Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Analysts Group, have been asked to conduct the following evaluations for Crown Resort on the Australian Securities Exchange (ASX) for 2017 and 2018. 1)

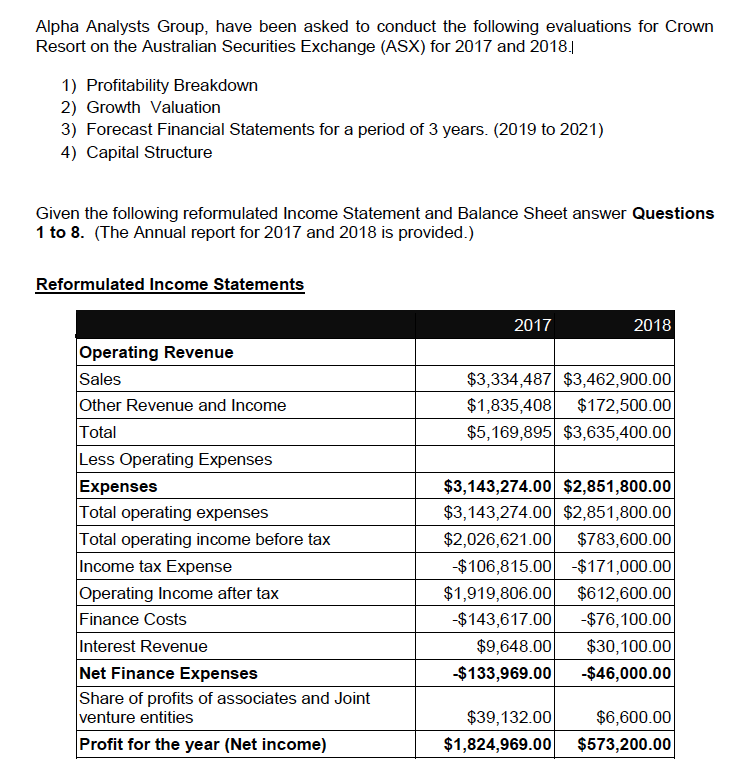

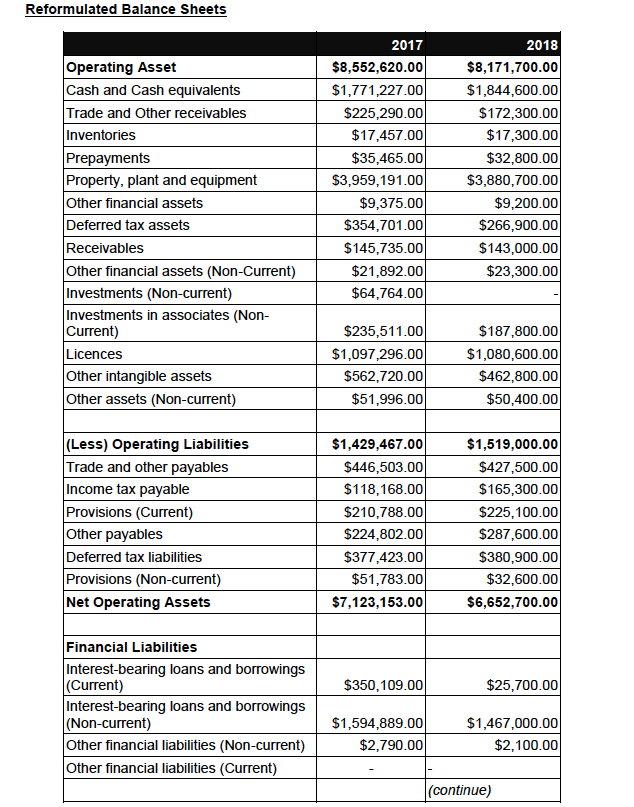

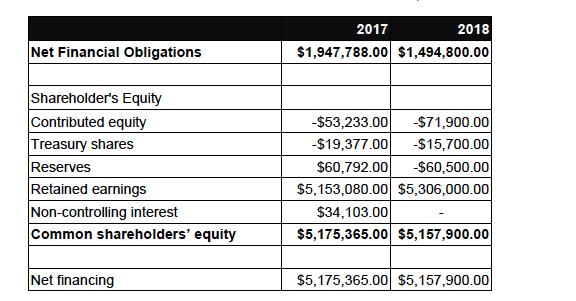

Alpha Analysts Group, have been asked to conduct the following evaluations for Crown Resort on the Australian Securities Exchange (ASX) for 2017 and 2018. 1) Profitability Breakdown 2) Growth Valuation 3) Forecast Financial Statements for a period of 3 years. (2019 to 2021) 4) Capital Structure Given the following reformulated Income Statement and Balance Sheet answer Questions 1 to 8. (The Annual report for 2017 and 2018 is provided.) Reformulated Income Statements 2017 2018 $3,334,487 $3,462,900.00 $1,835,408 $172,500.00 $5,169,895 $3,635,400.00 Operating Revenue Sales Other Revenue and Income Total Less Operating Expenses Expenses Total operating expenses Total operating income before tax Income tax Expense Operating Income after tax Finance Costs Interest Revenue Net Finance Expenses Share of profits of associates and Joint venture entities Profit for the year (Net income) $3,143,274.00 $2,851,800.00 $3,143,274.00 $2,851,800.00 $2,026,621.00 $783,600.00 $106,815.00 $171,000.00 $1,919,806.00 $612,600.00 $143,617.00 -$76,100.00 $9,648.00 $30,100.00 $133,969.00 -$46,000.00 $39,132.00 $1,824,969.00 $6,600.00 $573,200.00 Reformulated Balance Sheets Operating Asset Cash and Cash equivalents Trade and Other receivables Inventories Prepayments Property, plant and equipment Other financial assets Deferred tax assets Receivables Other financial assets (Non-Current) Investments (Non-current) Investments in associates (Non- Current) Licences Other intangible assets Other assets (Non-current) 2017 $8,552,620.00 $1,771,227.00 $225,290.00 $17,457.00 $35,465.00 $3,959,191.00 $9,375.00 $354,701.00 $145,735.00 $21,892.00 $64,764.00 2018 $8,171,700.00 $1,844,600.000 $172,300.00 $17,300.00 $32,800.00 $3,880,700.000 $9,200.00 $266,900.00 $143,000.00 $23,300.00 $235,511.00 $1,097,296.00 $562,720.00 $51,996.00 $187,800.00 $1,080,600.00 $462,800.00 $50,400.00 (Less) Operating Liabilities Trade and other payables Income tax payable Provisions (Current) Other payables Deferred tax liabilities Provisions (Non-current) Net Operating Assets $1,429,467.00 $446,503.00 $118,168.00 $210,788.00 $224,802.00 $377,423.00 $51,783.00 $7,123,153.00 $1,519,000.00 $427,500.00 $165,300.00 $225,100.00 $287,600.00 $380,900.000 $32,600.00 $6,652,700.00 $350,109.00 $25,700.00 Financial Liabilities Interest-bearing loans and borrowings (Current) Interest-bearing loans and borrowings (Non-current) Other financial liabilities (Non-current) Other financial liabilities (Current) $1,594,889.00 $2,790.00 $1,467,000.00 $2,100.00 (continue) 2017 2018 $1,947,788.00 $1,494,800.00 Net Financial Obligations Shareholder's Equity Contributed equity Treasury shares Reserves Retained earnings Non-controlling interest Common shareholders' equity $53,233.00 $71,900.00 $19,377.00 -$15,700.00 $60,792.00 -$60,500.00 $5,153,080.00 $5,306,000.00 $34,103.00 $5,175,365.00 $5,157,900.00 Net financing $5,175,365.00 $5,157,900.00 Question 6 Prepare Financial Statements Forecast for 2019 to 2023 using the table(s) below. (Note: 1: Make sure you show any additional information that you have used in the forecast To complete the forecast for 2019 to 2022, you need to calculate key ratios. Use the closing balance sheet amounts (2018), instead of averages in computing ratios. Complete Income and Balance sheet ratio table below. Add any additional ratios that is necessary to complete the Financial Forecast tables below. You may use the Historical Growth that is, for example Sales Growth from 2017 to 2018 as the growth rate for 2019, 2020 and 2012. Income and Balance sheet ratios 2018A 2019E 2020E 2021E Sales Growth Tax Rate Inventory Turnover (Operating Revenue / Inventory 2018) 3.85 3.85 3.85 3.85 30% 30% 30% 30% 210.14 210.14 210.14 210.14 Income statement 2018A 2019E 2020E 2021E Sales Total operating expenses Core operating income before tax Taxes Core operating income after tax Other income (expense) Operating income Note: If necessary, add items to the tables above. 10 Marks 2018A 2019E 2020E 2021E Balance sheet Inventory Property, plant and equipment Prepayments Other NOA Net operating assets (NOA). Note: If necessary, add items to the tables above. 2018A 2019E 2020E 2021E Operating income Change in NOA Free cash flow 5 Marks 2018 2019 2020 2021 RNOA Reol Growth in Reol Re0lt = 0lt (0 - 1)NO At-1 p= Cost of Operations (Calculated in Question6) Alpha Analysts Group, have been asked to conduct the following evaluations for Crown Resort on the Australian Securities Exchange (ASX) for 2017 and 2018. 1) Profitability Breakdown 2) Growth Valuation 3) Forecast Financial Statements for a period of 3 years. (2019 to 2021) 4) Capital Structure Given the following reformulated Income Statement and Balance Sheet answer Questions 1 to 8. (The Annual report for 2017 and 2018 is provided.) Reformulated Income Statements 2017 2018 $3,334,487 $3,462,900.00 $1,835,408 $172,500.00 $5,169,895 $3,635,400.00 Operating Revenue Sales Other Revenue and Income Total Less Operating Expenses Expenses Total operating expenses Total operating income before tax Income tax Expense Operating Income after tax Finance Costs Interest Revenue Net Finance Expenses Share of profits of associates and Joint venture entities Profit for the year (Net income) $3,143,274.00 $2,851,800.00 $3,143,274.00 $2,851,800.00 $2,026,621.00 $783,600.00 $106,815.00 $171,000.00 $1,919,806.00 $612,600.00 $143,617.00 -$76,100.00 $9,648.00 $30,100.00 $133,969.00 -$46,000.00 $39,132.00 $1,824,969.00 $6,600.00 $573,200.00 Reformulated Balance Sheets Operating Asset Cash and Cash equivalents Trade and Other receivables Inventories Prepayments Property, plant and equipment Other financial assets Deferred tax assets Receivables Other financial assets (Non-Current) Investments (Non-current) Investments in associates (Non- Current) Licences Other intangible assets Other assets (Non-current) 2017 $8,552,620.00 $1,771,227.00 $225,290.00 $17,457.00 $35,465.00 $3,959,191.00 $9,375.00 $354,701.00 $145,735.00 $21,892.00 $64,764.00 2018 $8,171,700.00 $1,844,600.000 $172,300.00 $17,300.00 $32,800.00 $3,880,700.000 $9,200.00 $266,900.00 $143,000.00 $23,300.00 $235,511.00 $1,097,296.00 $562,720.00 $51,996.00 $187,800.00 $1,080,600.00 $462,800.00 $50,400.00 (Less) Operating Liabilities Trade and other payables Income tax payable Provisions (Current) Other payables Deferred tax liabilities Provisions (Non-current) Net Operating Assets $1,429,467.00 $446,503.00 $118,168.00 $210,788.00 $224,802.00 $377,423.00 $51,783.00 $7,123,153.00 $1,519,000.00 $427,500.00 $165,300.00 $225,100.00 $287,600.00 $380,900.000 $32,600.00 $6,652,700.00 $350,109.00 $25,700.00 Financial Liabilities Interest-bearing loans and borrowings (Current) Interest-bearing loans and borrowings (Non-current) Other financial liabilities (Non-current) Other financial liabilities (Current) $1,594,889.00 $2,790.00 $1,467,000.00 $2,100.00 (continue) 2017 2018 $1,947,788.00 $1,494,800.00 Net Financial Obligations Shareholder's Equity Contributed equity Treasury shares Reserves Retained earnings Non-controlling interest Common shareholders' equity $53,233.00 $71,900.00 $19,377.00 -$15,700.00 $60,792.00 -$60,500.00 $5,153,080.00 $5,306,000.00 $34,103.00 $5,175,365.00 $5,157,900.00 Net financing $5,175,365.00 $5,157,900.00 Question 6 Prepare Financial Statements Forecast for 2019 to 2023 using the table(s) below. (Note: 1: Make sure you show any additional information that you have used in the forecast To complete the forecast for 2019 to 2022, you need to calculate key ratios. Use the closing balance sheet amounts (2018), instead of averages in computing ratios. Complete Income and Balance sheet ratio table below. Add any additional ratios that is necessary to complete the Financial Forecast tables below. You may use the Historical Growth that is, for example Sales Growth from 2017 to 2018 as the growth rate for 2019, 2020 and 2012. Income and Balance sheet ratios 2018A 2019E 2020E 2021E Sales Growth Tax Rate Inventory Turnover (Operating Revenue / Inventory 2018) 3.85 3.85 3.85 3.85 30% 30% 30% 30% 210.14 210.14 210.14 210.14 Income statement 2018A 2019E 2020E 2021E Sales Total operating expenses Core operating income before tax Taxes Core operating income after tax Other income (expense) Operating income Note: If necessary, add items to the tables above. 10 Marks 2018A 2019E 2020E 2021E Balance sheet Inventory Property, plant and equipment Prepayments Other NOA Net operating assets (NOA). Note: If necessary, add items to the tables above. 2018A 2019E 2020E 2021E Operating income Change in NOA Free cash flow 5 Marks 2018 2019 2020 2021 RNOA Reol Growth in Reol Re0lt = 0lt (0 - 1)NO At-1 p= Cost of Operations (Calculated in Question6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started