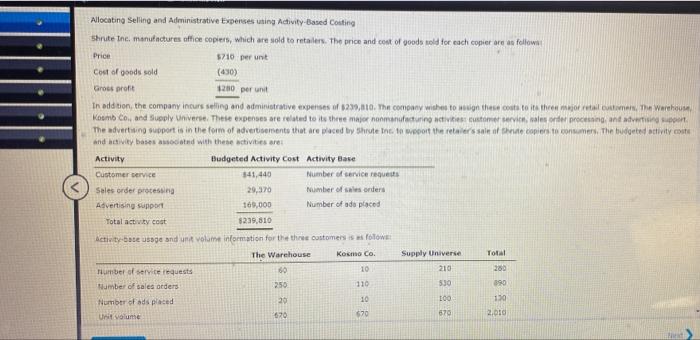

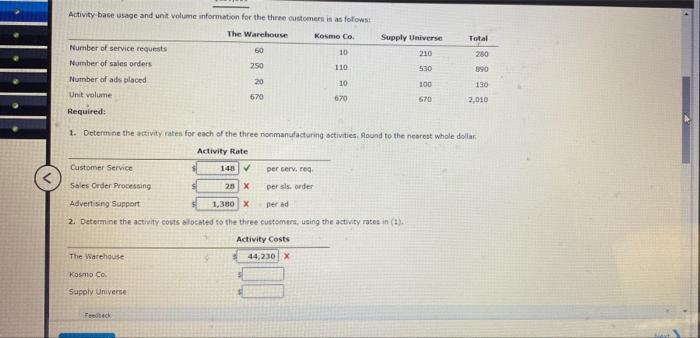

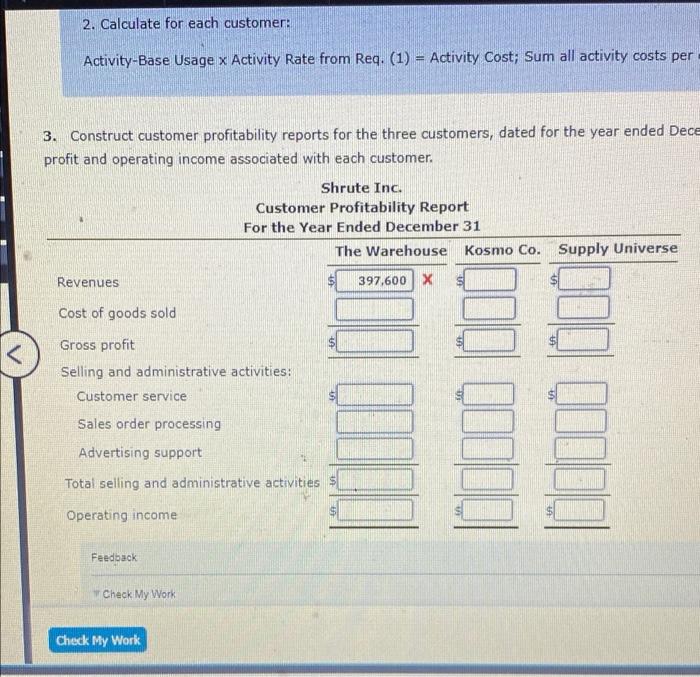

Allocating Selling and Administrative Expenses using Activity-Based Corting Shrute the manufactures office copiers, which are sold to retailers. The price and cost of yoods sold for each copier are as follow Price $710 perunt Cost of goods sold (430) Gross profit 1200 per unit In addition, the company incursseling and administrative expenses of $239,80. The company wishes to win these couts to its three major reme. The Warehouse Kom Co, and Supply Universe. These expenses are related to its three major nomanufacturing activities customer service, sales order processing and advertising The advertising support is in the form of advertisements that are placed by Shrutent to wport the retailers sale of the copies to consumers. The budgeted activity and activity based with these activities are Activity Budgeted Activity Cost Activity Base Customer service 341,440 Number of service requests Sales order processing 29,370 Number of salesonders Advertising support 169,000 Number of ade placed Total activity cost $239,810 Activitate usage and un volume information for the three customers is flow The Warehouse Kosmo Co. Supply Universe Total number of service requests 60 10 210 200 Number of sales orders 250 110 530 390 Number of ads placed 20 100 1:39 Un volume 620 $70 670 2.00 10 Total Supply Universe 210 200 Activity base usage and unit volume information for the three customers is as follows: The Warehouse Kosmo Co Number of service requests 60 10 Number of sales orders 250 110 Number of ads placed 20 10 Unit volume 670 670 Required: 530 390 100 130 670 2,010 1. Determine the activity rates for each of the three nonmanufacturing activities. Round to the nearest whole dollar Activity Rate Customer Service 140 per serv, reg Sales Order Processing 20 X per sis. order Advertising Support 1,380 x per ad 2. Determine the activity costs located to the three customers, using the activity rates in (1) Activity Costs The Warehouse 44,230 x Kosmo Co Supply Universe Peetech 2. Calculate for each customer: - Activity-Base Usage x Activity Rate from Req. (1) - Activity Cost; Sum all activity costs per 3. Construct customer profitability reports for the three customers, dated for the year ended Dece profit and operating income associated with each customer. Shrute Inc. Customer Profitability Report For the Year Ended December 31 The Warehouse Kosmo Co. Supply Universe Revenues 397,600 X Cost of goods sold $