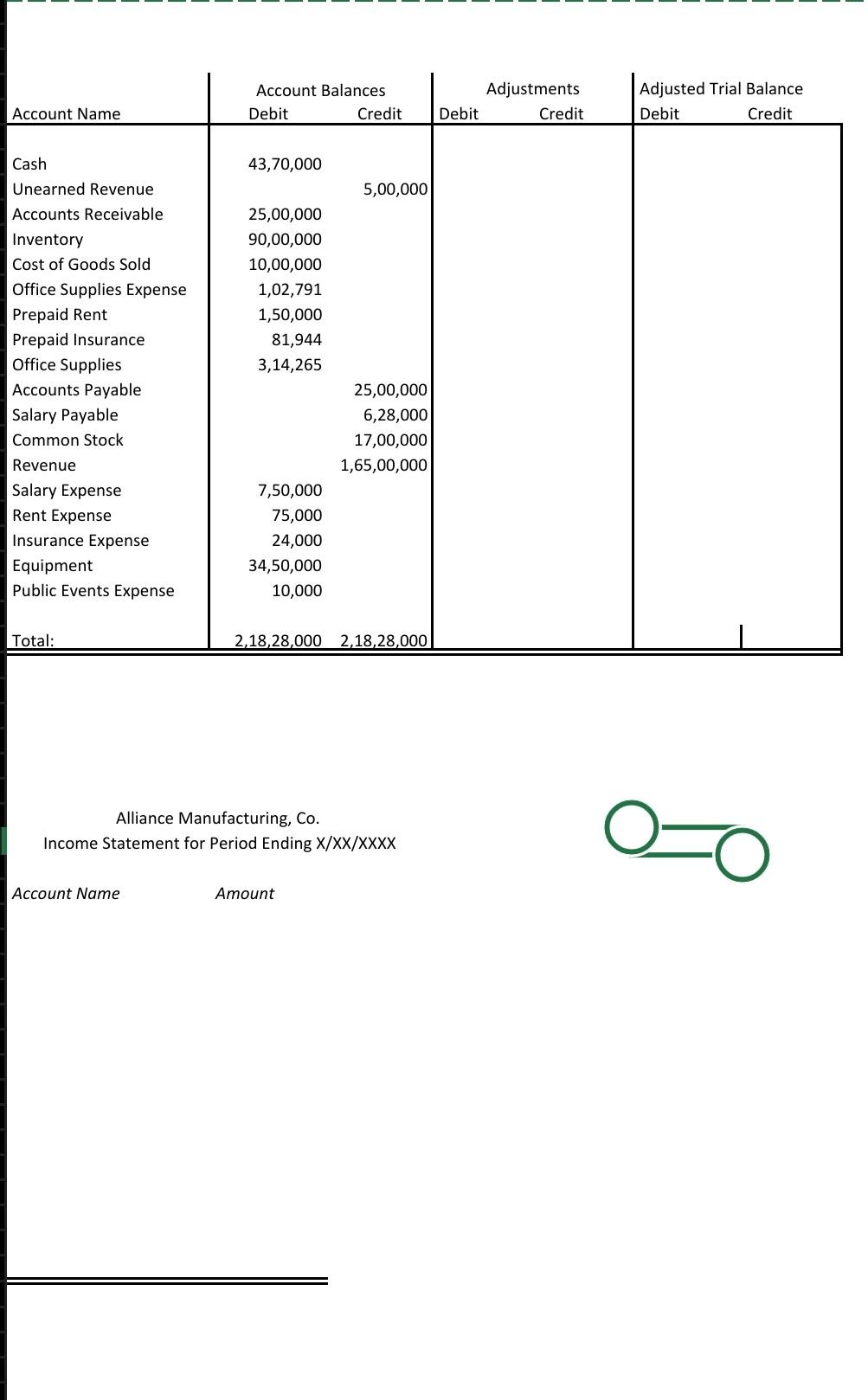

Part 1: Journal Entries for COGS and Inventory Directions: Using the transactional information provided for Alliance Manufacturing, Co., prepare journal entries using the data provided listed below (same as Tab 1 of the Excel document, entitled Overview), regarding the sale transactions that occurred for the company. Use the account names as listed in the Account Balances table on Tab 1 Overview. All sales and changes to cash, A/R and prepaid revenue have been recorded. Only make the entries to adjust for inventory and cost of goods sold. If a transaction does not require an additional entry, state this below the transaction. List your journal entries under each identified transaction. Transactional Information (same as Overview Tab): 1. Campbell's Soup, Company purchased $ 3,00,000 in various can sizes to cover their needs for the upcoming manufacturing needs. 2. The company entered into a contract to sell $ 5,25,000 of goods to an adult beverage manufacturer. The inventory has not yet been delivered. 3.Coca-Cola purchased beverage cans for the amount of $4,00,000 . 4. The purchasing agent for the Campbell Soup, Company ordered the wrong type of can. They returned $1,25,000 worth of product. The items were put back in inventory for resale. 5. A chain restaurant purchased goods for $2,50,000 for their production for food distribution. Part 2: Updated Income Statement Directions: Using the information you created for your journal entries in Tab 2 Journal Entries, update the information for Alliance Manufacturing, Co. The information below is copied from the Tab 1 Overview. Use the worksheet information to prepare the income statement. Once the worksheet is complete, use the space below to make your formal income statement. Reminder: Not all information listed belongs on the income statement, so please pay attention to what accounts you are including on your statement.

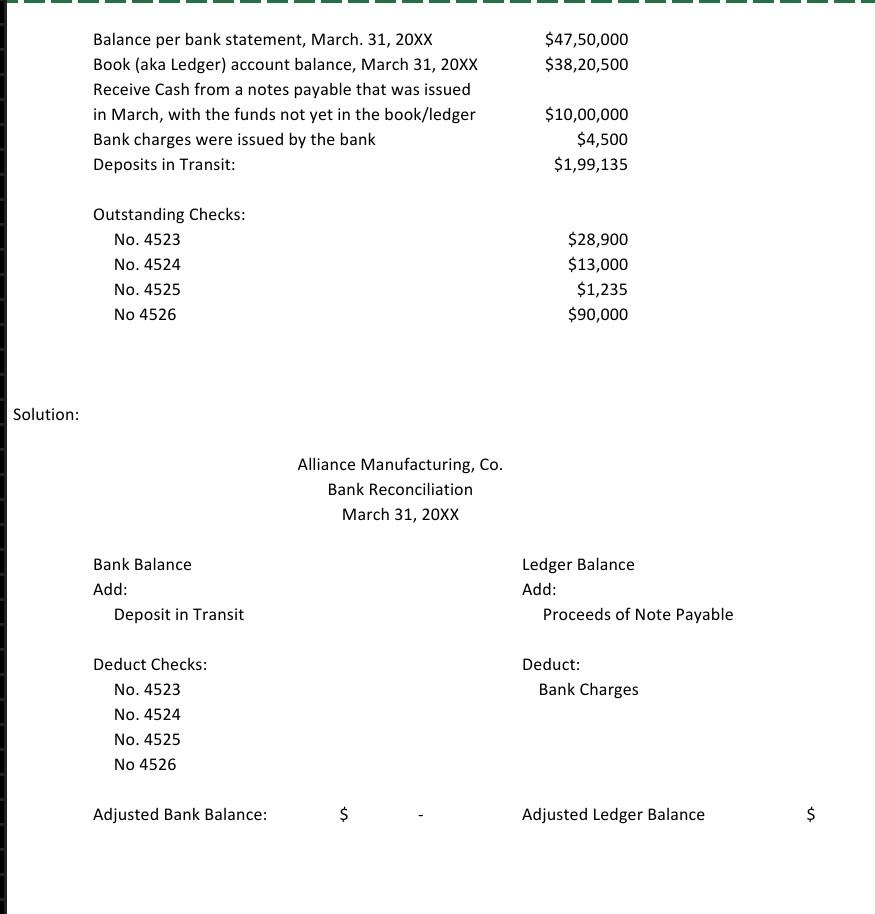

Part3: Bank Reconciliation You have finally completed the corrections to the journal entries for the COGS/Inventory fiasco, and corrected the income statements. What a mess! You consider asking your boss for a raisebut you still have your regular duties to complete first for the day. It's time to move to your next project - the monthly bank statement reconciliations! You lay out the bank statements, and compare the information on the statements to the cash balances listed in the book values. the information you have is listed below. Directions: Using the information provided below, prepare the bank reconciliation and determine the correct available cash balance for Alliance Manufacturing, Co. Use the template listed below, or you can create your own template.

Thn information far Allinnen MAanifartirine ra ie liethd halams Alliance Manufacturing, Co. Income Statement for Period Ending X/XX/XXXX Account Name Amount Balance per bank statement, March. 31, 20XX Book (aka Ledger) account balance, March 31, 20XX Receive Cash from a notes payable that was issued in March, with the funds not yet in the book/ledger Bank charges were issued by the bank Deposits in Transit: Outstanding Checks: No. 4523 No. 4524 No. 4525 No 4526 $47,50,000 $38,20,500 $10,00,000 $4,500 $1,99,135 $28,900 $13,000 $1,235 $90,000 Solution: Alliance Manufacturing, Co. Bank Reconciliation March 31, 20XX Bank Balance Add: Deposit in Transit Deduct Checks: No. 4523 No. 4524 No. 4525 No 4526 Ledger Balance Add: Proceeds of Note Payable Deduct: Bank Charges Adjusted Bank Balance: $ Adjusted Ledger Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started