Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allowance for Doubtful Accounts is a contra-account that is disclosed under Current Assets of the Balance Sheet. Depreciation is used to report the fair market

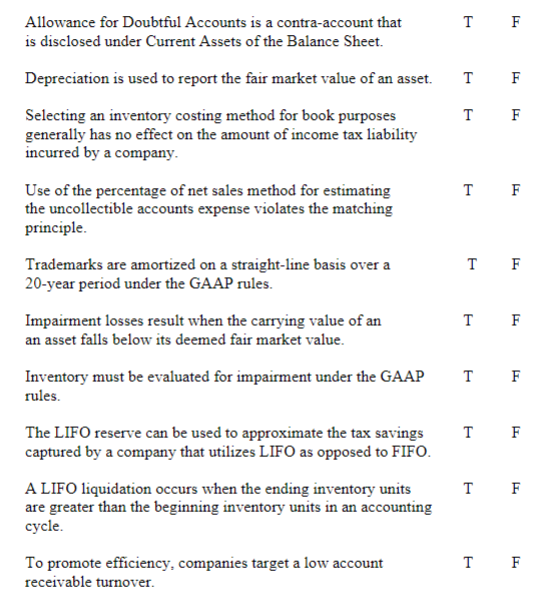

Allowance for Doubtful Accounts is a contra-account that is disclosed under Current Assets of the Balance Sheet. Depreciation is used to report the fair market value of an asset. Selecting an inventory costing method for book purposes generally has no effect on the amount of income tax liability incurred by a company. Use of the percentage of net sales method for estimating the uncollectible accounts expense violates the matching principle. Trademarks are amortized on a straight-line basis over a 20-year period under the GAAP rules. Impairment losses result when the carrying value of an an asset falls below its deemed fair market value. Inventory must be evaluated for impairment under the GAAP rules. The LIFO reserve can be used to approximate the tax savings captured by a company that utilizes LIFO as opposed to FIFO. A LIFO liquidation occurs when the ending inventory units are greater than the beginning inventory units in an accounting cycle. To promote efficiency, companies target a low account T F receivable turnover. Allowance for Doubtful Accounts is a contra-account that is disclosed under Current Assets of the Balance Sheet. Depreciation is used to report the fair market value of an asset. Selecting an inventory costing method for book purposes generally has no effect on the amount of income tax liability incurred by a company. Use of the percentage of net sales method for estimating the uncollectible accounts expense violates the matching principle. Trademarks are amortized on a straight-line basis over a 20-year period under the GAAP rules. Impairment losses result when the carrying value of an an asset falls below its deemed fair market value. Inventory must be evaluated for impairment under the GAAP rules. The LIFO reserve can be used to approximate the tax savings captured by a company that utilizes LIFO as opposed to FIFO. A LIFO liquidation occurs when the ending inventory units are greater than the beginning inventory units in an accounting cycle. To promote efficiency, companies target a low account T F receivable turnover

Allowance for Doubtful Accounts is a contra-account that is disclosed under Current Assets of the Balance Sheet. Depreciation is used to report the fair market value of an asset. Selecting an inventory costing method for book purposes generally has no effect on the amount of income tax liability incurred by a company. Use of the percentage of net sales method for estimating the uncollectible accounts expense violates the matching principle. Trademarks are amortized on a straight-line basis over a 20-year period under the GAAP rules. Impairment losses result when the carrying value of an an asset falls below its deemed fair market value. Inventory must be evaluated for impairment under the GAAP rules. The LIFO reserve can be used to approximate the tax savings captured by a company that utilizes LIFO as opposed to FIFO. A LIFO liquidation occurs when the ending inventory units are greater than the beginning inventory units in an accounting cycle. To promote efficiency, companies target a low account T F receivable turnover. Allowance for Doubtful Accounts is a contra-account that is disclosed under Current Assets of the Balance Sheet. Depreciation is used to report the fair market value of an asset. Selecting an inventory costing method for book purposes generally has no effect on the amount of income tax liability incurred by a company. Use of the percentage of net sales method for estimating the uncollectible accounts expense violates the matching principle. Trademarks are amortized on a straight-line basis over a 20-year period under the GAAP rules. Impairment losses result when the carrying value of an an asset falls below its deemed fair market value. Inventory must be evaluated for impairment under the GAAP rules. The LIFO reserve can be used to approximate the tax savings captured by a company that utilizes LIFO as opposed to FIFO. A LIFO liquidation occurs when the ending inventory units are greater than the beginning inventory units in an accounting cycle. To promote efficiency, companies target a low account T F receivable turnover Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started