Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allocating a Transaction Price and Recording Revenue and Cost of Revenue retailer is $ 5 4 , and its standalone selling price is $ 7

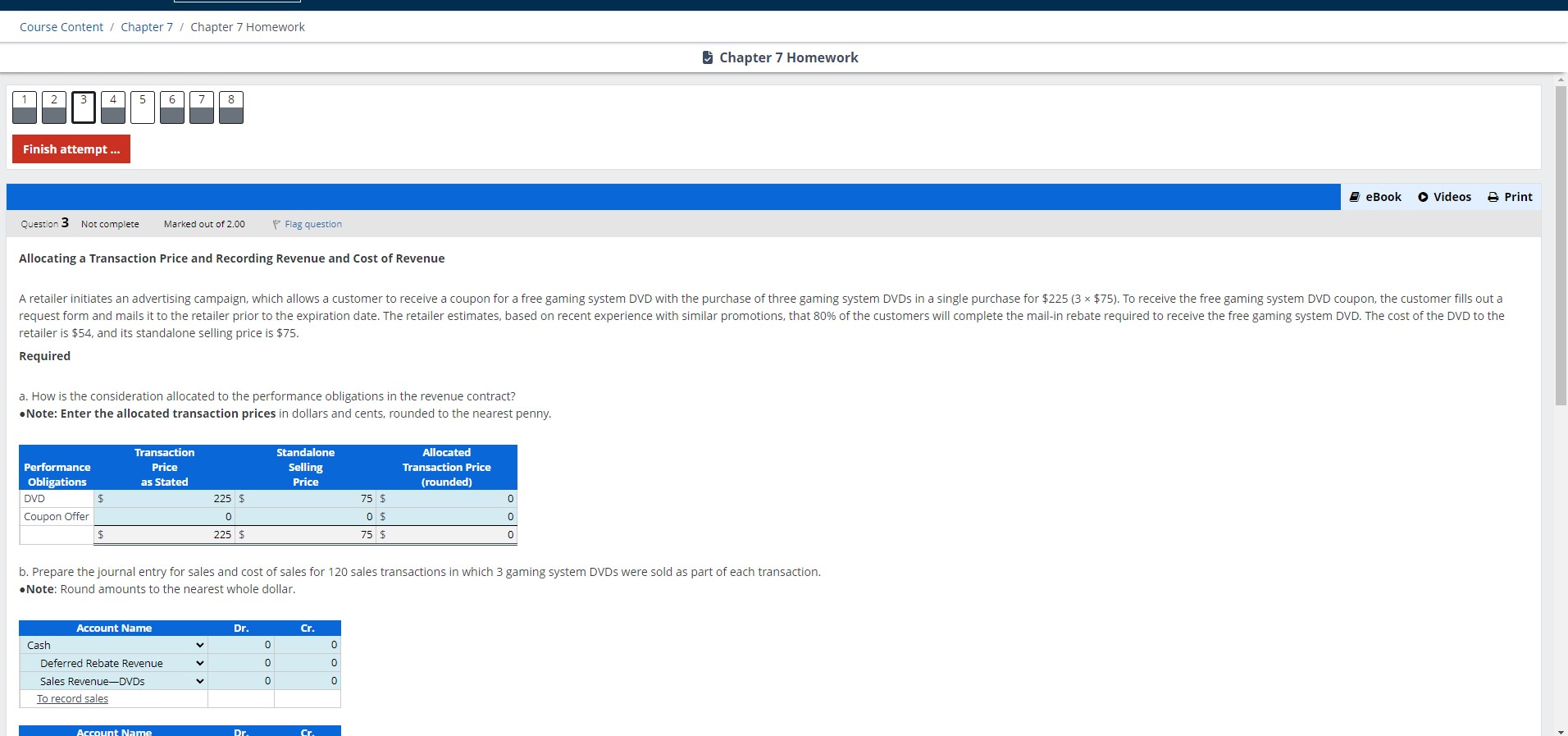

Allocating a Transaction Price and Recording Revenue and Cost of Revenue

retailer is $ and its standalone selling price is $

Required

a How is the consideration allocated to the performance obligations in the revenue contract?

Note: Enter the allocated transaction prices in dollars and cents, rounded to the nearest penny.

b Prepare the journal entry for sales and cost of sales for sales transactions in which gaming system DVDs were sold as part of each transaction.

Note: Round amounts to the nearest whole dollar.

c Assume the retailer has no past experience to estimate the amount of redemption.

Show how the consideration is allocated to the performance obligations in the revenue contract.

Note: Enter the allocated transaction prices in dollars and cents, rounded to the nearest penny.

Prepare the journal entry for sales and cost of sales for sales transactions in which gaming system DVDs were sold as part of each transaction.

Note: Round amounts to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started