Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALSO **** How do you calculate basic EPS? Colnago Corporation reports the following capital structure at the beginning and end of the year: Beginning End

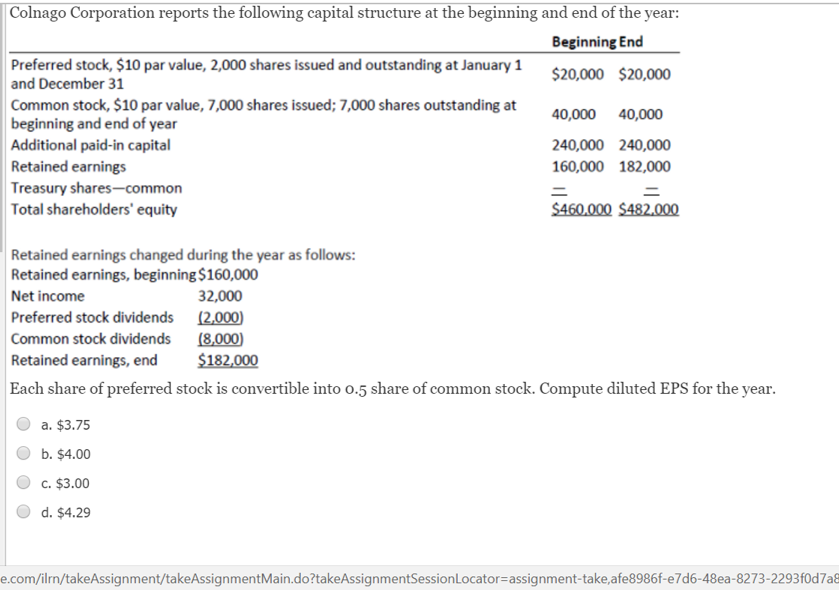

ALSO **** How do you calculate basic EPS?

Colnago Corporation reports the following capital structure at the beginning and end of the year: Beginning End Preferred stock, $10 par value, 2,000 shares issued and outstanding at January 1 and December 31 Common stock, $10 par value, 7,000 shares issued; 7,000 shares outstanding at beginning and end of year Additional paid-in capital Retained earnings Treasury shares-common Total shareholders' equity $20,000 $20,000 0,000 40,000 240,000240,000 60,000 182,000 $460.000 $482.000 Retained earnings changed during the year as follows: Retained earnings, beginning $160,000 Net income Preferred stock dividends 2000 Common stock dividends (8,000 Retained earnings, end $182,000 32,000 Each share of preferred stock is convertible into o.5 share of common stock. Compute diluted EPS for the year O a. $3.75 b. $4.00 c. $3.00 d. $4.29 e.com/ilrn/takeAssignment/takeAssignment Main.do?takeAssignmentSessionLocator= assignment-take,afe8986f-e7d6-48ea-8273-2293 f0d7a8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started