Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Winston Company had two products code named X and Y. The firm had the following budget for August: Product X Product Y Total Sales

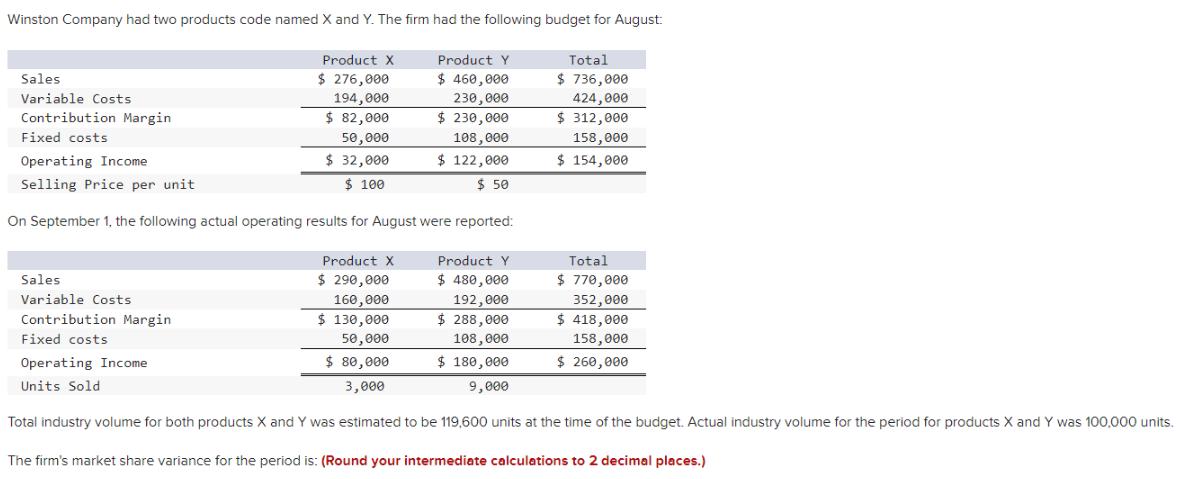

Winston Company had two products code named X and Y. The firm had the following budget for August: Product X Product Y Total Sales $ 276,000 $ 460,000 $ 736,000 Variable Costs 194,000 230,000 424,000 Contribution Margin $ 82,000 $ 230,000 $ 312,000 Fixed costs 50,000 108,000 158,000 $ 32,000 $ 100 $ 122,000 $ 50 Operating Income $ 154,000 Selling Price per unit On September 1, the following actual operating results for August were reported: Product X Product Y Total Sales $ 290,000 $ 480,000 $ 770,000 Variable Costs 192,000 $ 288,000 108,000 $ 180,000 160,000 352,000 $ 418,000 $ 130,000 50,000 $ 80,000 Contribution Margin Fixed costs 158,000 Operating Income $ 260,000 Units Sold 3,000 9,000 Total industry volume for both products X and Y was estimated to be 119,600 units at the time of the budget. Actual industry volume for the period for products X and Y was 100,000 units. The firm's market share variance for the period is: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $4,850 unfavorable. $26,170 unfavorable. $19,860 favorable. $52,180 favorable. $77,910 favorable.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 52180 Favorable Explanation Budgeted Units Prod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started