Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Al-Radwan Company achieved the following percentages in the past year: Assets + Sales = 1.5 *** Liabilities + Sales = 05 Profit margin from sales

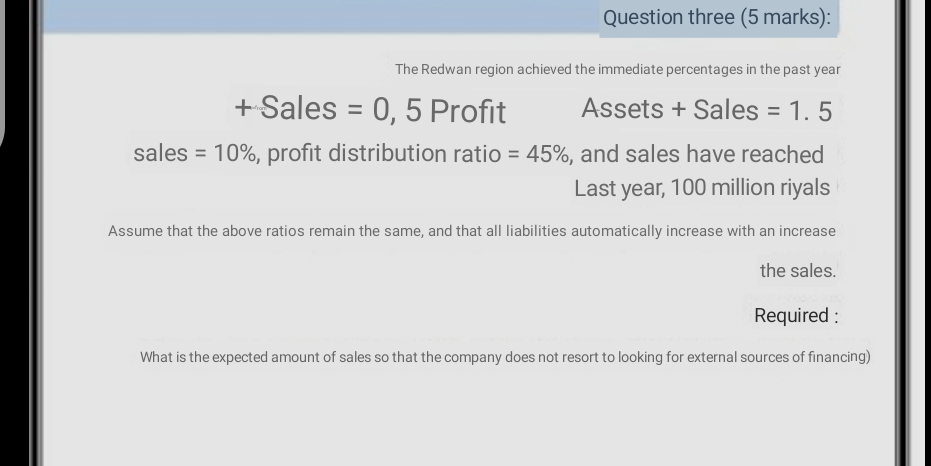

Al-Radwan Company achieved the following percentages in the past year: Assets + Sales = 1.5 *** Liabilities + Sales = 05 Profit margin from sales = 10%, profit distribution ratio = 45%, and last year's sales amounted to 100 million riyals. Assume the above ratios are kept constant As it is, and that all liabilities increase automatically with the increase in sales. Required: What is the amount of expected sales so that the company does not resort to looking for external funding sources?

Question three (5 marks): The Redwan region achieved the immediate percentages in the past year + Sales = 0, 5 Profit Assets + Sales = 1.5 sales = 10%, profit distribution ratio = 45%, and sales have reached Last year, 100 million riyals Assume that the above ratios remain the same, and that all liabilities automatically increase with an increase the sales. Required: What is the expected amount of sales so that the company does not resort to looking for external sources of financing) Question three (5 marks): The Redwan region achieved the immediate percentages in the past year + Sales = 0, 5 Profit Assets + Sales = 1.5 sales = 10%, profit distribution ratio = 45%, and sales have reached Last year, 100 million riyals Assume that the above ratios remain the same, and that all liabilities automatically increase with an increase the sales. Required: What is the expected amount of sales so that the company does not resort to looking for external sources of financing)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started