Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alora Enterprises creates and manufactures unique toys. However, it has exhausted its financing options with banks and stockholders. It approaches one of its vendors

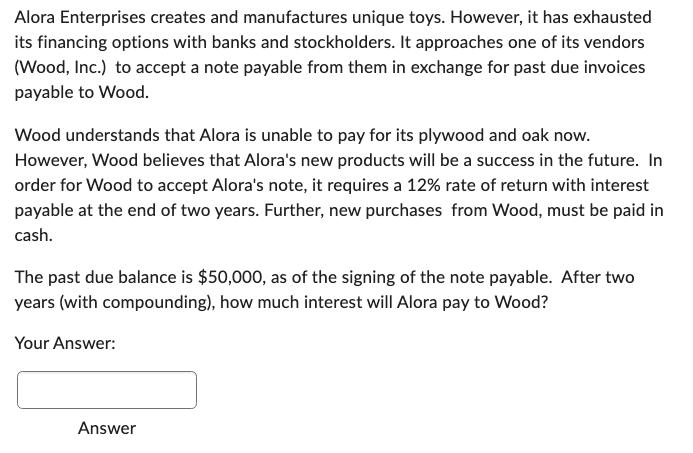

Alora Enterprises creates and manufactures unique toys. However, it has exhausted its financing options with banks and stockholders. It approaches one of its vendors (Wood, Inc.) to accept a note payable from them in exchange for past due invoices payable to Wood. Wood understands that Alora is unable to pay for its plywood and oak now. However, Wood believes that Alora's new products will be a success in the future. In order for Wood to accept Alora's note, it requires a 12% rate of return with interest payable at the end of two years. Further, new purchases from Wood, must be paid in cash. The past due balance is $50,000, as of the signing of the note payable. After two years (with compounding), how much interest will Alora pay to Wood? Your Answer: Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started