Question

* Allison receives a 10% ownership in the capital and profits of XYZ Partnership in return for services she will provide the partnership. As part

* Allison receives a 10% ownership in the capital and profits of XYZ Partnership in return for services she will provide the partnership. As part of the agreement, however, if she withdraws from the partnership within two years or fails to satisfactorily perform the services required, she must return the partnership interest to the partnership. The interest she received from the partnership is currently worth $40,000.

-Please explain the general rule on how Allison should treat this transaction.

-How would the transaction be treated if Allison makes a Section 83(b) election?

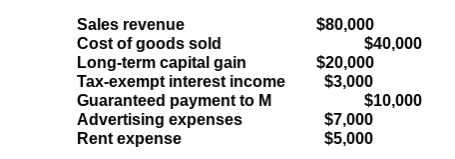

* M and N form MN LLC. M and N share profits and losses equally. Ms initial basis in her LLC interest is $10,000. Ns initial basis is $20,000. The LLC has no liabilities at the beginning or end of the year. During the current year, the LLC experienced the following:

- What is Ms tax basis (outside basis) in her LLC interest at the end of the year?

- What is Ns tax basis (outside basis) in his LLC interest at the end of the year?

* P, Q, and R Corporations form PQR, LLC. P Corporation owns 20% of the LLC. Q Corporation owns 55% of the LLC. R Corporation owns 25% of the LLC. P Corporations taxable year end is June 30. Qs taxable year end is October 31. Rs taxable year end is June 30.

-What is the partnerships required taxable year?

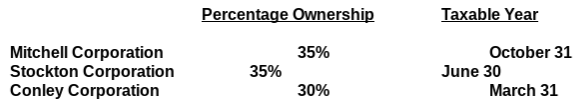

* Mitchell Corporation, Stockton Corporation, and Conley Corporation are members of the newly formed Jazz, LLC, which is treated as a partnership for income tax purposes. Here is more information regarding the three corporations.

-What is the required taxable year for Jazz, LLC?

****THE FACTS AND INFORMATION PROVIDED IS ACCURATE AND COMPLETE.****

Sales revenue Cost of goods sold Long-term capital gain Tax-exempt interest income Guaranteed payment to M Advertising expenses Rent expense $80,000 $40,000 $20,000 $3,000 $10,000 $7,000 $5,000 Percentage Ownership Taxable Year 35% Mitchell Corporation Stockton Corporation Conley Corporation 35% October 31 June 30 March 31 30% Sales revenue Cost of goods sold Long-term capital gain Tax-exempt interest income Guaranteed payment to M Advertising expenses Rent expense $80,000 $40,000 $20,000 $3,000 $10,000 $7,000 $5,000 Percentage Ownership Taxable Year 35% Mitchell Corporation Stockton Corporation Conley Corporation 35% October 31 June 30 March 31 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started