Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alon company sells homes and kitchen appliances. The company has no sales force of its own, rather, it relies on independent sales agents to market

Alon company sells homes and kitchen appliances. The company has no sales force of its own, rather, it relies on independent sales agents to market its products. These agents require a 15% sales commission for all items sold.

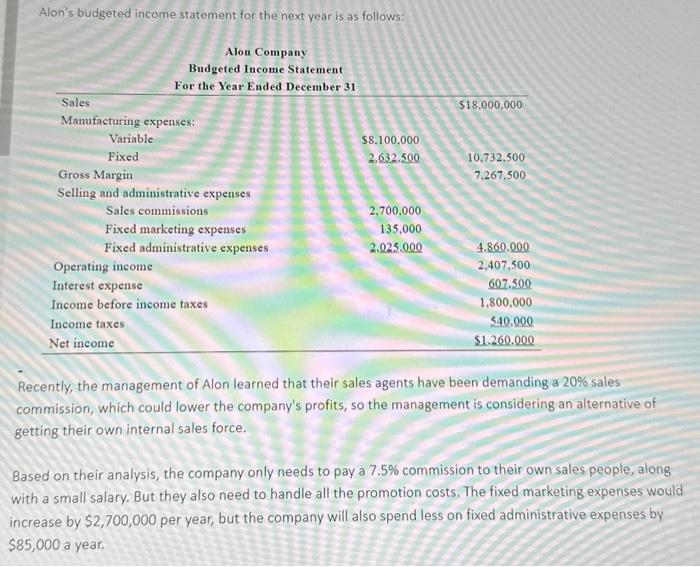

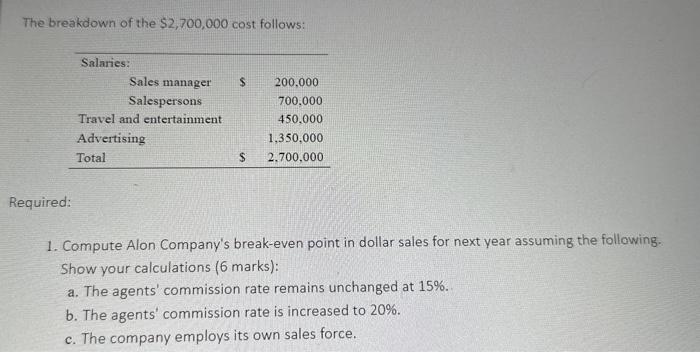

Alon's budgeted income statement for the next year is as follows: Recently, the management of Alon learned that their sales agents have been demanding a 20% sales commission, which could lower the company's profits, so the management is considering an alternative of getting their own internal sales force. Based on their analysis, the company only needs to pay a 7.5% commission to their own sales people, along. with a small salary. But they also need to handle all the promotion costs. The fixed marketing expenses would increase by $2,700,000 per year, but the company will also spend less on fixed administrative expenses by $85,000 a year. The breakdown of the $2,700,000 cost follows: Required: 1. Compute Alon Company's break-even point in dollar sales for next year assuming the following. Show your calculations ( 6 marks): a. The agents' commission rate remains unchanged at 15%. b. The agents' commission rate is increased to 20%. c. The company employs its own sales force

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started