Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alma would like to tie depreciation on the Hummer to actual use. She estimates that the vehicle will have 100,000 miles at the time of

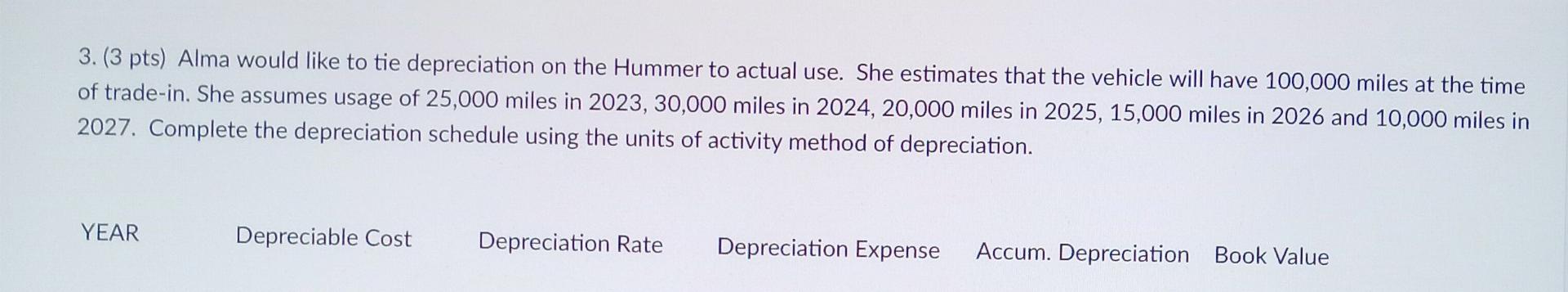

Alma would like to tie depreciation on the Hummer to actual use. She estimates that the vehicle will have 100,000 miles at the time of trade-in. She assumes usage of 25,000 miles in 2023, 30,000 miles in 2024, 20,000 miles in 2025, 15,000 miles in 2026 and 10,000 miles in 2027. Complete the depreciation schedule using the units of activity method of depreciation.

YEAR Depreciable Cost Depreciation Rate Depreciation Expense Accum. Depreciation Book Value

3. (3 pts) Alma would like to tie depreciation on the Hummer to actual use. She estimates that the vehicle will have 100,000 miles at the time of trade-in. She assumes usage of 25,000 miles in 2023,30,000 miles in 2024,20,000 miles in 2025, 15,000 miles in 2026 and 10,000 miles in 2027. Complete the depreciation schedule using the units of activity method of depreciation. YEAR Accum. Depreciation Book Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started