Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Corporation purchased several municipal bonds and AAA corporate bonds ylelding an average of four percent and six percent, respectively. Additionally, it also purchased

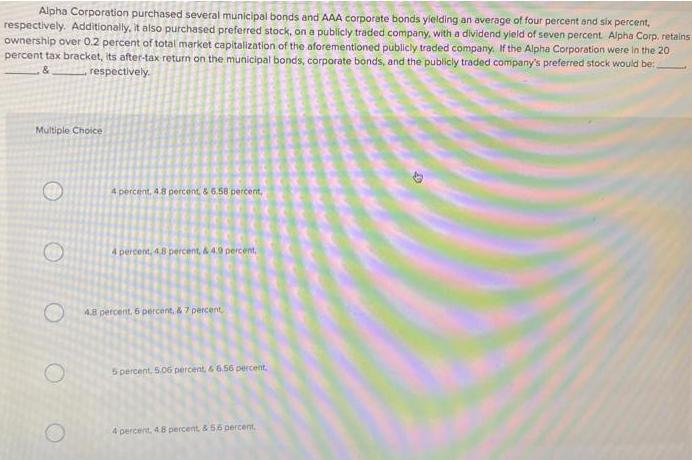

Alpha Corporation purchased several municipal bonds and AAA corporate bonds ylelding an average of four percent and six percent, respectively. Additionally, it also purchased preferred stock, on a publicly traded company, with a dividend yield of seven percent Alpha Corp, retains ownership over 0.2 percent of total market capitalization of the aforementioned publicly traded company. If the Alpha Corporation were in the 20 percent tax bracket, its after-tax return on the municipal bonds, corporate bonds, and the publicly traded company's preferred stock would be: & , respectively. Multiple Choice 4 percent, 48 percent & 6.58 percent, 4 percent, 4.8 percent, & 4.9 percent, 4.8 percent, 6 percent, &7 percent 5 percent. 5.06 percent, 66.56 percent. 4 percent, 48 percent & 56 percent.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer The correct option is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started