Answered step by step

Verified Expert Solution

Question

1 Approved Answer

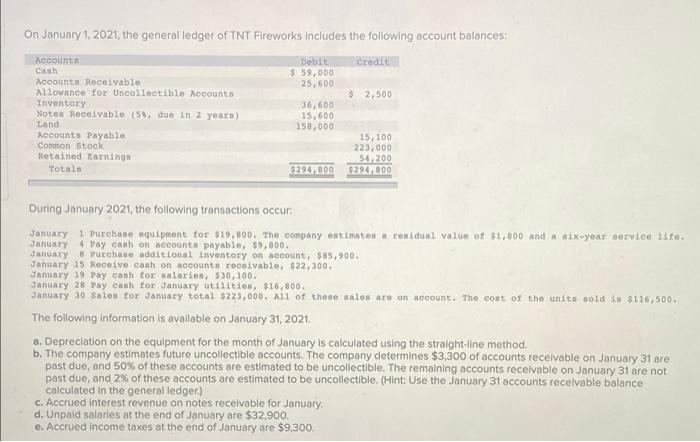

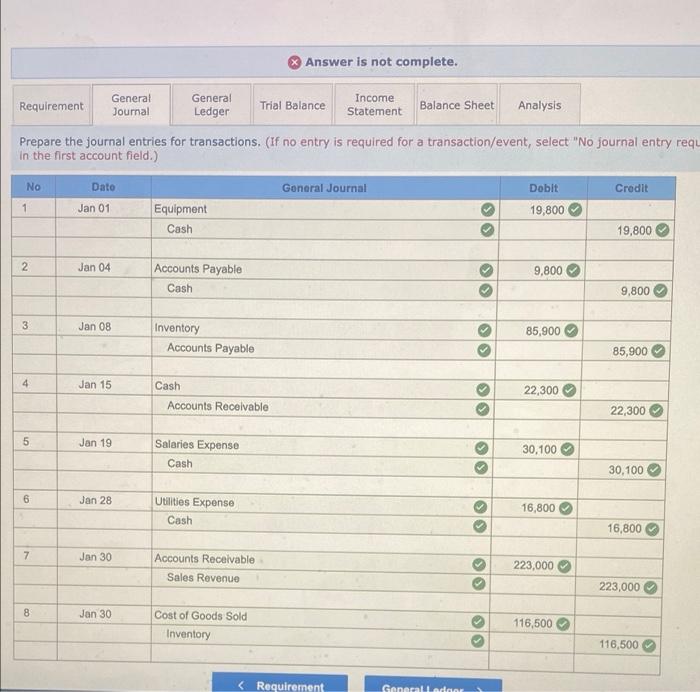

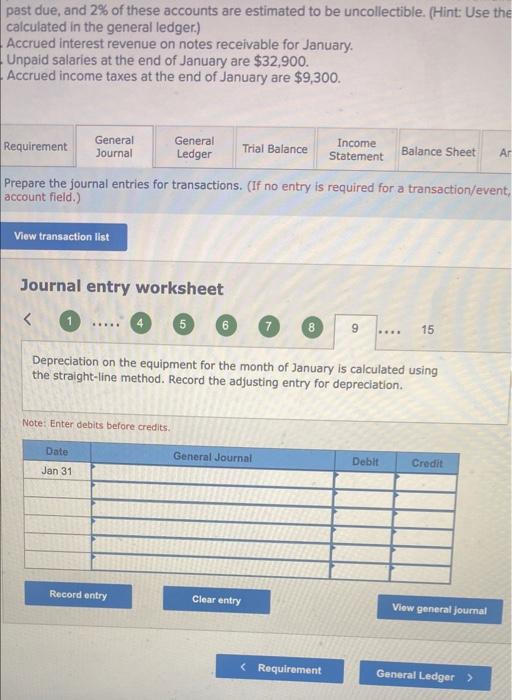

Already posted this question but it was not completely finished. I need help finishing the general journal (posted below pages 9-15 in the general journal

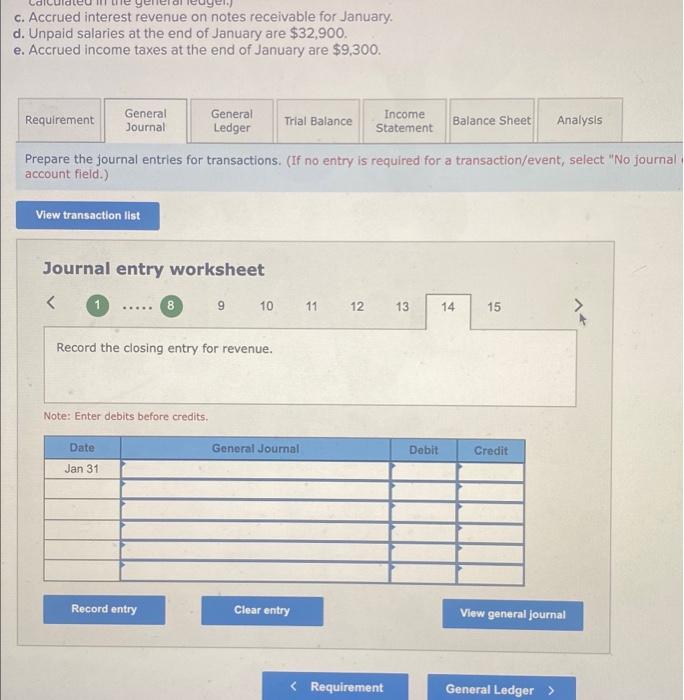

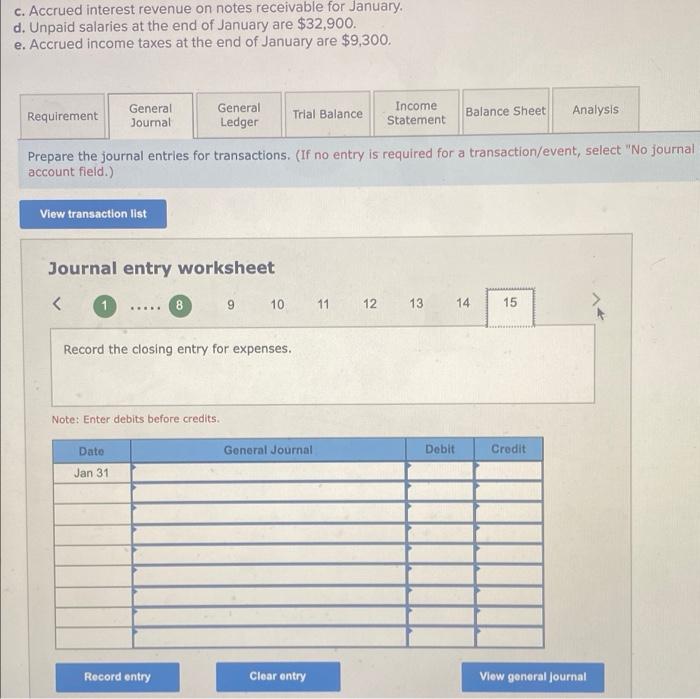

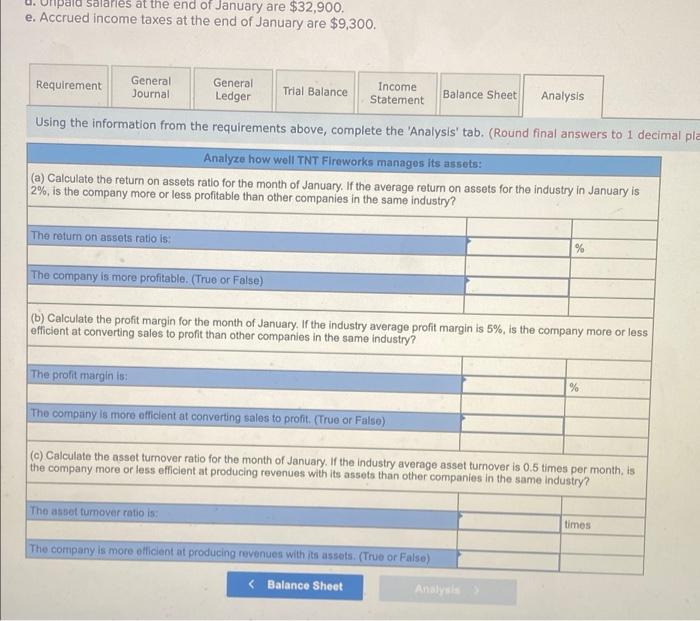

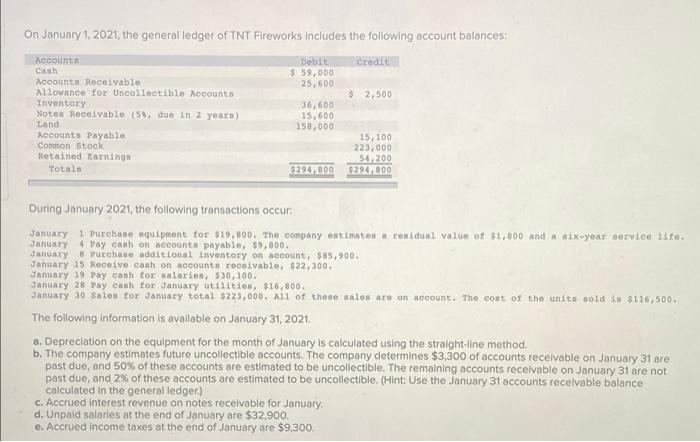

Already posted this question but it was not completely finished. I need help finishing the general journal (posted below pages 9-15 in the general journal AND the part that is already completed). ALSO need help doing the analysis portion posted. all for the same problem.

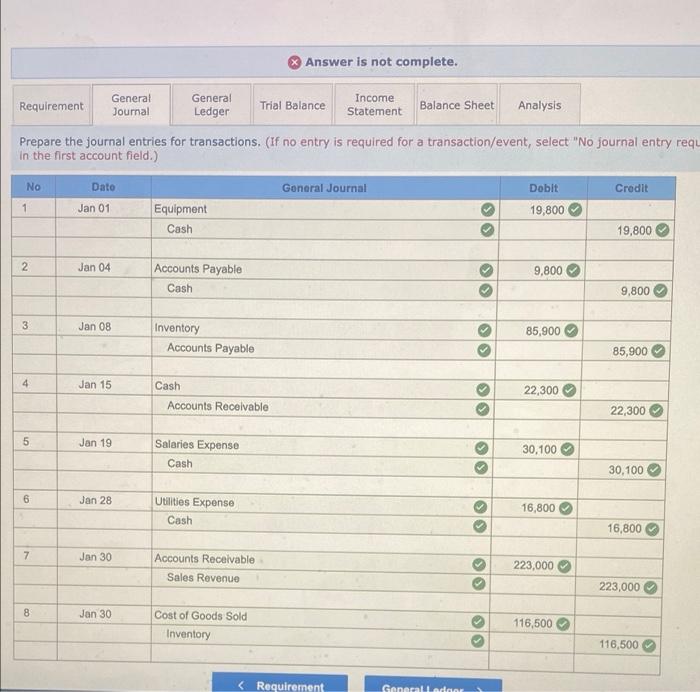

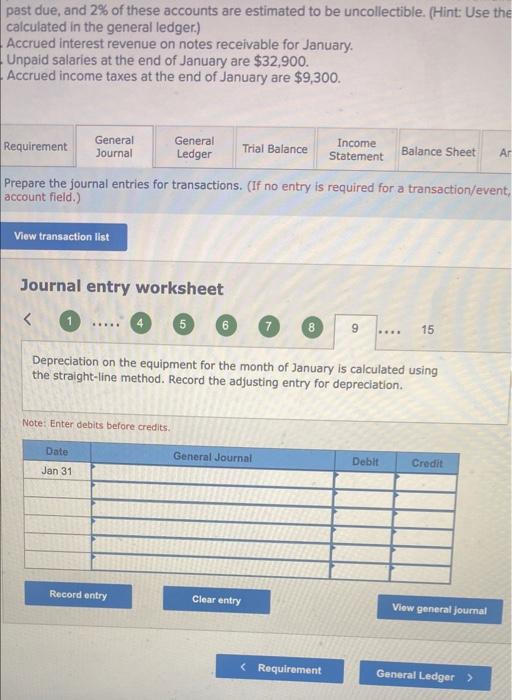

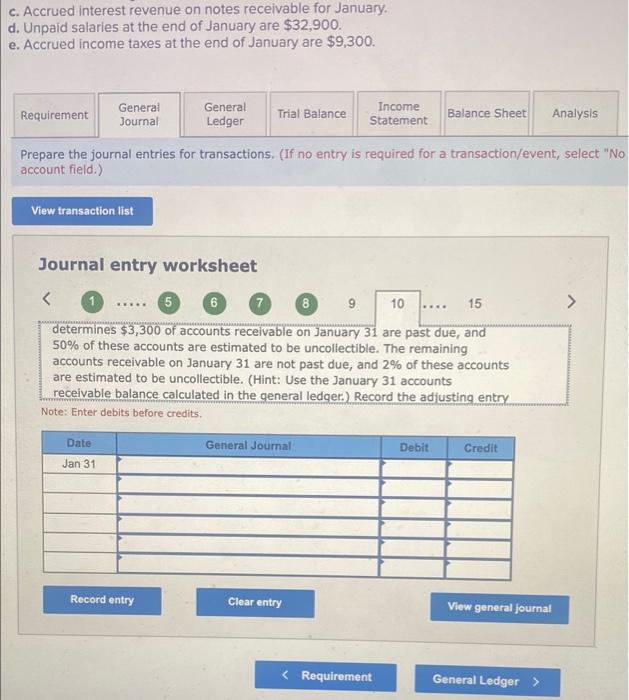

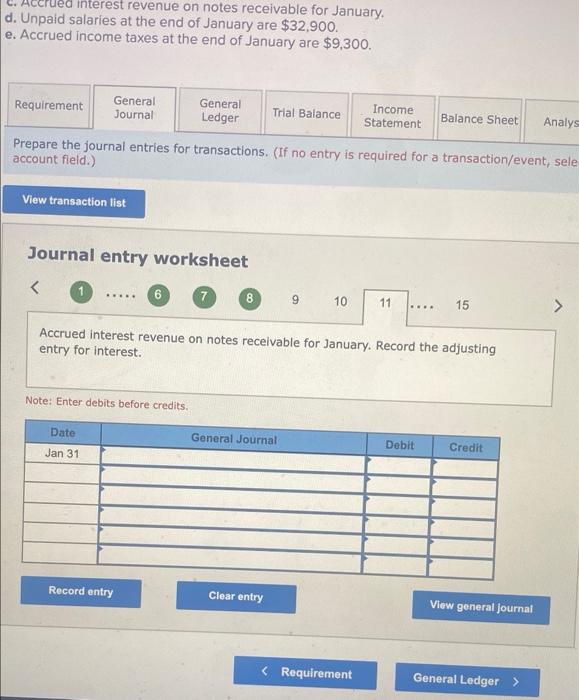

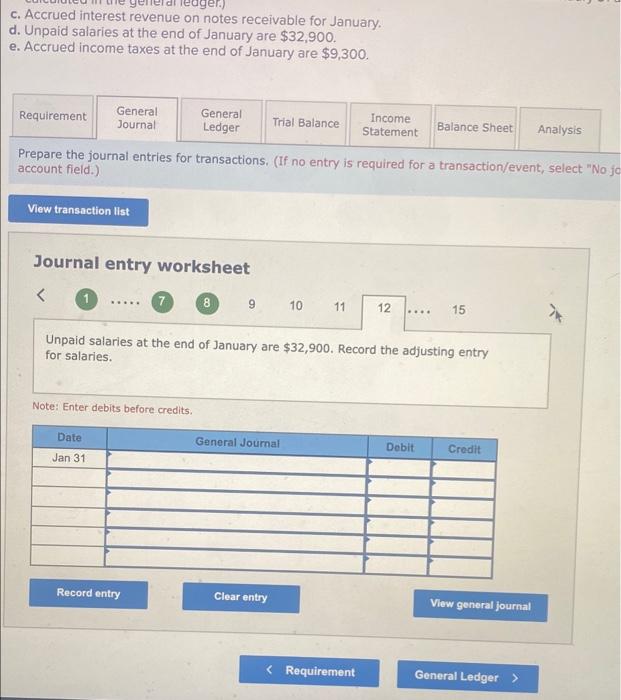

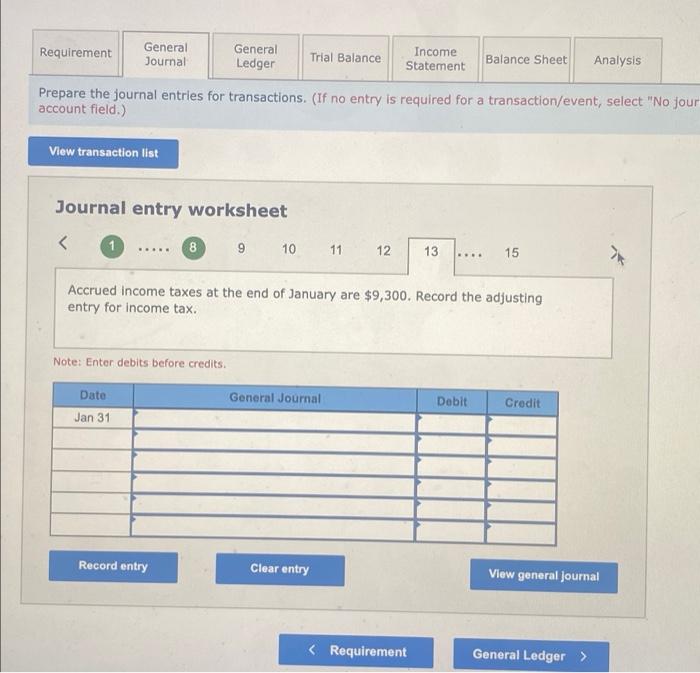

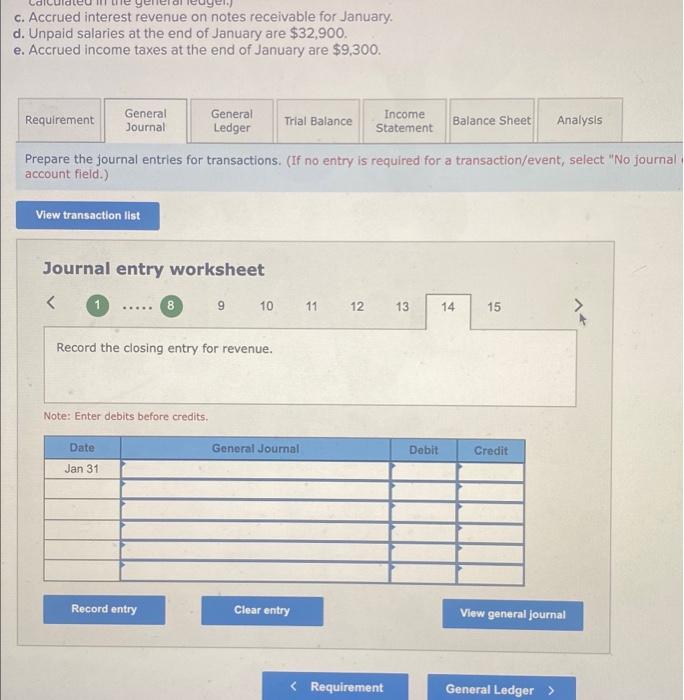

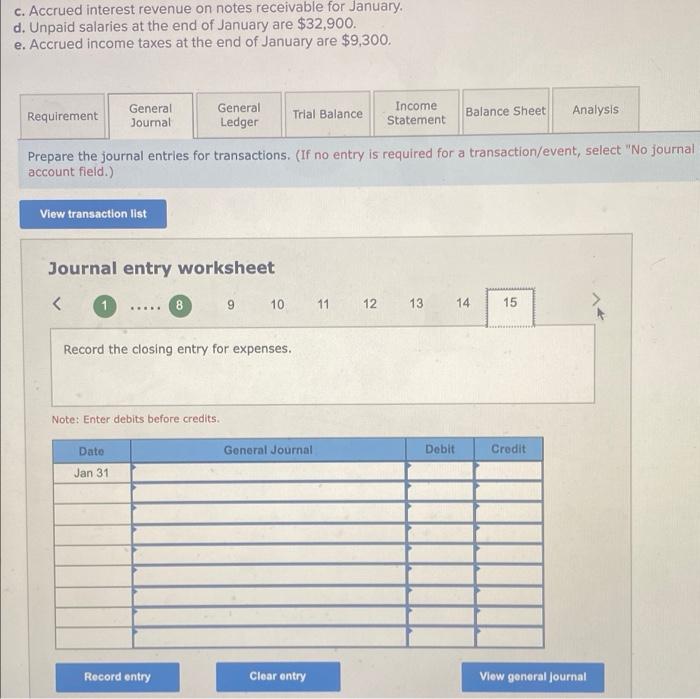

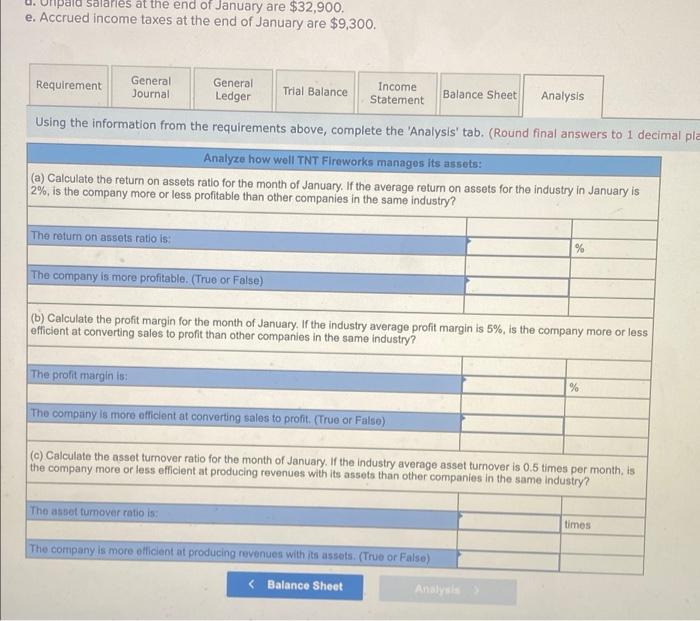

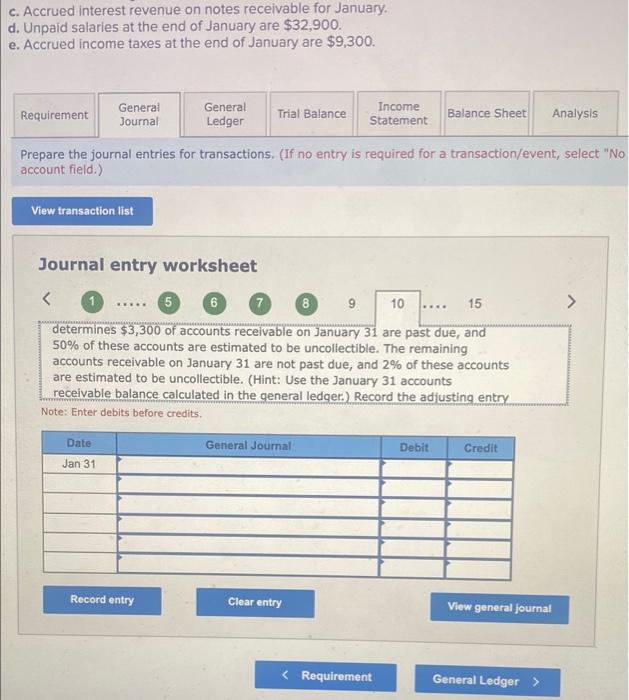

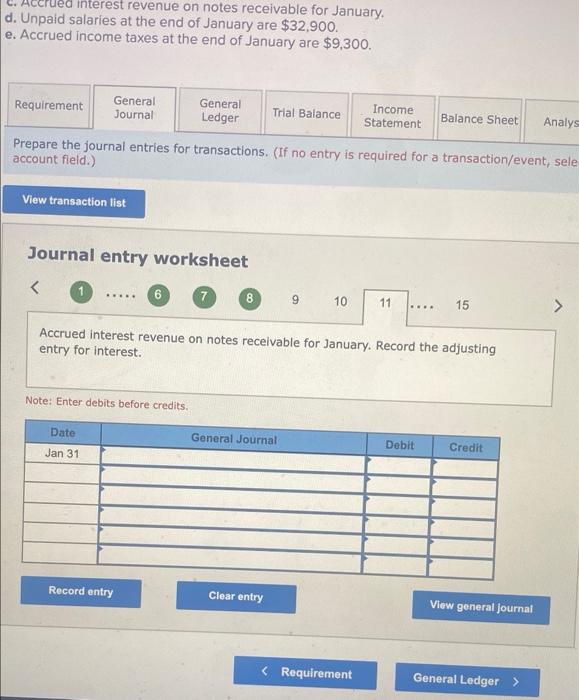

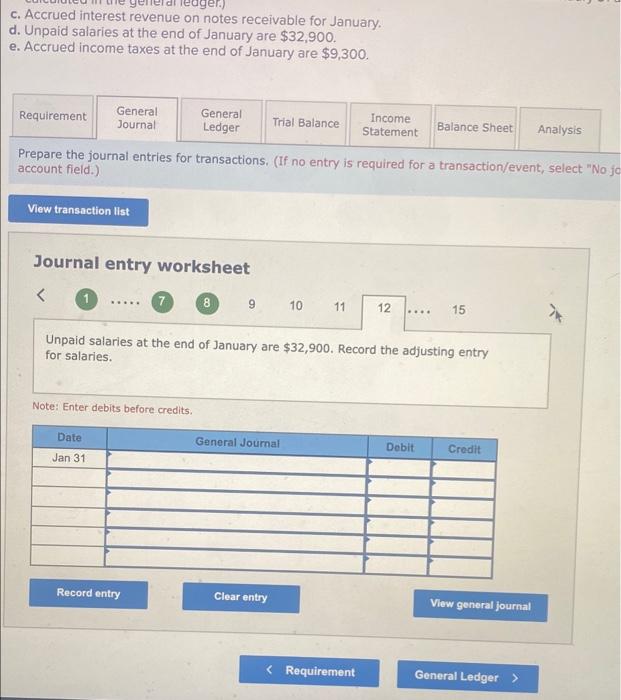

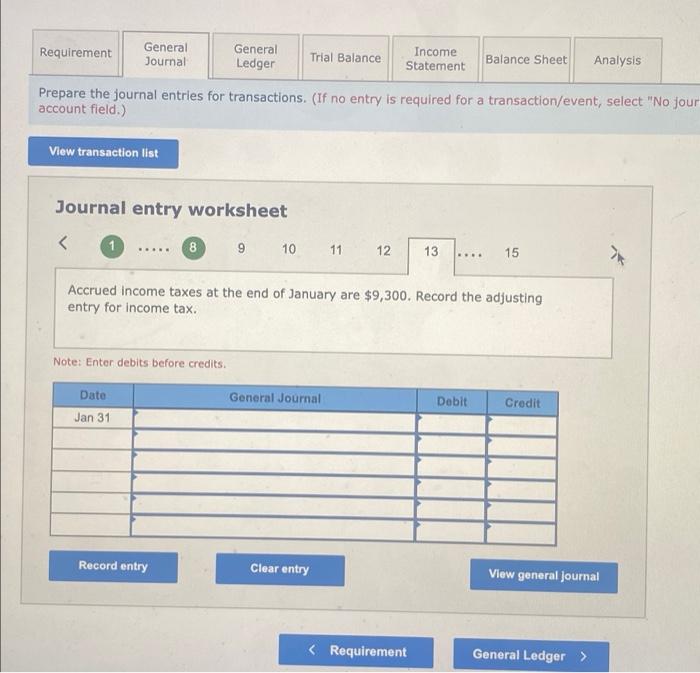

Answer is not complete. General General Income Requirement Journal Ledger Trial Balance Analysis Balance Sheet Statement Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No journal entry requ in the first account field.) No Dato Goneral Journal Dobit Credit Jan 01 19,800 Equipment Cash 19,800 2 Jan 04 Accounts Payable Cash 9,800 9,800 3 Jan 08 85,900 Inventory Accounts Payable 85,900 4 Jan 15 22,300 Cash Accounts Recevable >> 22,300 5 Jan 19 Salaries Expense Cash 30,100 >> 30,100 6 Jan 28 Utilities Expense Cash 16,800 >> 16,800 7 Jan 30 Accounts Receivable 223,000 Sales Revenue 223,000 8 Jan 30 Cost of Goods Sold Inventory 116,500 116,500 C. ed interest revenue on notes receivable for January d. Unpaid salaries at the end of January are $32,900. e. Accrued income taxes at the end of January are $9,300. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analys Prepare the journal entries for transactions. (If no entry is required for a transaction/event, sele account field.) View transaction list Journal entry worksheet ... 7 8 9 10 11 15 Accrued interest revenue on notes receivable for January. Record the adjusting entry for interest. Note: Enter debits before credits. Date General Journal Debit Jan 31 Credit Record entry Clear entry View general journal c. Accrued interest revenue on notes receivable for January d. Unpaid salaries at the end of January are $32,900. e. Accrued income taxes at the end of January are $9,300. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No jo account field.) View transaction list Journal entry worksheet Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No jour account field.) View transaction list Journal entry worksheet c. Accrued interest revenue on notes receivable for January d. Unpaid salaries at the end of January are $32,900. e. Accrued income taxes at the end of January are $9,300. Requirement General General Income Trial Balance Balance Sheet Journal Analysis Ledger Statement Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No journal account field.) View transaction list Journal entry worksheet c. Accrued interest revenue on notes receivable for January d. Unpaid salaries at the end of January are $32,900. e. Accrued income taxes at the end of January are $9,300, Requirement General General Trial Balance Income Balance Sheet Analysis Journal Ledger Statement Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No journal account field.) View transaction list Journal entry worksheet V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started