Allocate the shared fixed overhead costs using the direct labor dollars driver. Then determine the product margins for each product line.

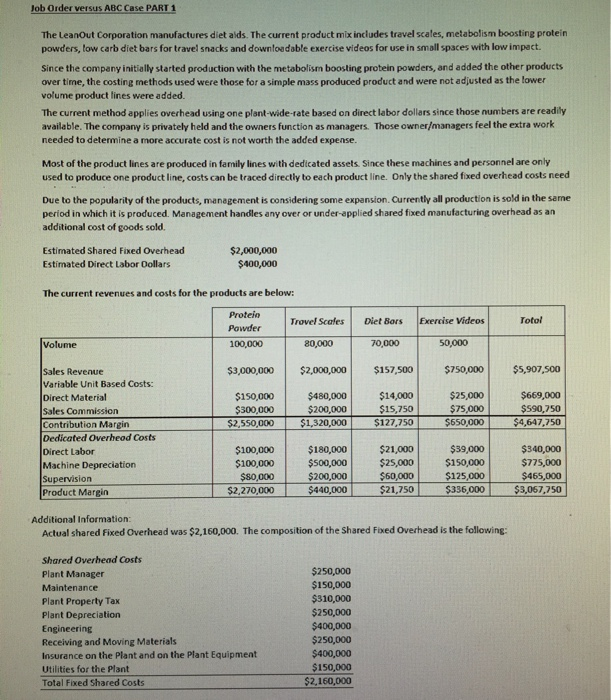

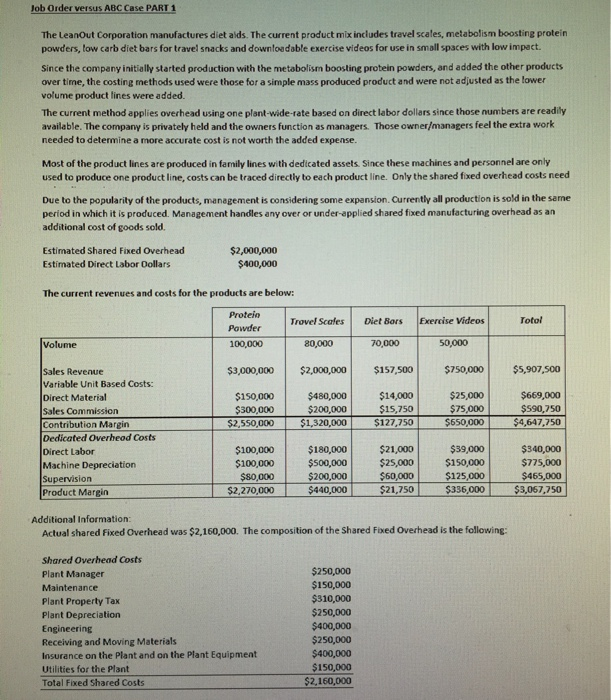

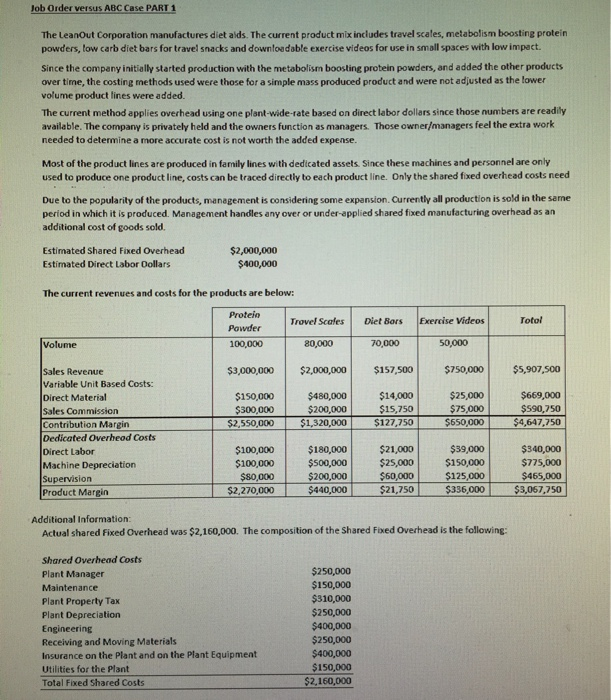

Job Order versus ABC Case PART 1 The LeanOut Corporation manufactures diet alds. The current product mix includes travel scales, metabolism boosting protein powders, tow carb diet bars for travel snacks and downfoedable exercise videos for use in small spaces with low impact Since the company initially started production with the metabolisn boosting protein powders, and added the other products over time, the costing methods used were those for a simple mass produced product and were not adjusted as the lower volume product lines were added. The current method applies overhead using one plant-wide-rate based on direct labor dollars since those numbers are readily available. The company is privately held and the owners function as managers. Those owner/managers feel the extra work needed to determine a more accurate cost is not worth the added expense. Most of the product lines are produced in family lines with dedicated assets. Since these machines and personnel are only used to produce one product line, costs can be traced directly to each product line. Only the shared fixed overhead costs need Due to the popularity of the products, management is considering some expansion. Currently all production is sold in the same period in which it is produced. Management handles any over or under-applied shared fixed manufacturing overhead as an additional cost of goods sold Estimated Shared Fixed Overhead Estimated Direct Labor Dollars $2,000,000 $400,000 The current revenues and costs for the products are below: Protein Powder 100,000 Trovel Scafes Diet Bors Exercise Videos Totol Volume 80,000 70,000 50,000 $3,000,000 $2,000,000157,500$750,000 $5,907,500 Sales Revenue Variable Unit Based Costs: Direct Material Sales Commission Contribution Margin Dedicated Overheod Costs Direct Labor Machine Depreciation Supervision Product Margin $200,000 $2,550,000 $1,320,000 $150,000$480,000$14,000 $15,750 127,750 $25,000 $75,000 $650,000 $669,000 $590,750 $4,647,750 $300,000 $100,000$180,000$21,000 $39,000 $340,000 $775,000 $100,000| $80,000 $500,000 | $200,000 $440,000 $25,000 | $150,000 $125,000 $60,000 $21,750 $2,270,000 336,000 $3,067,750 Additional Information Actual shared Fixed Overhead was $2,160,00o. The composition of the Shared Fixed Overhead is the following: Shared Overhead Costs Plant Manager Maintenance Plant Property Tax Plant Depreciation Engineering Receiving and Moving Materials Insurance on the Plant and on the Plant Equipment Utilities for the Plant Total Fixed Shared Costs $250,000 $150,000 $310,000 $250,000 $400,000 $250,000 $150,000 $2,160,000