Question

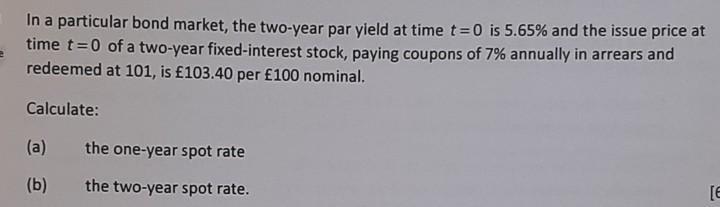

In a particular bond market, the two-year par yield at time t=0 is 5.65% and the issue price at time t=0 of a two-year

In a particular bond market, the two-year par yield at time t=0 is 5.65% and the issue price at time t=0 of a two-year fixed-interest stock, paying coupons of 7% annually in arrears and redeemed at 101, is 103.40 per 100 nominal. Calculate: (a) (b) the one-year spot rate the two-year spot rate. [E

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Manufacturing Processes for Engineering Materials

Authors: Serope Kalpakjian, Steven Schmid

5th edition

132272717, 978-0132272711

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App