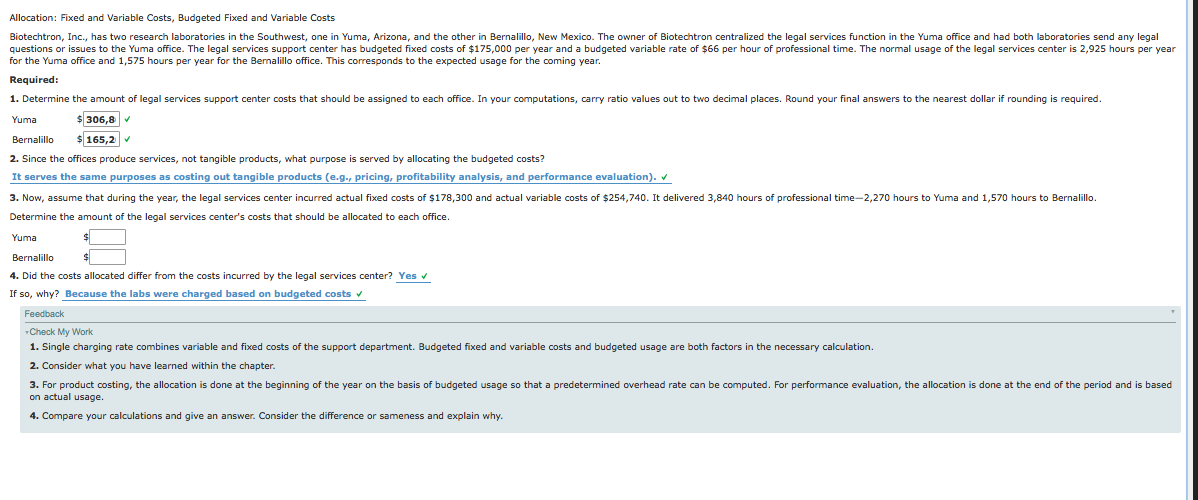

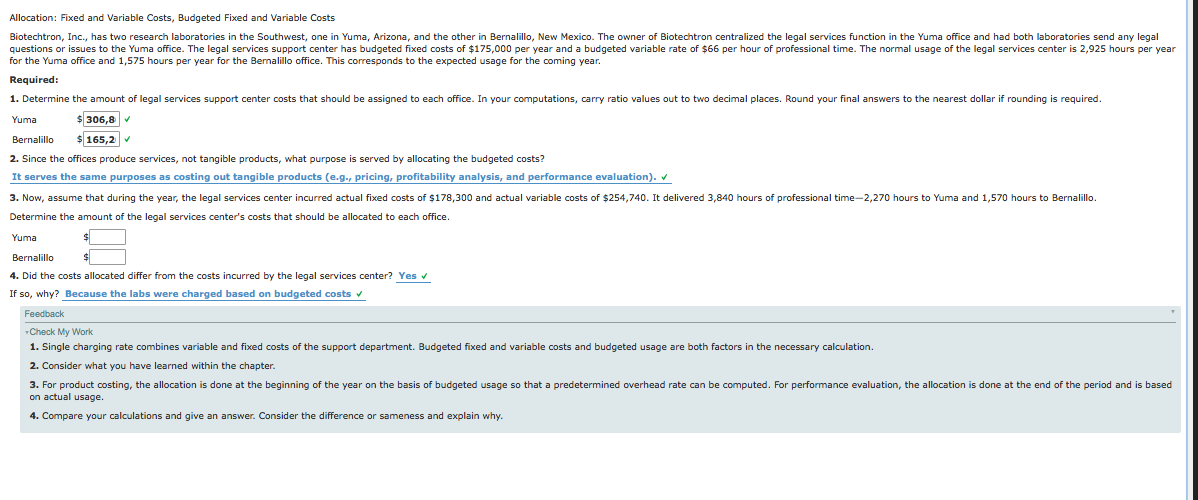

Allocation: Fixed and Variable Costs, Budgeted Fixed and Variable Costs Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of $175,000 per year and a budgeted variable rate of $66 per hour of professional time. The normal usage of the legal services center is 2,925 hours per year for the Yuma office and 1,575 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year. Required: 1. Determine the amount of legal services support center costs that should be assigned to each office. In your computations, carry ratio values out to two decimal places. Round your final answers to the nearest dollar if rounding is required. Yuma $306,8 Bernalillo $ 165,2 2. Since the offices produce services, not tangible products, what purpose is served by allocating the budgeted costs? It serves the same purposes as costing out tangible products (e.g. pricing, profitability analysis, and performance evaluation). V 3. Now, assume that during the year, the legal services center incurred actual fixed costs of $178,300 and actual variable costs of $254,740. It delivered 3,840 hours of professional time-2,270 hours to Yuma and 1,570 hours to Bernalillo. Determine the amount of the legal services center's costs that should be allocated to each office. Yuma $ Bernalillos 4. Did the costs allocated differ from the costs incurred by the legal services center? Yes If so, why? Because the labs were charged based on budgeted costs Feedback Check My Work 1. Single charging rate combines variable and fixed costs of the support department. Budgeted fixed and variable costs and budgeted usage are both factors in the necessary calculation. 2. Consider what you have learned within the chapter. 3. For product costing, the allocation is done at the beginning of the year on the basis of budgeted usage so that a predetermined overhead rate can be computed. For performance evaluation, the allocation is done at the end of the period and is based on actual usage. 4. Compare your calculations and give an answer. Consider the difference or sameness and explain why. Allocation: Fixed and Variable Costs, Budgeted Fixed and Variable Costs Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of $175,000 per year and a budgeted variable rate of $66 per hour of professional time. The normal usage of the legal services center is 2,925 hours per year for the Yuma office and 1,575 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year. Required: 1. Determine the amount of legal services support center costs that should be assigned to each office. In your computations, carry ratio values out to two decimal places. Round your final answers to the nearest dollar if rounding is required. Yuma $306,8 Bernalillo $ 165,2 2. Since the offices produce services, not tangible products, what purpose is served by allocating the budgeted costs? It serves the same purposes as costing out tangible products (e.g. pricing, profitability analysis, and performance evaluation). V 3. Now, assume that during the year, the legal services center incurred actual fixed costs of $178,300 and actual variable costs of $254,740. It delivered 3,840 hours of professional time-2,270 hours to Yuma and 1,570 hours to Bernalillo. Determine the amount of the legal services center's costs that should be allocated to each office. Yuma $ Bernalillos 4. Did the costs allocated differ from the costs incurred by the legal services center? Yes If so, why? Because the labs were charged based on budgeted costs Feedback Check My Work 1. Single charging rate combines variable and fixed costs of the support department. Budgeted fixed and variable costs and budgeted usage are both factors in the necessary calculation. 2. Consider what you have learned within the chapter. 3. For product costing, the allocation is done at the beginning of the year on the basis of budgeted usage so that a predetermined overhead rate can be computed. For performance evaluation, the allocation is done at the end of the period and is based on actual usage. 4. Compare your calculations and give an answer. Consider the difference or sameness and explain why