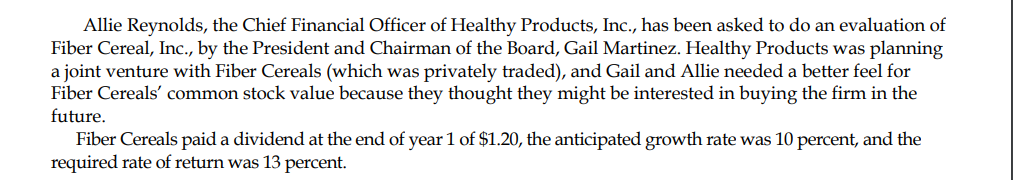

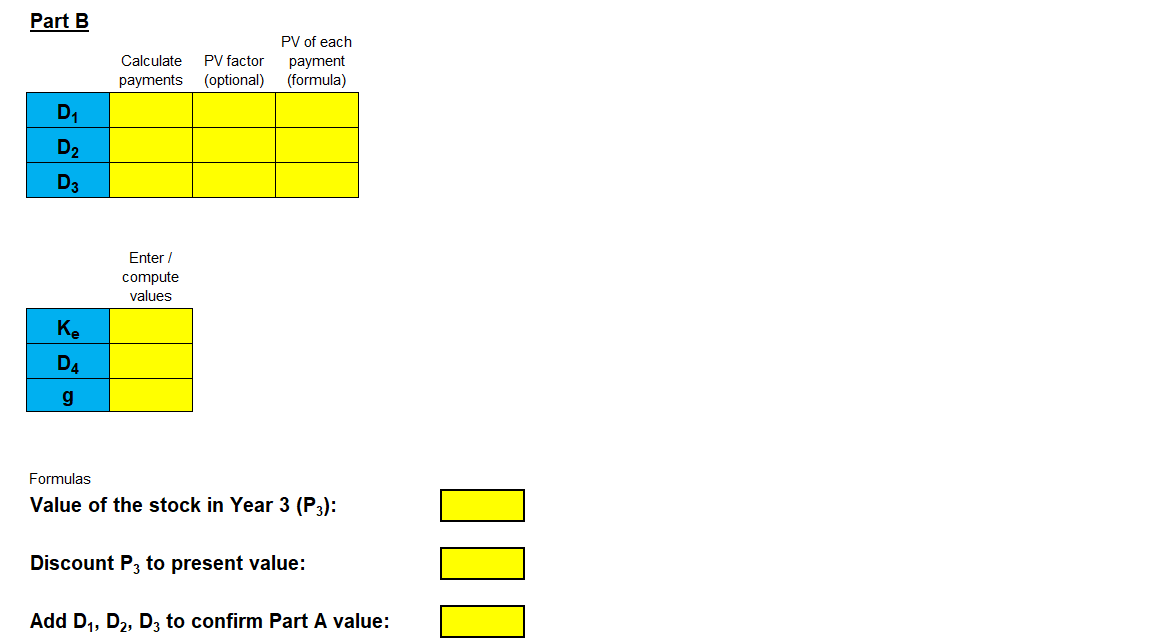

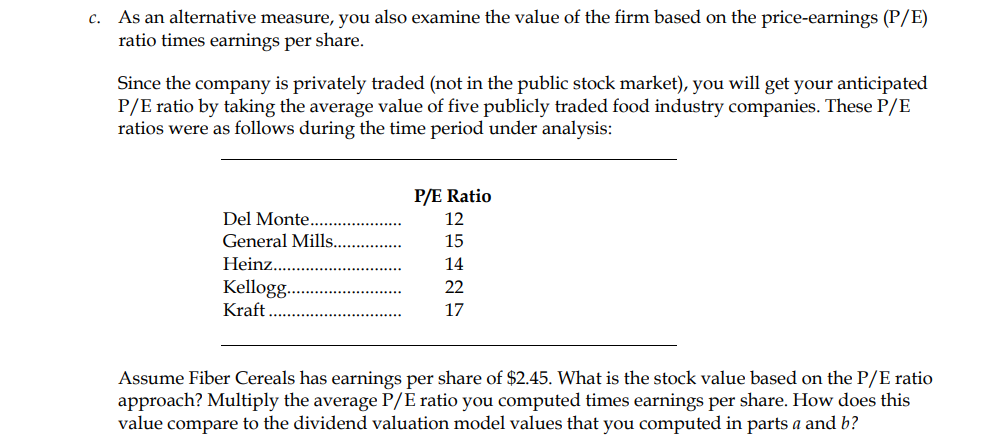

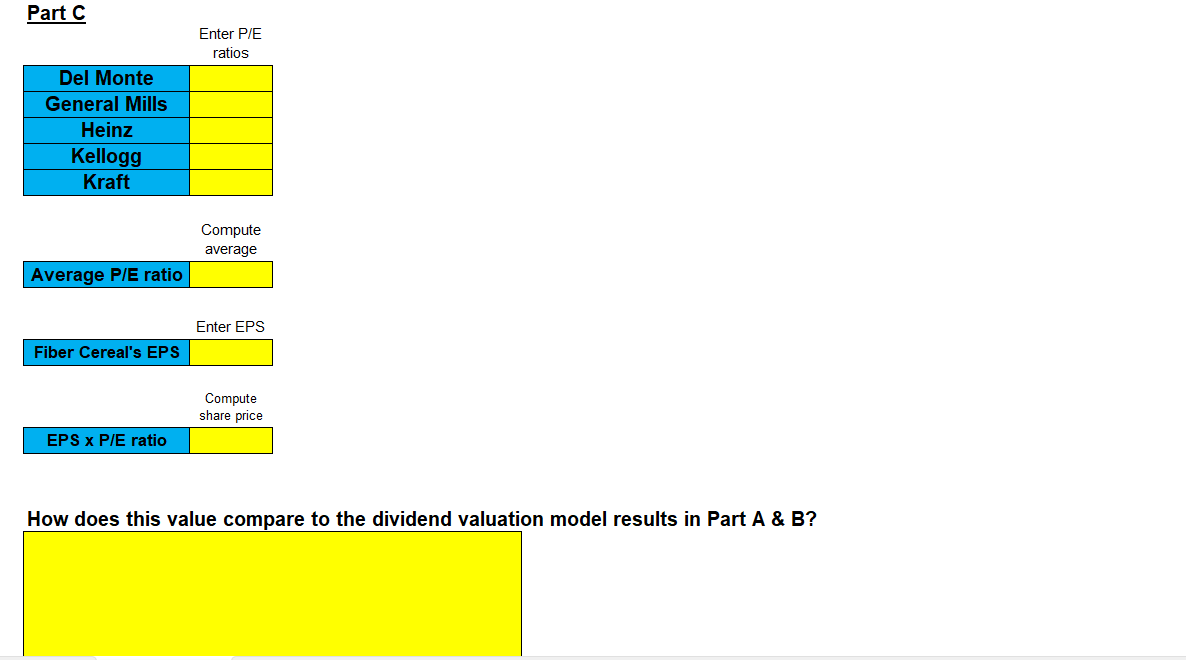

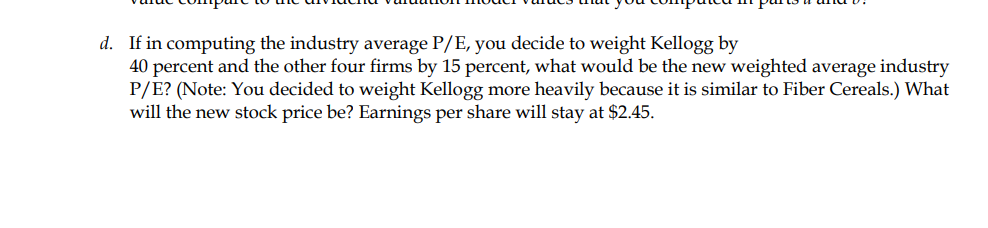

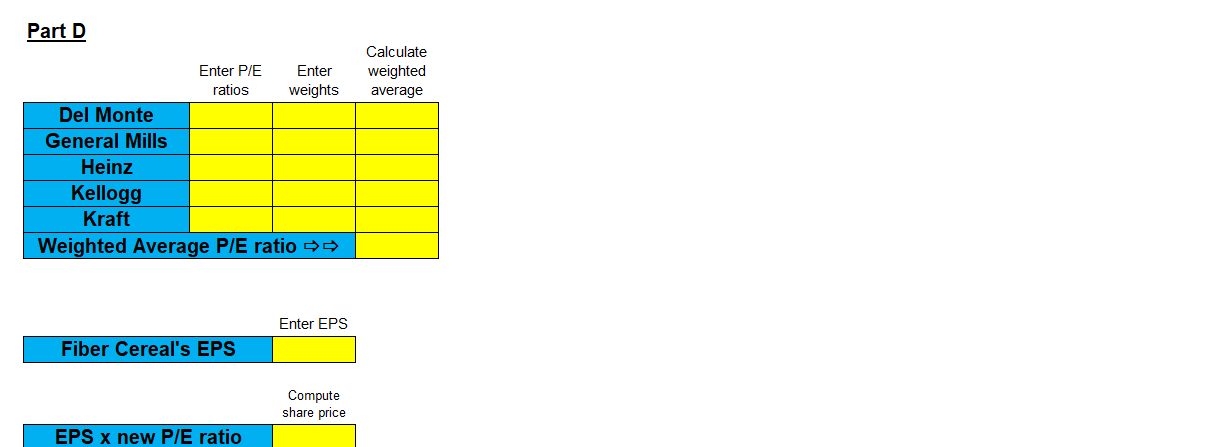

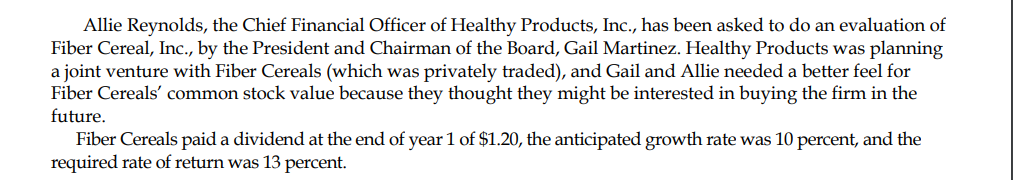

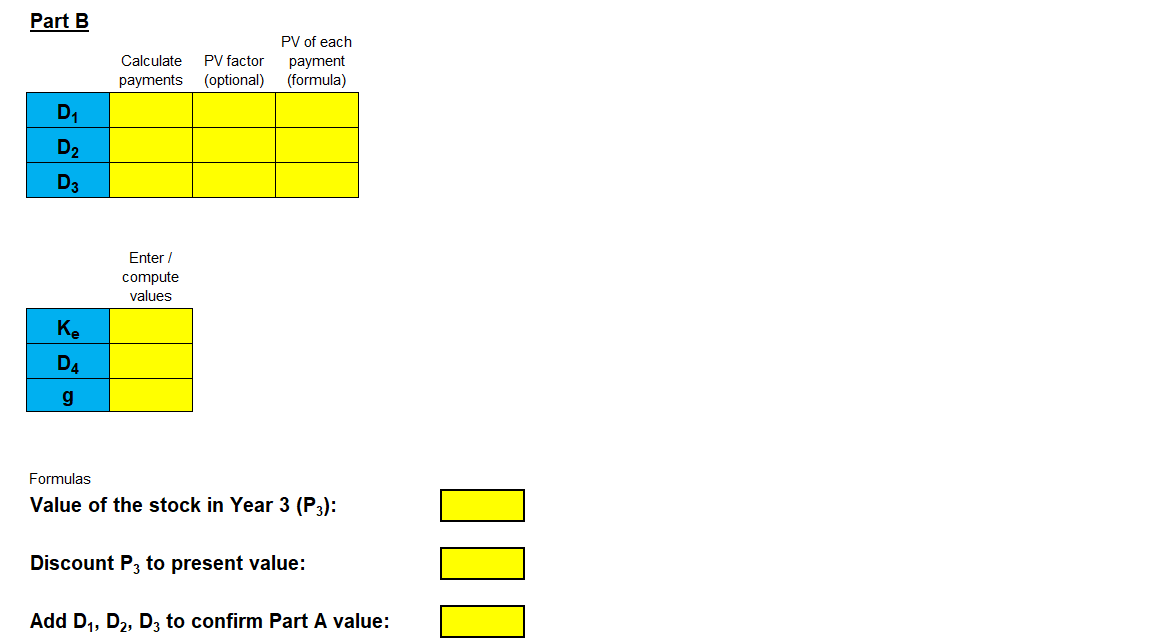

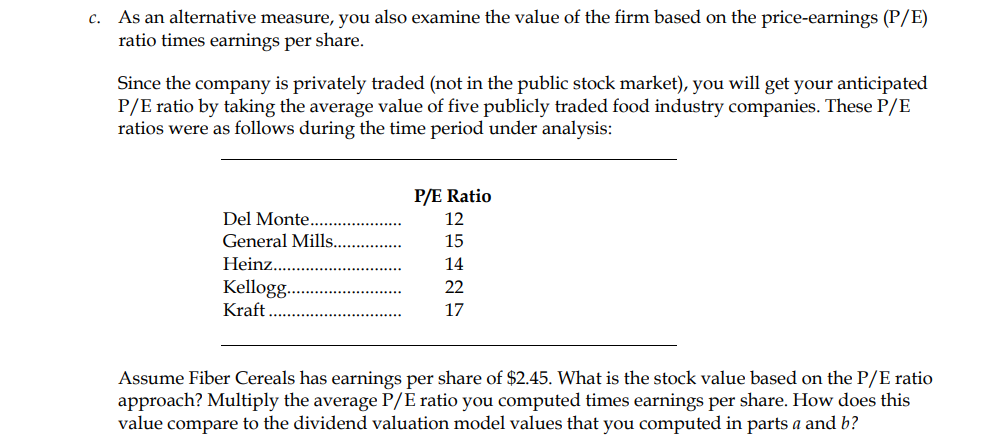

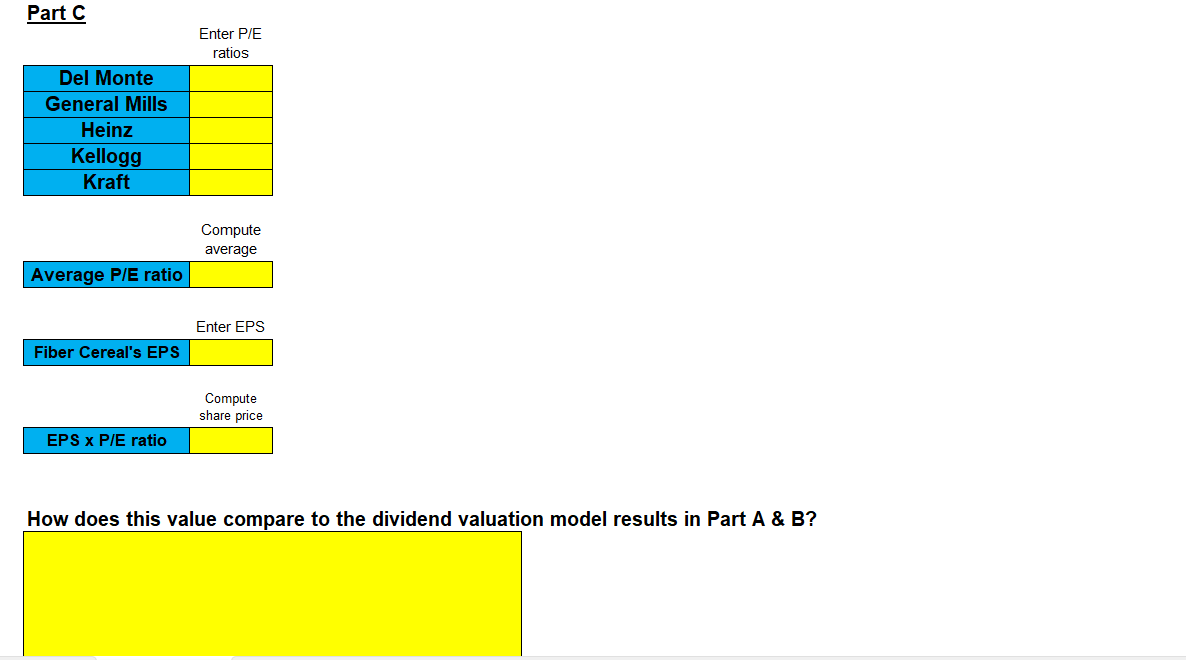

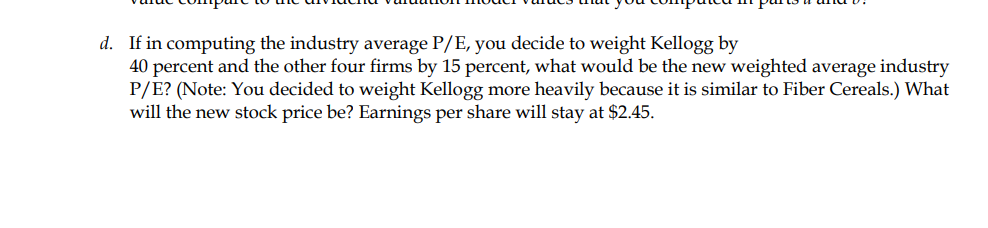

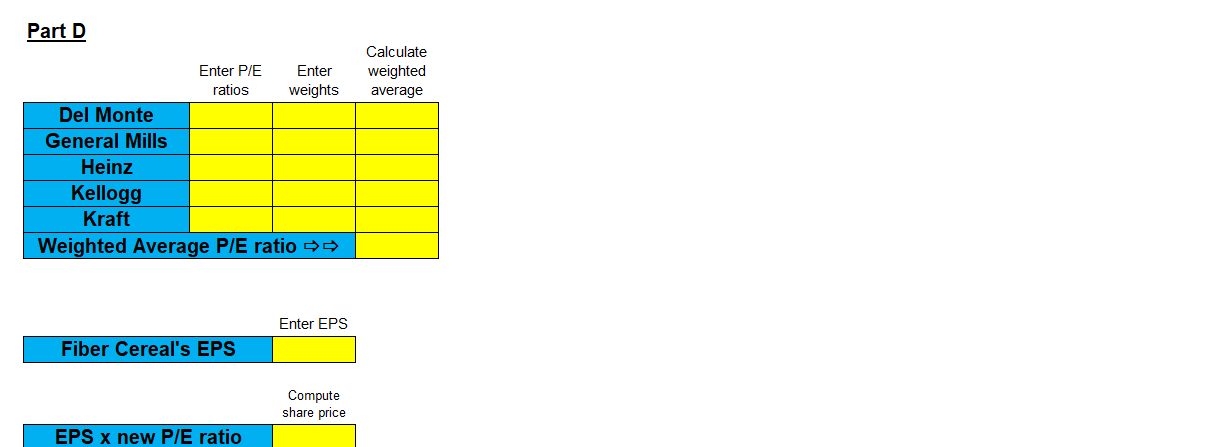

Allie Reynolds, the Chief Financial Officer of Healthy Products, Inc., has been asked to do an evaluation of Fiber Cereal, Inc., by the President and Chairman of the Board, Gail Martinez. Healthy Products was planning a joint venture with Fiber Cereals (which was privately traded), and Gail and Allie needed a better feel for Fiber Cereals' common stock value because they thought they might be interested in buying the firm in the future. Fiber Cereals paid a dividend at the end of year 1 of $1.20, the anticipated growth rate was 10 percent, and the required rate of return was 13 percent. Part B PV of each Calculate PV factor payment Enter / compute values Formulas Value of the stock in Year 3(P3) : Discount P3 to present value: Add D1,D2,D3 to confirm Part A value: c. As an alternative measure, you also examine the value of the firm based on the price-earnings (P/E) ratio times earnings per share. Since the company is privately traded (not in the public stock market), you will get your anticipated P/E ratio by taking the average value of five publicly traded food industry companies. These P/E ratios were as follows during the time period under analysis: Assume Fiber Cereals has earnings per share of $2.45. What is the stock value based on the P/E ratio approach? Multiply the average P/E ratio you computed times earnings per share. How does this value compare to the dividend valuation model values that you computed in parts a and b ? Part C Enter P/E ratios Compute average Enter EPS Compute share price 1 How does this value compare to the dividend valuation model results in Part A&B ? d. If in computing the industry average P/E, you decide to weight Kellogg by 40 percent and the other four firms by 15 percent, what would be the new weighted average industry P/E? (Note: You decided to weight Kellogg more heavily because it is similar to Fiber Cereals.) What will the new stock price be? Earnings per share will stay at $2.45. PartD \begin{tabular}{|c|c|c|c|} \multicolumn{2}{c}{EnterP/Eratios} & \multicolumn{1}{c|}{Enterweights} & \multicolumn{1}{c}{Calculateweightedaverage} \\ \hline Del Monte & & & \\ \hline General Mills & & & \\ \hline Heinz & & & \\ \hline Kellogg & & & \\ \hline \multicolumn{2}{|c|}{ Kraft } & & \\ \hline Weighted Average P/E ratio & \\ \hline \end{tabular} Enter EPS Fiber Cereal's EPS Compute share price Allie Reynolds, the Chief Financial Officer of Healthy Products, Inc., has been asked to do an evaluation of Fiber Cereal, Inc., by the President and Chairman of the Board, Gail Martinez. Healthy Products was planning a joint venture with Fiber Cereals (which was privately traded), and Gail and Allie needed a better feel for Fiber Cereals' common stock value because they thought they might be interested in buying the firm in the future. Fiber Cereals paid a dividend at the end of year 1 of $1.20, the anticipated growth rate was 10 percent, and the required rate of return was 13 percent. Part B PV of each Calculate PV factor payment Enter / compute values Formulas Value of the stock in Year 3(P3) : Discount P3 to present value: Add D1,D2,D3 to confirm Part A value: c. As an alternative measure, you also examine the value of the firm based on the price-earnings (P/E) ratio times earnings per share. Since the company is privately traded (not in the public stock market), you will get your anticipated P/E ratio by taking the average value of five publicly traded food industry companies. These P/E ratios were as follows during the time period under analysis: Assume Fiber Cereals has earnings per share of $2.45. What is the stock value based on the P/E ratio approach? Multiply the average P/E ratio you computed times earnings per share. How does this value compare to the dividend valuation model values that you computed in parts a and b ? Part C Enter P/E ratios Compute average Enter EPS Compute share price 1 How does this value compare to the dividend valuation model results in Part A&B ? d. If in computing the industry average P/E, you decide to weight Kellogg by 40 percent and the other four firms by 15 percent, what would be the new weighted average industry P/E? (Note: You decided to weight Kellogg more heavily because it is similar to Fiber Cereals.) What will the new stock price be? Earnings per share will stay at $2.45. PartD \begin{tabular}{|c|c|c|c|} \multicolumn{2}{c}{EnterP/Eratios} & \multicolumn{1}{c|}{Enterweights} & \multicolumn{1}{c}{Calculateweightedaverage} \\ \hline Del Monte & & & \\ \hline General Mills & & & \\ \hline Heinz & & & \\ \hline Kellogg & & & \\ \hline \multicolumn{2}{|c|}{ Kraft } & & \\ \hline Weighted Average P/E ratio & \\ \hline \end{tabular} Enter EPS Fiber Cereal's EPS Compute share price