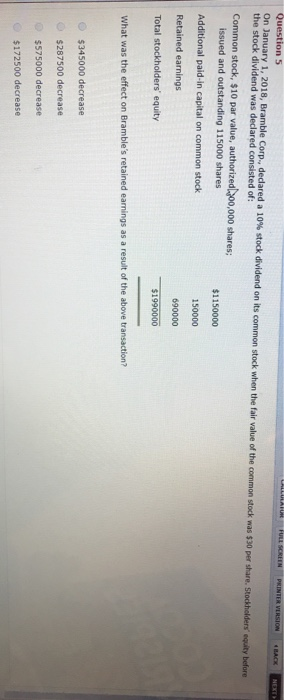

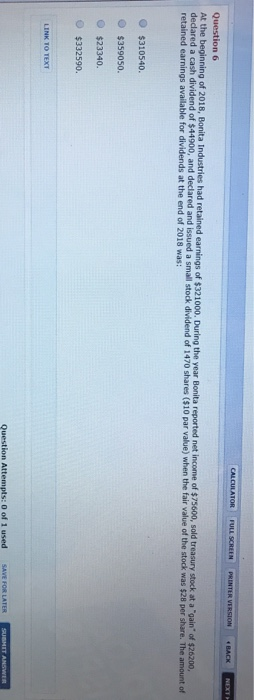

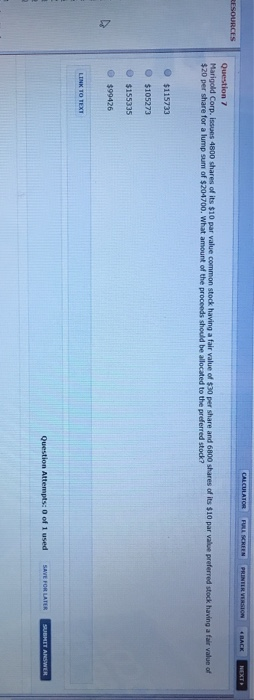

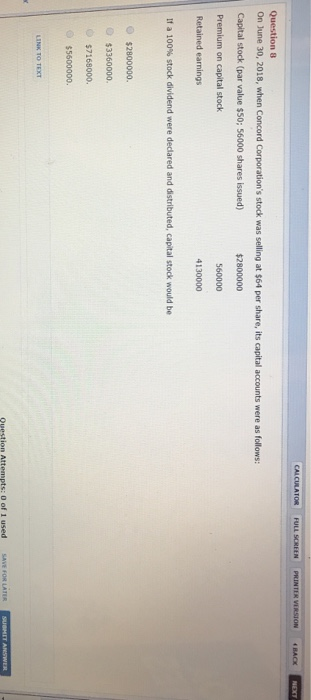

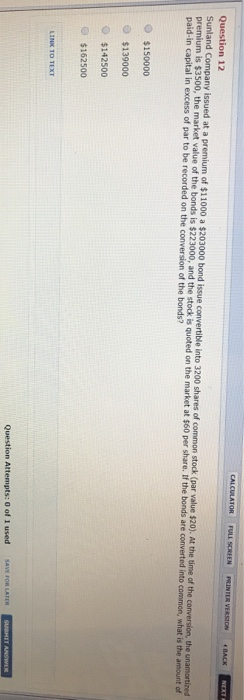

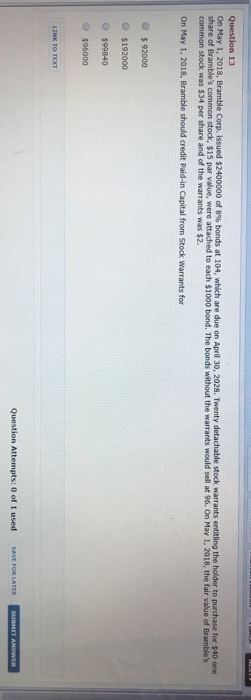

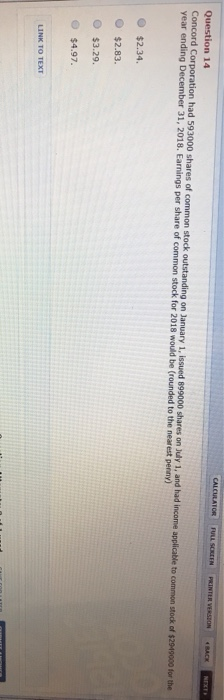

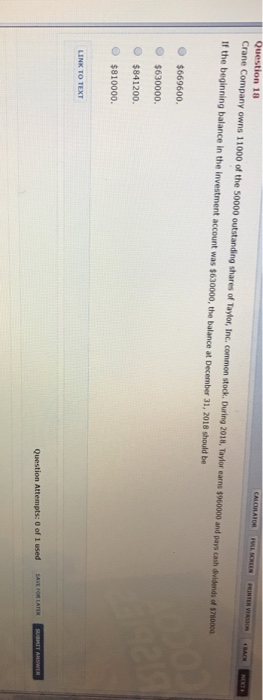

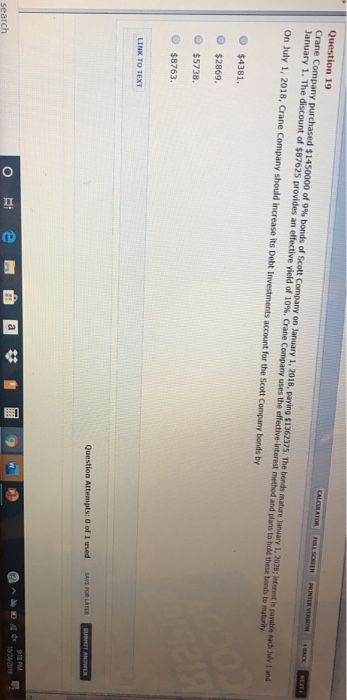

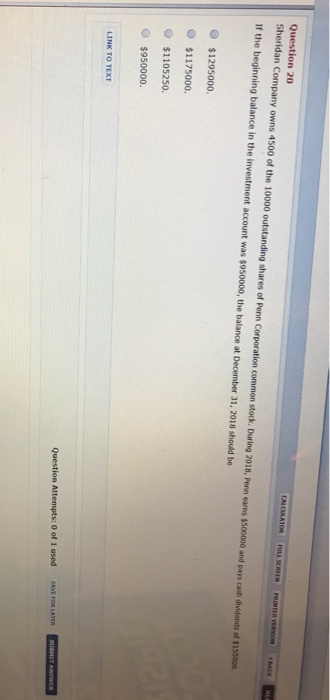

ALLULAR ULL SCREEN PRINTER VERSION BACK NEXT Question 5 On January 1, 2018, Bramble Corp., dedared a 10% stock dividend on its common stock when the fair value of the common stock was $30 per share. Stockholders' equity before the stock dividend was declared consisted of: Common stock, $10 par value, authorized 700,000 shares; issued and outstanding 115000 shares $1150000 Additional paid-in capital on common stock 150000 Retained earnings 690000 Total stockholders' equity $1990000 What was the effect on Bramble's retained earnings as a result of the above transaction? $345000 decrease $287500 decrease $575000 decrease $172500 decrease CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT RESOURCES Question 7 Marigold Corp.Issuns 4800 shares of its $10 par value common stock having a fair value of $30 per share and 6800 shares of its $10 par valle preferred stock having a fair value of $20 per share for a lump sum of $204700. What amount of the proceeds should be allocated to the preferred stock? $115733 $105273 $155335 $99426 Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER FULL SCREEN PRINTER VERSION BACK CALCULATOR Questions On June 30, 2018, when Concord Corporation's stock was selling at $64 per share, its capital accounts were as follows: Capital stock (par value $50; 56000 shares issued) $2800000 Premium on capital stock 560000 Retained earnings 4130000 If a 100% stock dividend were declared and distributed, capital stock would be 52800000 $3360000 $7168000 55600000 LINK TO TEXT CALCULATOR FULL SCREEN PRINTER VERSION Question 12 Sunland Company issued at a premium of $11000 a $203000 bond issue convertible into 3200 shares of common stock (par value $20). At the time of the conversion, the premium is $3500, the market value of the bonds is $223000, and the stock is quoted on the market at $50 per share of the bonds are converted into common, what is the amount of amortized paid in capital in excess of par to be recorded on the conversion of the bonds? $150000 $139000 5142500 $162500 LINK TO TEXT Question Attems of Question 13 On May 1, 2018, Bramble Corp. issued $2400000 of 8% bonds at 104, which are due on April 30, 2028. Twenty detachable stock warrants entitling the holder to purchase for $40 one share of Bramble's common stock, $15 par value, were attached to each $1000 bond. The bonds without the warrants would sell at 90. On May 1, 2018, the fair value of Bramble's common stock was $34 per share and of the warrants was $2. On May 1, 2018, Bramble should credit Paid-in Capital from Stock Warrants for $92000 $192000 $99840 $96000 Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER CALCULATOR FULL SCREEN PRINTER VERSION RACE NEXT Question 14 Concord Corporation had 593000 shares of common stock outstanding on January 1, issued 899000 shares on My 1, and had income applicable to common stock of $2949000 for the year ending December 31, 2018. Earnings per share of common stock for 2018 would be (rounded to the nearest penny) $2.34. $2.83. $3.29. $4.97. LINK TO TEXT Question 18 Crane Company owns 11000 of the 50000 outstanding shares of Taylor, Inc. common stock. During 2018, Taylor earns 3960000 and pars cash dividends of 7000 If the beginning balance in the investment account was $6.30000, the balance at December 31, 2018 should be $669600. $630000. $841200 $810000. LINK TO TEXT Question Attempts of usedS LANGETARER CALCULATOR FLL SCREEN Question 19 Crane Company purchased $1450000 of 9% bonds of Scott Company on January 1, 2018, paying $1362375. The bonds mature January 1, 2020 tersis a January 1. The discount of $87625 provides an effective yield of 10%. Crane Company uses the effective-Interest method and plans to hold these bonds to maturity On July 1, 2018, Crane Company should increase its Debt Investments account for the Scott Company bonds by PRINTER VERSION BACK $4381. 0 $2869. $5738 $8763 LINK TO TEXT Question Attempts: 0 of 1 used SAVE FOR LATER SUIT ANSWER search o e SIUM @ AWD 0102/2018 a * Question 20 Sheridan Company owns 4500 of the 10000 outstanding shares of Penn Corporation common stock. During 2018. If the beginning balance in the investment account was $950000, the balance at December 31, 2018 should be 500 00 0 $1295000 $1175000 $1105250 $950000. LINK TO TEXT Question Attempts of 1 used SAME FOR LATES T