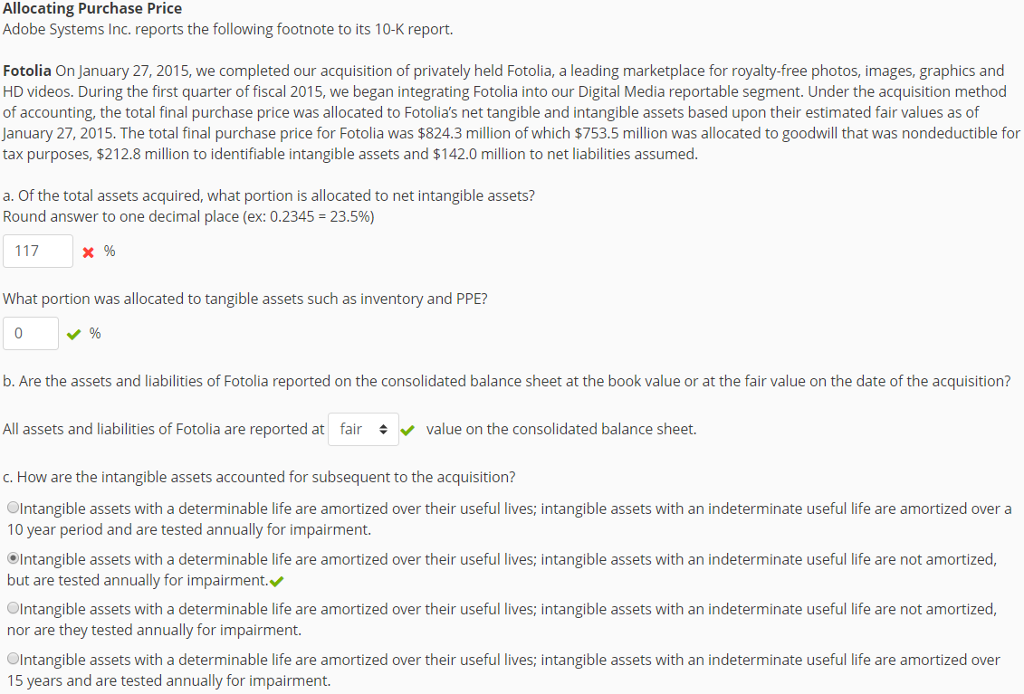

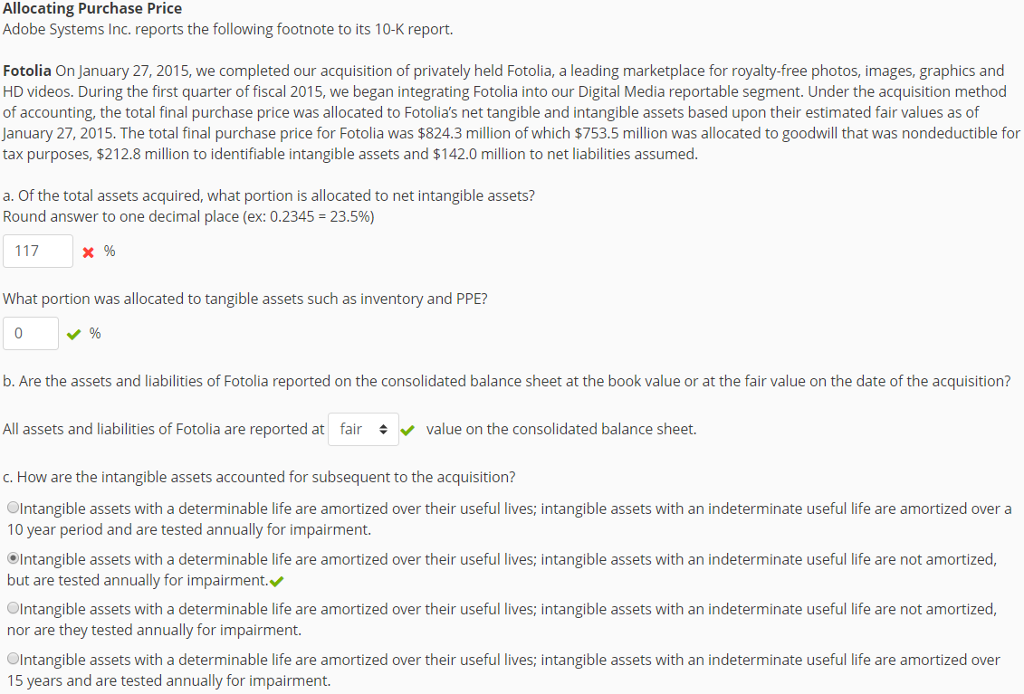

Allocating Purchase Price Adobe Systems Inc. reports the following footnote to its 10-K report. Fotolia On January 27, 2015, we completed our acquisition of privately held Fotolia, a leading marketplace for royalty-free photos, images, graphics and HD videos. During the first quarter of fiscal 2015, we began integrating Fotolia into our Digital Media reportable segment. Under the acquisition method of accounting, the total final purchase price was allocated to Fotolia's net tangible and intangible assets based upon their estimated fair values as of January 27, 2015. The total final purchase price for Fotolia was $824.3 million of which $753.5 million was allocated to goodwill that was nondeductible for tax purposes, $212.8 million to identifiable intangible assets and $142.0 million to net liabilities assumed. a. Of the total assets acquired, what portion is allocated to net intangible assets? Round answer to one decimal place (ex: 0.2345 = 23.5%) 117 What portion was allocated to tangible assets such as inventory and PPE? O ? % b. Are the assets and liabilities of Fotolia reported on the consolidated balance sheet at the book value or at the fair value on the date of the acquisition? All assets and liabilities of Fotolia are reported at fair value on the consolidated balance sheet. c. How are the intangible assets accounted for subsequent to the acquisition? OIntangible assets with a determinable life are amortized over their useful lives; intangible assets with an indeterminate useful life are amortized over a 10 year period and are tested annually for impairment. OIntangible assets with a determinable life are amortized over their useful lives; intangible assets with an indeterminate useful life are not amortized, but are tested annually for impairment. Olntangible assets with a determinable life are amortized over their useful lives; intangible assets with an indeterminate useful life are not amortized, nor are they tested annually for impairment. OIntangible assets with a determinable life are amortized over their useful lives; intangible assets with an indeterminate useful life are amortized over 15 years and are tested annually for impairment