Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha company is trying to install a new machine that has estimated cost Rs. 200,000 by replacing an old machine. The new machine required

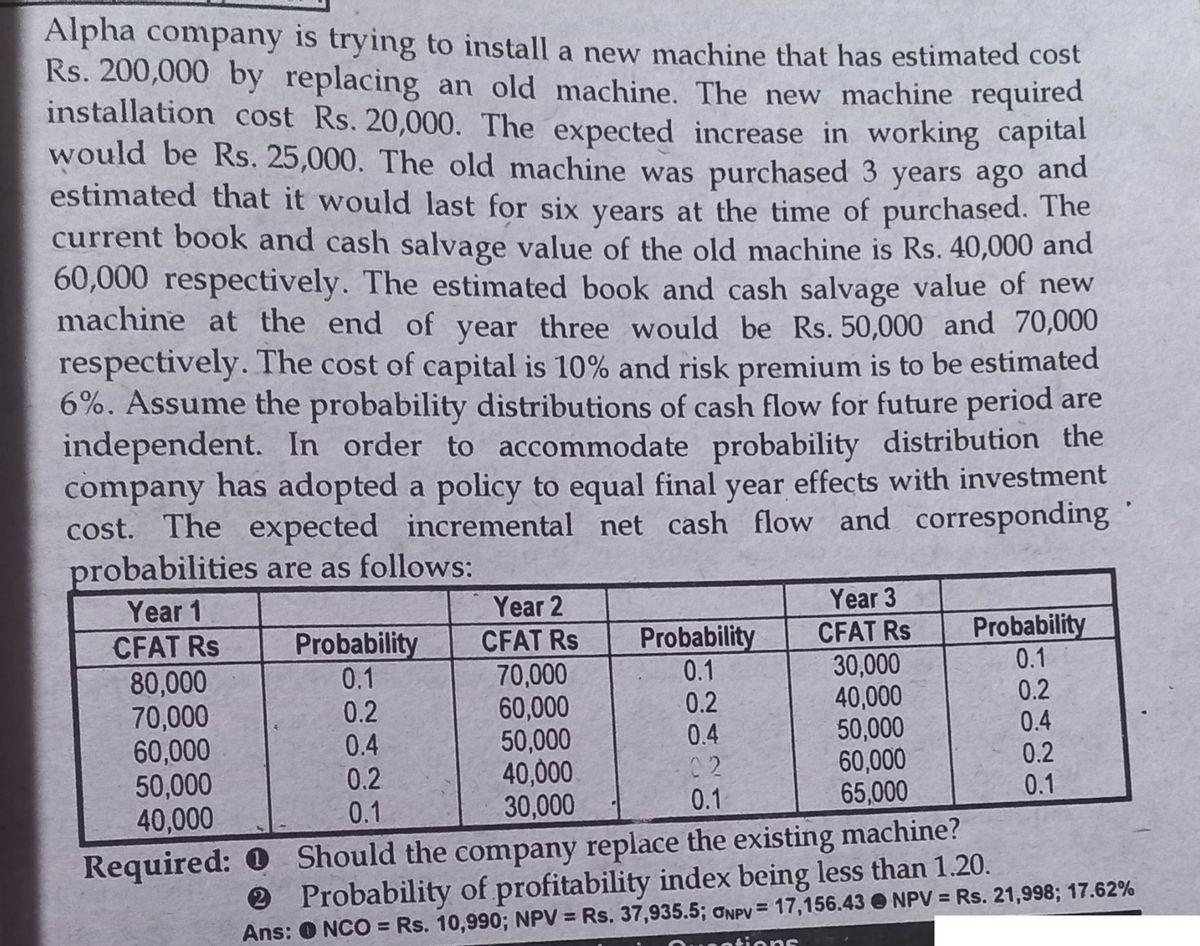

Alpha company is trying to install a new machine that has estimated cost Rs. 200,000 by replacing an old machine. The new machine required installation cost Rs. 20,000. The expected increase in working capital would be Rs. 25,000. The old machine was purchased 3 years ago and estimated that it would last for six years at the time of purchased. The current book and cash salvage value of the old machine is Rs. 40,000 and 60,000 respectively. The estimated book and cash salvage value of new machine at the end of year three would be Rs. 50,000 and 70,000 respectively. The cost of capital is 10% and risk premium is to be estimated 6%. Assume the probability distributions of cash flow for future period are independent. In order to accommodate probability distribution the company has adopted a policy to equal final year effects with investment cost. The expected incremental net cash flow and corresponding probabilities are as follows: Year 1 CFAT Rs 80,000 70,000 60,000 50,000 40,000 Required: 0 Probability 0.1 0.2 0.4 0.2 0.1 Year 2 CFAT Rs 70,000 60,000 50,000 40,000 30,000 Probability 0.1 0.2 0.4 02 0.1 Year 3 CFAT Rs tions 30,000 40,000 50,000 60,000 65,000 Probability 0.1 0.2 0.4 0.2 0.1 Should the company replace the existing machine? Probability of profitability index being less than 1.20. Ans: NCO = Rs. 10,990; NPV = Rs. 37,935.5; ONPV = 17,156.43 NPV = Rs. 21,998; 17.62%

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Given Cost of new machine Rs 200000 Installation cost of new machine Rs 20000 Increase in working capital Rs 25000 Cost of old machine 3 years ago Unk...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started