alll one Question PLEASE ANSWER EVERY SINGLE PART. thank you for answering!

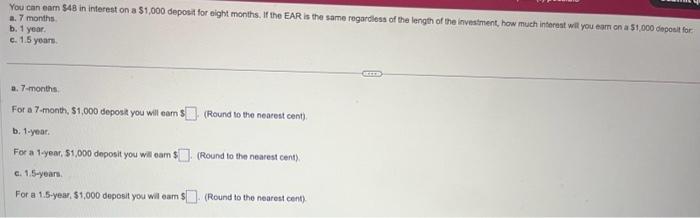

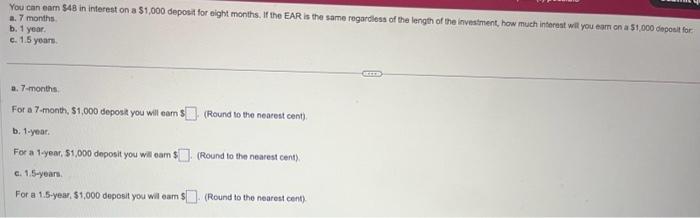

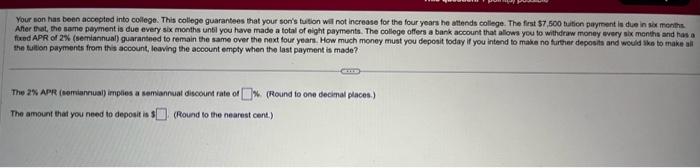

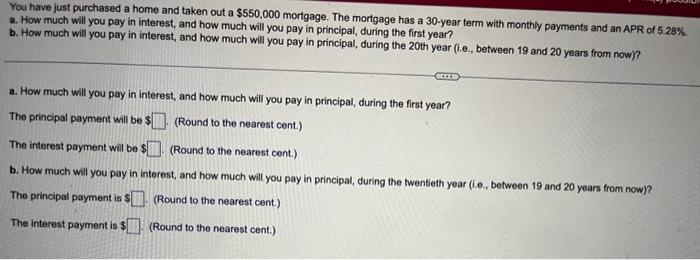

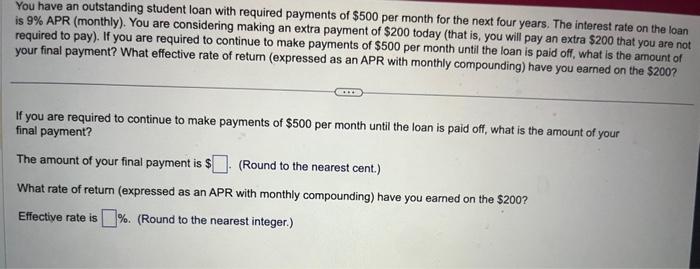

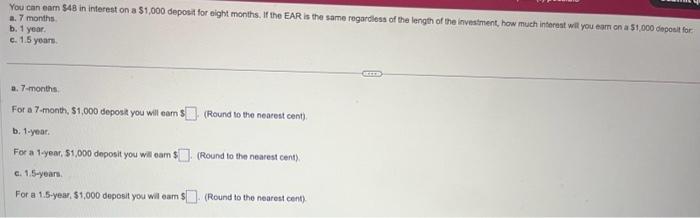

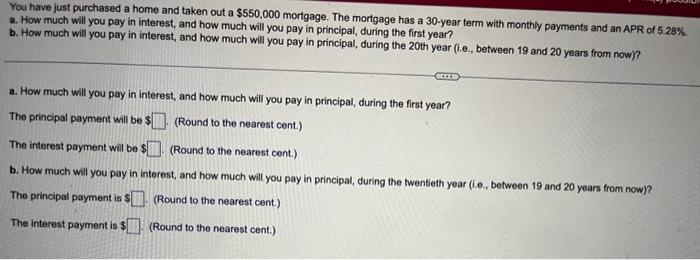

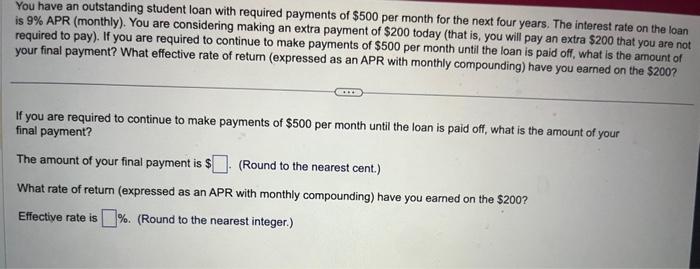

You can earn $48 in interest on a $1,000 deposit for eight months. If the EAR is the same rogarcless of the length of the invesiment, how much interest will you earn on a $1,000 dopoel for a. 7 months b. 1 yoar. c. 1.5 yoars. a. 7-months For a 7-month, 51,000 depost you will eam? (Round to the nearest cent). b. 1-year. For a 1-yeer, $1,000 deposit you wis eam $ (Round to the nearest cent). c. 1.5-yeans. For a 1.5-year, $1,000 deposit you wal eam \$ (Round to the nearest cent). Your son has been accepted into college. This college guarantees that your son's tution wit not increase for the four years he attends college. The frst $7,500 bution payront is die in six menthe Aher tovat, the same payment is due every six months unbil you have made a fotal of eight payments. The colloge offers a bank account that allows you to withdraw monay werery six menths and has a fred APR of 2% (se-niannual) guaranteed to remain the same over the next four years. How much money must you deposit foday if you intend to makis no furterer deposits and would Ike to make all the twibon payments from this account, leaving the account empty when the last payment is made? The 2\% APR (cemiannuai) implies a semiannuat discount fate of *. (Round to one decinal places.) The amount that you need to deposit is 1 (Round to the nearest cent.) You have just purchased a home and taken out a $550,000 mortgage. The mortgage has a 30 -year term with monthly payments and an APR of 5.28%. a. How much will you pay in interest, and how much will you pay in principal, during the first year? b. How much will you pay in interest, and how much will you pay in principal, during the 20 th year (i.e., between 19 and 20 years from now)? a. How much will you pay in interest, and how much will you pay in principal, during the first year? The principal payment will be \$ (Round to the nearest cent.) The interest payment will be $ (Round to the nearest cent.) b. How much will you pay in interest, and how much will you pay in principal, during the twentieth year (i.e., between 19 and 20 years from now)? The principal payment is $ (Round to the nearest cent.) The interest payment is $ (Round to the nearest cent.) You have an outstanding student loan with required payments of $500 per month for the next four years. The interest rate on the loan is 9% APR (monthly). You are considering making an extra payment of $200 today (that is, you will pay an extra $200 that you are no required to pay). If you are required to continue to make payments of $500 per month until the loan is paid off, what is the amount of your final payment? What effective rate of return (expressed as an APR with monthly compounding) have you earned on the $200 ? If you are required to continue to make payments of $500 per month until the loan is paid off, what is the amount of your final payment? The amount of your final payment is $ (Round to the nearest cent.) What rate of return (expressed as an APR with monthly compounding) have you earned on the $200 ? Effective rate is %. (Round to the nearest integer.)