Answered step by step

Verified Expert Solution

Question

1 Approved Answer

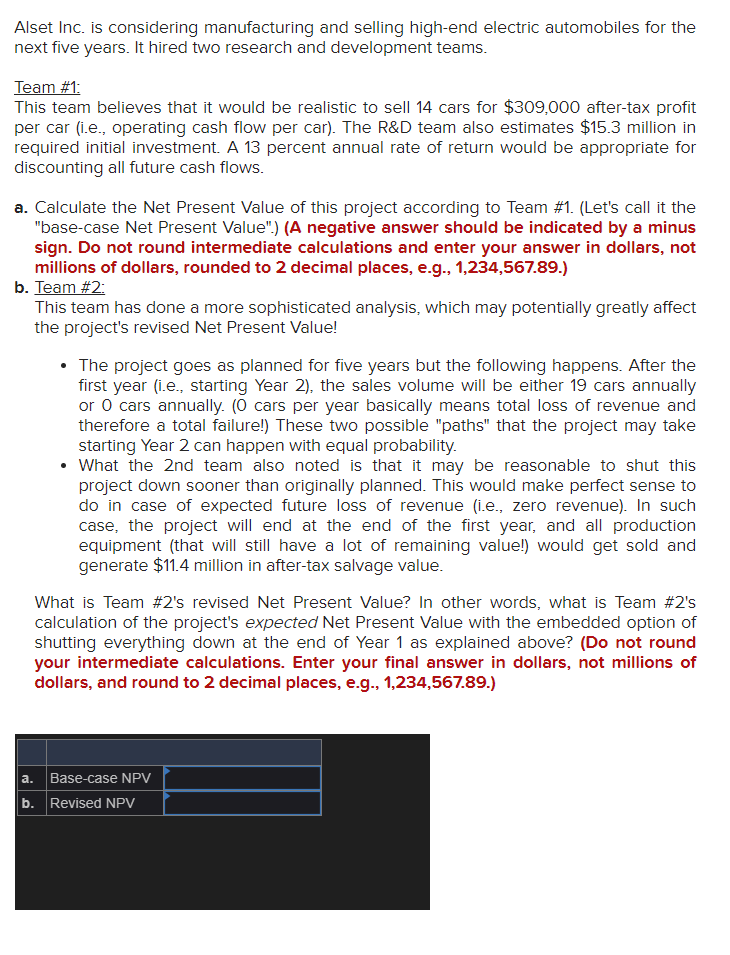

Alset Inc. is considering manufacturing and selling high - end electric automobiles for the next five years. It hired two research and development teams. Team

Alset Inc. is considering manufacturing and selling highend electric automobiles for the

next five years. It hired two research and development teams.

Team #:

This team believes that it would be realistic to sell cars for $ aftertax profit

per car ie operating cash flow per car The R&D team also estimates $ million in

required initial investment. A percent annual rate of return would be appropriate for

discounting all future cash flows.

a Calculate the Net Present Value of this project according to Team #Lets call it the

"basecase Net Present Value".A negative answer should be indicated by a minus

sign. Do not round intermediate calculations and enter your answer in dollars, not

millions of dollars, rounded to decimal places, eg

b Team #:

This team has done a more sophisticated analysis, which may potentially greatly affect

the project's revised Net Present Value!

The project goes as planned for five years but the following happens. After the

first year ie starting Year the sales volume will be either cars annually

or cars annually. cars per year basically means total loss of revenue and

therefore a total failure! These two possible "paths" that the project may take

starting Year can happen with equal probability.

What the nd team also noted is that it may be reasonable to shut this

project down sooner than originally planned. This would make perfect sense to

do in case of expected future loss of revenue ie zero revenue In such

case, the project will end at the end of the first year, and all production

equipment that will still have a lot of remaining value! would get sold and

generate $ million in aftertax salvage value.

What is Team #s revised Net Present Value? In other words, what is Team #s

calculation of the project's expected Net Present Value with the embedded option of

shutting everything down at the end of Year as explained above? Do not round

your intermediate calculations. Enter your final answer in dollars, not millions of

dollars, and round to decimal places, eg

a Basecase NPV

b Revised NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started