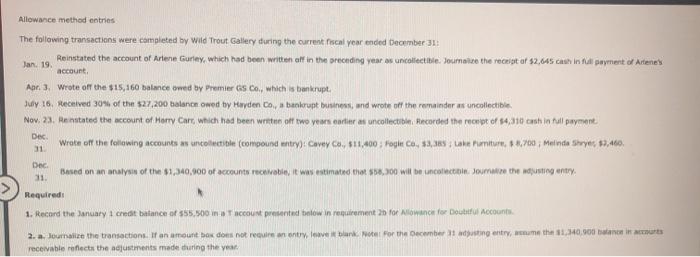

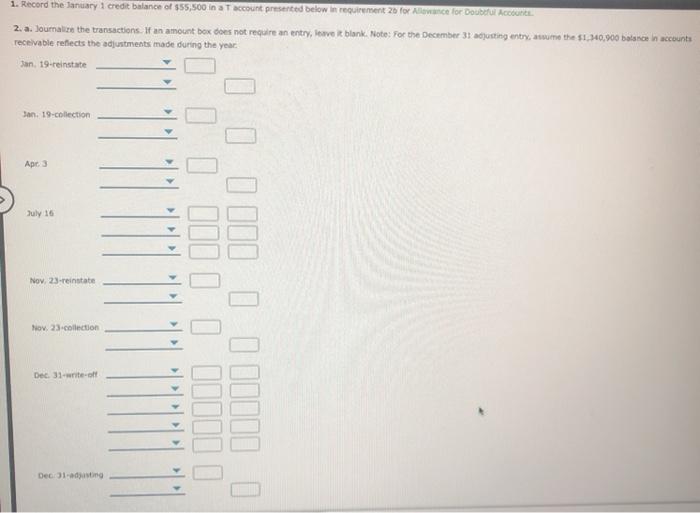

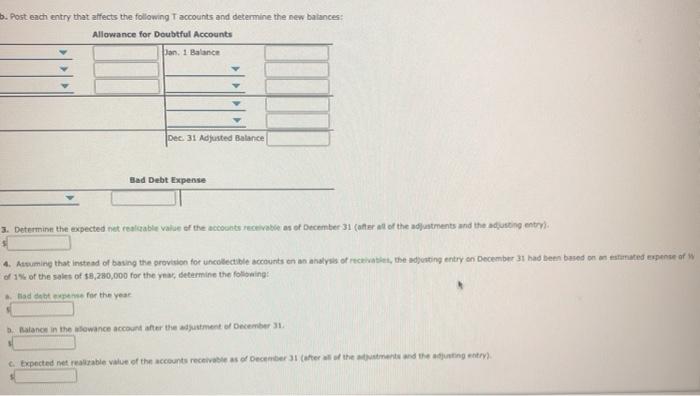

Allowance method entries The following transactions were completed by Wild Trout Gallery during the current fiscal year ended December 31 Reinstated the account of Arlene Gurley, which had been written alf in the preceding year as uncollectible. Journaise the receipt of 52,645 chinupayment of Artene's Jan. 19, account, Apr 3. Wrote of the $15,160 balance awed by Premier Co., which is bankrupt. July 16, received 30% of the $27,200 balance owed by Hayden Co, a bankrupt business, and wrote off the remainder as uncollectible Nov. 23. Remitated the account of Horry Care, which had been written oft two years eater as uncollectibleHecorded the meet of 84, 310 cash in tall payment Dec Wrate of the following accounts as uncolatible (compound untry): Covey Co., $15,000 : Vogle ce, 52,28 i lokeramtur, &,po Melinda Stryer 27,400. Based on an analysis of the $1.940,900 of accounts receivable, it was estimated that $2,200 will be incolectin. Soumanize the mounting enny 31 Dec 11. Required: 1. Record the January 1 credit balance of 555,500 in account presented below in rurement for Allowance for Doubtful Accounts 2. a. Journalize the transactions. If an amount box does not require an entry leave blank Note For the December austing entry, ume tha 1,340.000 bits receivable reflects the adjustments made during the year 1. Record the January 1 credit balance of $55,500 in an account presented below in requirement 20 for Allance for Double Account 2. a. Joumalize the transactions. If an amount box does not require an entry, leave it blank. Note: For the December 31 adjusting entry sure the $1.290,000 balance in accounts receivable reflects the adjustments made during the year Jan 19-reinstate Jan. 19-collection Apr 3 > > > | July 16 II l III 1 lbb. I Il lll l l bill Nov, 23 reinstate Nov. 23.collection > > > > > > > > Dec. 31-write-off Deciding b. Post each entry that affects the following accounts and determine the new balances: Allowance for Doubtful Accounts Jan. 1 Balance Dec. 31 Adjusted Balance Sad Debt Expense 3. Determine the expected at realable value of the accounts receivable as of December 31 (after all of the adjustments and the dusting entry) 4. Asuming that instead of basing the provision for uncollectible accounts on an analysis of receive the adjusting entry on December 31 had been based on an estimated expense of W of 1% of the sales of $8,280,000 for the year, determine the following tad dette for the year Balance in the towance account after the adjustment of December Expected netrable value of the accounts receivable as of December of the went and the singer)