Answered step by step

Verified Expert Solution

Question

1 Approved Answer

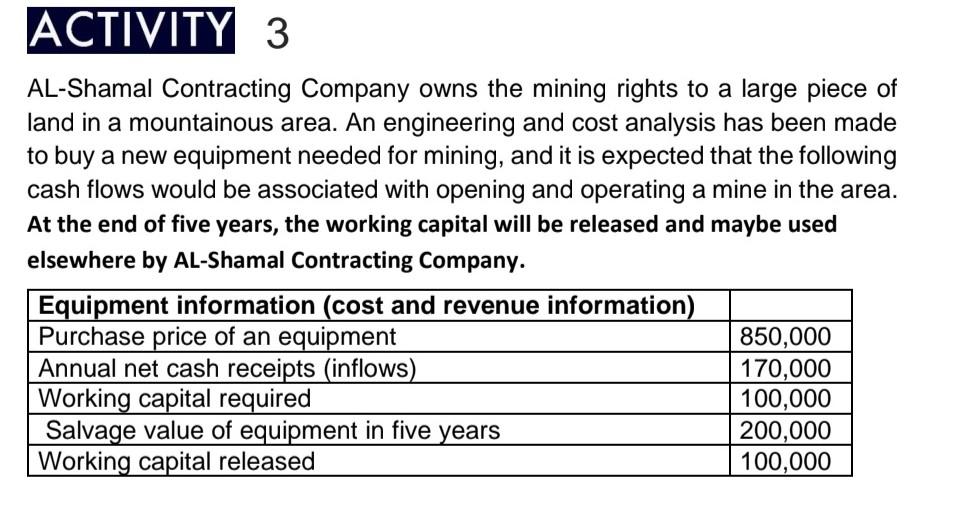

AL-Shamal Contracting Company owns the mining rights to a large piece of land in a mountainous area. An engineering and cost analysis has been made

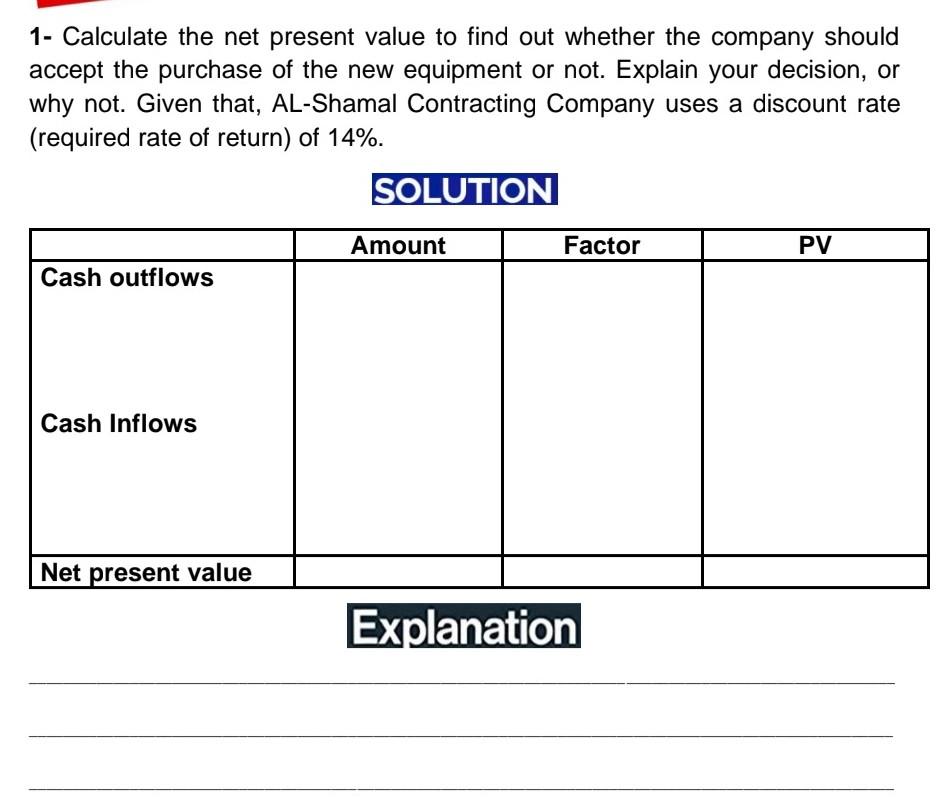

AL-Shamal Contracting Company owns the mining rights to a large piece of land in a mountainous area. An engineering and cost analysis has been made to buy a new equipment needed for mining, and it is expected that the following cash flows would be associated with opening and operating a mine in the area. At the end of five years, the working capital will be released and maybe used elsewhere by AL-Shamal Contracting Company. 1- Calculate the net present value to find out whether the company should accept the purchase of the new equipment or not. Explain your decision, or why not. Given that, AL-Shamal Contracting Company uses a discount rate (required rate of return) of \14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started