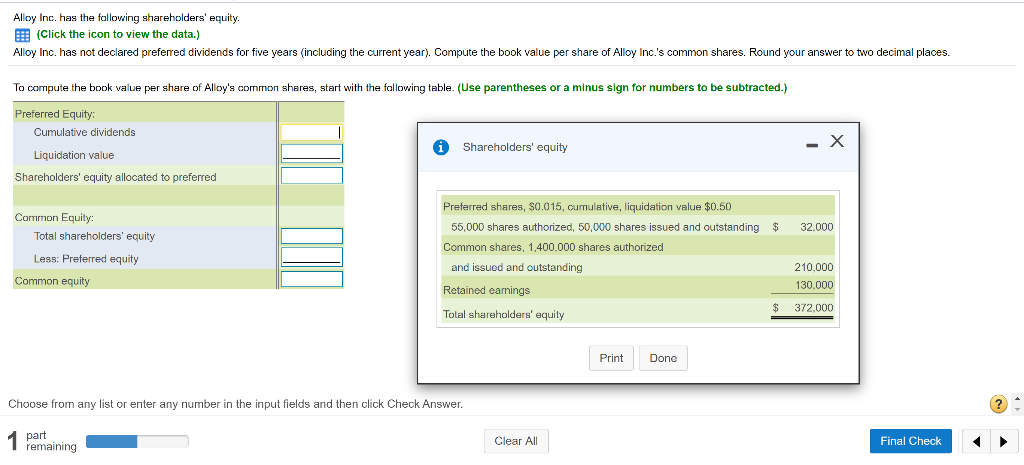

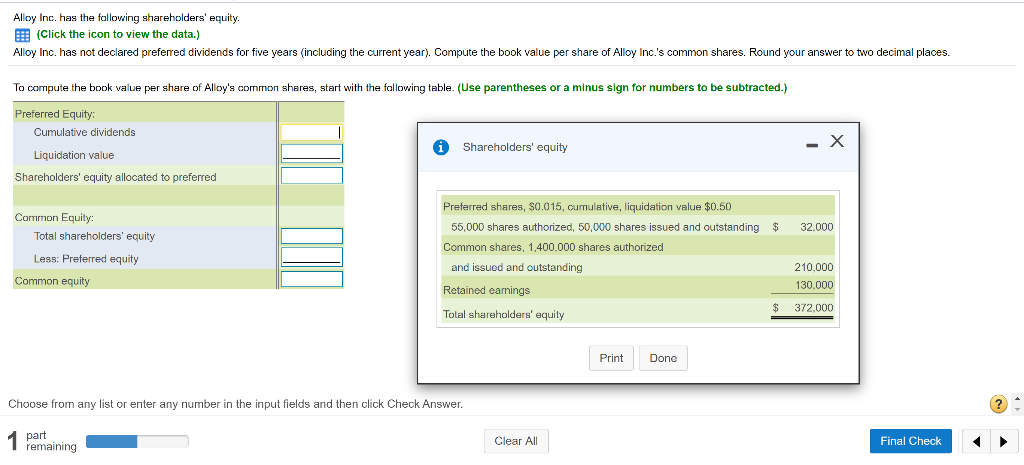

Alloy Inc. has the following shareholders' equity. (Click the icon to view the data.) Alloy Inc. has not declared preferred dividends for five years (including the current year). Compute the book value per share of Alloy Inc.'s common shares. Round your answer to two decimal places. To compute the book value per share of Alloy's common shares, start with the following table. (Use parentheses or a minus sign for numbers to be subtracted.) Preferred Equity Cumulative dividends Shareholders' equity Liquidation value Shareholders' equity allocated to preferred $ 32.000 Common Equily: Total shareholders' equity Less: Preferred equity Common equity Preferred shares, $0.015, cumulative, liquidation value $0.50 55,000 shares authorized, 50,000 shares issued and outstanding Common shares, 1,400,000 shares authorized and issued and outstanding 210.000 130.000 Retained earnings $ 372.000 Total shareholders' equily Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Final Check Alloy Inc. has the following shareholders' equity. (Click the icon to view the data.) Alloy Inc. has not declared preferred dividends for five years (including the current year). Compute the book value per share of Alloy Inc.'s common shares. Round your answer to two decimal places. To compute the book value per share of Alloy's common shares, start with the following table. (Use parentheses or a minus sign for numbers to be subtracted.) Preferred Equity Cumulative dividends Shareholders' equity Liquidation value Shareholders' equity allocated to preferred $ 32.000 Common Equily: Total shareholders' equity Less: Preferred equity Common equity Preferred shares, $0.015, cumulative, liquidation value $0.50 55,000 shares authorized, 50,000 shares issued and outstanding Common shares, 1,400,000 shares authorized and issued and outstanding 210.000 130.000 Retained earnings $ 372.000 Total shareholders' equily Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? 1 part remaining Clear All Final Check