Answered step by step

Verified Expert Solution

Question

1 Approved Answer

also do the calculationa require Personal Finance Case #17 Bruce and Faith Johnston, 64 and 58, are preparing for retirement within two years. Other short-term

also do the calculationa require

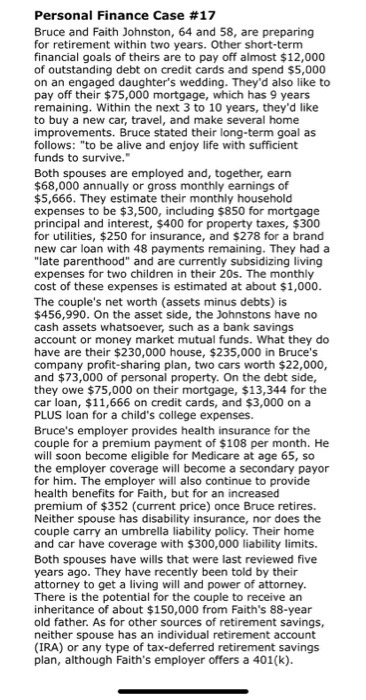

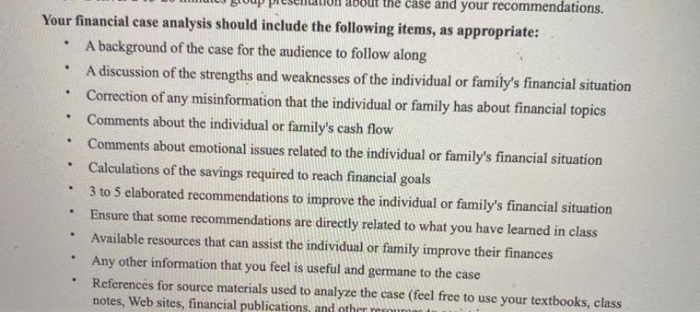

Personal Finance Case #17 Bruce and Faith Johnston, 64 and 58, are preparing for retirement within two years. Other short-term financial goals of theirs are to pay off almost $12,000 of outstanding debt on credit cards and spend $5,000 on an engaged daughter's wedding. They'd also like to pay off their $75,000 mortgage, which has 9 years remaining. Within the next 3 to 10 years, they'd like to buy a new car, travel, and make several home improvements. Bruce stated their long-term goal as follows: "to be alive and enjoy life with sufficient funds to survive. Both spouses are employed and, together, earn $68,000 annually or gross monthly earnings of $5,666. They estimate their monthly household expenses to be $3,500, including $850 for mortgage principal and interest, $400 for property taxes, $300 for utilities, $250 for insurance, and $278 for a brand new car loan with 48 payments remaining. They had a "late parenthood" and are currently subsidizing living expenses for two children in their 20s. The monthly cost of these expenses is estimated at about $1,000. The couple's net worth (assets minus debts) is $456,990. On the asset side, the Johnstons have no cash assets whatsoever, such as a bank savings account or money market mutual funds. What they do have are their $230,000 house, $235,000 in Bruce's company profit-sharing plan, two cars worth $22,000, and $73,000 of personal property. On the debt side, they owe $75,000 on their mortgage, $13,344 for the car loan, $11,666 on credit cards, and $3,000 on a PLUS loan for a child's college expenses. Bruce's employer provides health insurance for the couple for a premium payment of $108 per month. He will soon become eligible for Medicare at age 65, so the employer coverage will become a secondary payor for him. The employer will also continue to provide health benefits for Faith, but for an increased premium of $352 (current price) once Bruce retires. Neither spouse has disability insurance, nor does the couple carry an umbrella liability policy. Their home and car have coverage with $300,000 liability limits. Both spouses have wills that were last reviewed five years ago. They have recently been told by their attorney to get a living will and power of attorney. There is the potential for the couple to receive an inheritance of about $150,000 from Faith's 88-year old father. As for other sources of retirement savings, neither spouse has an individual retirement account (IRA) or any type of tax-deferred retirement savings plan, although Faith's employer offers a 401(k). w P n about the case du your comments. Your financial case analysis should include the following items, as appropriate: A background of the case for the audience to follow along A discussion of the strengths and weaknesses of the individual or family's financial situation Correction of any misinformation that the individual or family has about financial topics Comments about the individual or family's cash flow Comments about emotional issues related to the individual or family's financial situation Calculations of the savings required to reach financial goals . 3 to 5 elaborated recommendations to improve the individual or family's financial situation Ensure that some recommendations are directly related to what you have learned in class Available resources that can assist the individual or family improve their finances Any other information that you feel is useful and germane to the case References for source materials used to analyze the case (feel free to use your textbooks, class notes. Web sites financial publications, and other Personal Finance Case #17 Bruce and Faith Johnston, 64 and 58, are preparing for retirement within two years. Other short-term financial goals of theirs are to pay off almost $12,000 of outstanding debt on credit cards and spend $5,000 on an engaged daughter's wedding. They'd also like to pay off their $75,000 mortgage, which has 9 years remaining. Within the next 3 to 10 years, they'd like to buy a new car, travel, and make several home improvements. Bruce stated their long-term goal as follows: "to be alive and enjoy life with sufficient funds to survive. Both spouses are employed and, together, earn $68,000 annually or gross monthly earnings of $5,666. They estimate their monthly household expenses to be $3,500, including $850 for mortgage principal and interest, $400 for property taxes, $300 for utilities, $250 for insurance, and $278 for a brand new car loan with 48 payments remaining. They had a "late parenthood" and are currently subsidizing living expenses for two children in their 20s. The monthly cost of these expenses is estimated at about $1,000. The couple's net worth (assets minus debts) is $456,990. On the asset side, the Johnstons have no cash assets whatsoever, such as a bank savings account or money market mutual funds. What they do have are their $230,000 house, $235,000 in Bruce's company profit-sharing plan, two cars worth $22,000, and $73,000 of personal property. On the debt side, they owe $75,000 on their mortgage, $13,344 for the car loan, $11,666 on credit cards, and $3,000 on a PLUS loan for a child's college expenses. Bruce's employer provides health insurance for the couple for a premium payment of $108 per month. He will soon become eligible for Medicare at age 65, so the employer coverage will become a secondary payor for him. The employer will also continue to provide health benefits for Faith, but for an increased premium of $352 (current price) once Bruce retires. Neither spouse has disability insurance, nor does the couple carry an umbrella liability policy. Their home and car have coverage with $300,000 liability limits. Both spouses have wills that were last reviewed five years ago. They have recently been told by their attorney to get a living will and power of attorney. There is the potential for the couple to receive an inheritance of about $150,000 from Faith's 88-year old father. As for other sources of retirement savings, neither spouse has an individual retirement account (IRA) or any type of tax-deferred retirement savings plan, although Faith's employer offers a 401(k). w P n about the case du your comments. Your financial case analysis should include the following items, as appropriate: A background of the case for the audience to follow along A discussion of the strengths and weaknesses of the individual or family's financial situation Correction of any misinformation that the individual or family has about financial topics Comments about the individual or family's cash flow Comments about emotional issues related to the individual or family's financial situation Calculations of the savings required to reach financial goals . 3 to 5 elaborated recommendations to improve the individual or family's financial situation Ensure that some recommendations are directly related to what you have learned in class Available resources that can assist the individual or family improve their finances Any other information that you feel is useful and germane to the case References for source materials used to analyze the case (feel free to use your textbooks, class notes. Web sites financial publications, and other Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started