Answered step by step

Verified Expert Solution

Question

1 Approved Answer

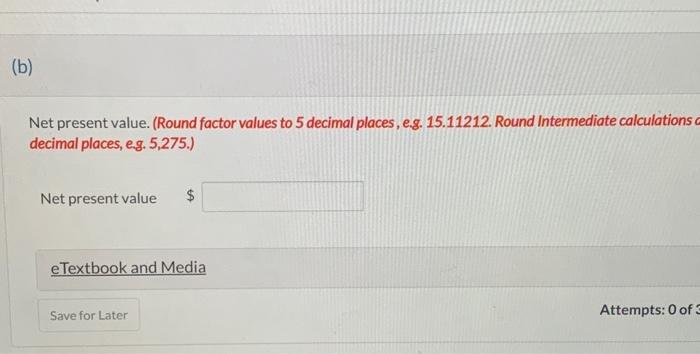

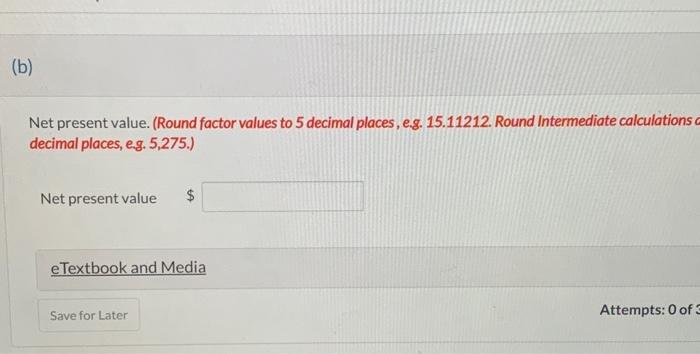

Already found cash payback period (6.5), just confused on calcualtion on Net present value Ayayai Growth Farms, a farming cooperative, is considering purchasing a tractor

Already found cash payback period (6.5), just confused on calcualtion on Net present value

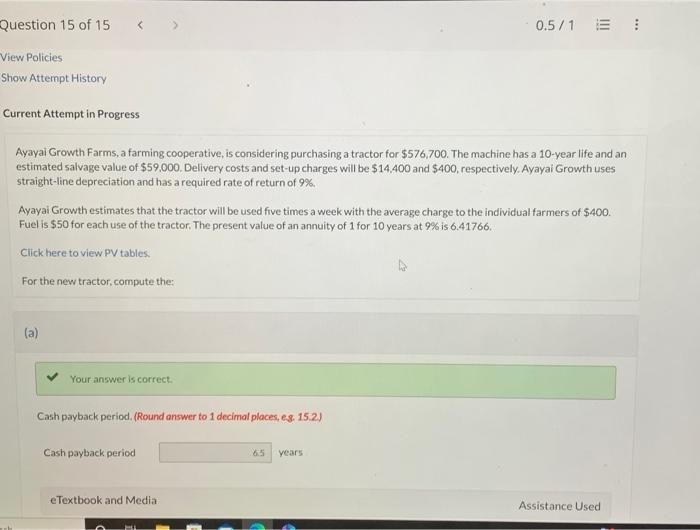

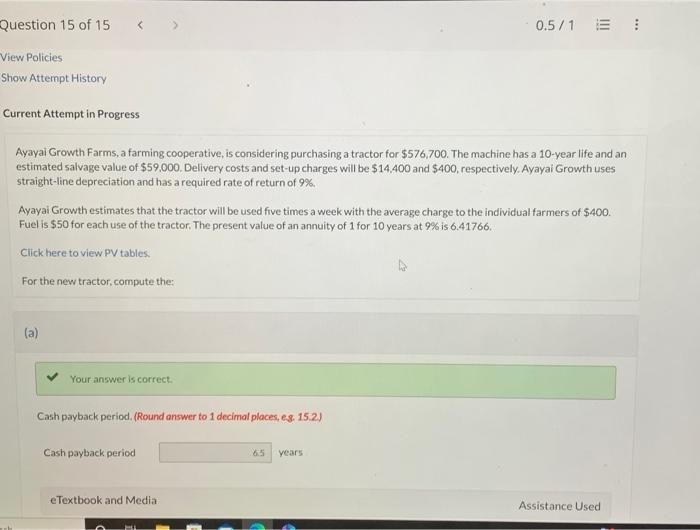

Ayayai Growth Farms, a farming cooperative, is considering purchasing a tractor for $576,700. The machine has a 10-year life and an estimated salvage value of $59,000. Delivery costs and set-up charges will be $14.400 and $400, respectively. Ayayai Growth uses straight-line depreciation and has a required rate of return of 9% Ayayai Growth estimates that the tractor will be used five times a week with the average charge to the individual farmers of $400. Fuel is $50 for each use of the tractor. The present value of an annuity of 1 for 10 years at 9% is 6.41766 . Click here to view PV tables. For the new tractor, compute the: (a) Your answer is correct. Cash payback period. (Round answer to 1 decimal places, es. 15.2) Net present value. (Round factor values to 5 decimal places, e.g. 15.11212. Round Intermediate calculations decimal places, eg. 5,275.) Net present value Attempts: 0 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started