You are an auditor and you have been asked to review the December 31, 2024, balance sheet for Locust Point Incorporated. After four days

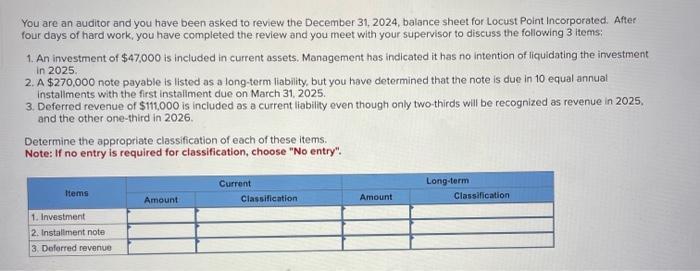

You are an auditor and you have been asked to review the December 31, 2024, balance sheet for Locust Point Incorporated. After four days of hard work, you have completed the review and you meet with your supervisor to discuss the following 3 items: 1. An investment of $47,000 is included in current assets. Management has indicated it has no intention of liquidating the investment in 2025. 2. A $270,000 note payable is listed as a long-term liability, but you have determined that the note is due in 10 equal annual installments with the first installment due on March 31, 2025. 3. Deferred revenue of $111,000 is included as a current liability even though only two-thirds will be recognized as revenue in 2025, and the other one-third in 2026. Determine the appropriate classification of each of these items. Note: If no entry is required for classification, choose "No entry". Items 1. Investment 2. Installment note 3. Deferred revenue Amount Current Classification Amount Long-term Classification

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 5 6 7 6000 8 9 10 11 12 13 14 15 16 A No 1 2 3 B Investment E Determine the appropr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started