Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 a) Mohmad Corporation currently holds two batches of bonds. The firm has bought ten units of bond issued by Adnan Corporation and

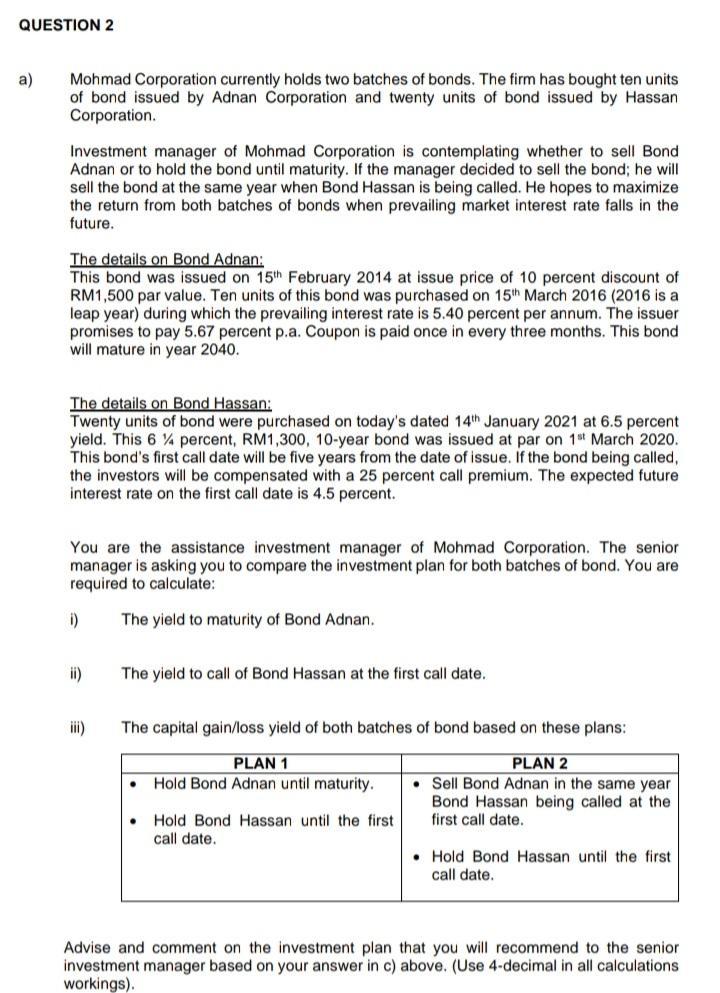

QUESTION 2 a) Mohmad Corporation currently holds two batches of bonds. The firm has bought ten units of bond issued by Adnan Corporation and twenty units of bond issued by Hassan Corporation. Investment manager of Mohmad Corporation is contemplating whether to sell Bond Adnan or to hold the bond until maturity. If the manager decided to sell the bond; he will sell the bond at the same year when Bond Hassan is being called. He hopes to maximize the return from both batches of bonds when prevailing market interest rate falls in the future. The details on Bond Adnan: This bond was issued on 15th February 2014 at issue price of 10 percent discount of RM1,500 par value. Ten units of this bond was purchased on 15th March 2016 (2016 is a leap year) during which the prevailing interest rate is 5.40 percent per annum. The issuer promises to pay 5.67 percent p.a. Coupon is paid once in every three months. This bond will mature in year 2040. The details on Bond Hassan: Twenty units of bond were purchased on today's dated 14th January 2021 at 6.5 percent yield. This 6% percent, RM1,300, 10-year bond was issued at par on 1st March 2020. This bond's first call date will be five years from the date of issue. If the bond being called, the investors will be compensated with a 25 percent call premium. The expected future interest rate on the first call date is 4.5 percent. You are the assistance investment manager of Mohmad Corporation. The senior manager is asking you to compare the investment plan for both batches of bond. You are required to calculate: The yield to maturity of Bond Adnan. i) ii) iii) The yield to call of Bond Hassan at the first call date. The capital gain/loss yield of both batches of bond based on these plans: PLAN 1 PLAN 2 Hold Bond Adnan until maturity. Sell Bond Adnan in the same year. Bond Hassan being called at the first call date. Hold Bond Hassan until the first call date. Hold Bond Hassan until the first call date. Advise and comment on the investment plan that you will recommend to the senior investment manager based on your answer in c) above. (Use 4-decimal in all calculations workings).

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Bond Adnans yield to maturity is 58 Bond Adnans YTM can be calculated using the following formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started