Answered step by step

Verified Expert Solution

Question

1 Approved Answer

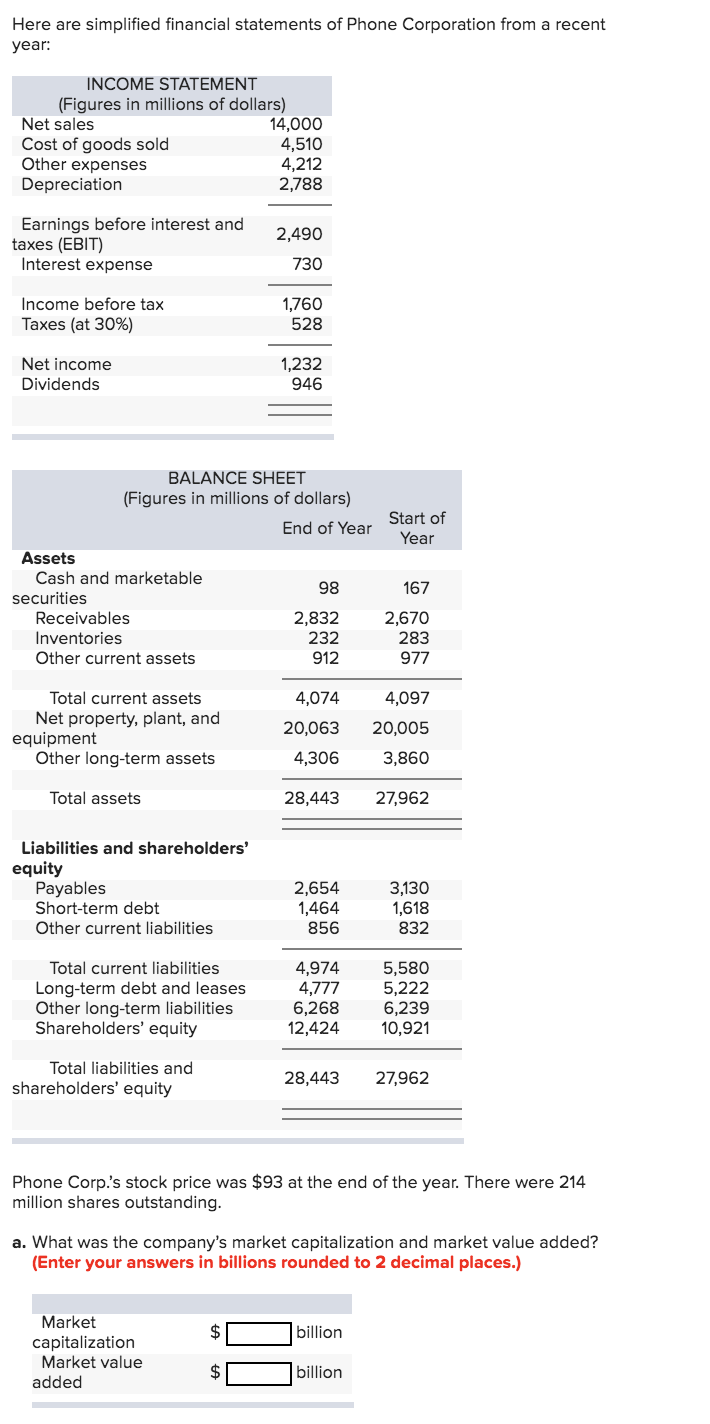

Also need find its Market to Book ratio Here are simplified financial statements of Phone Corporation from a recent year: INCOME STATEMENT (Figures in millions

Also need find its Market to Book ratio

Here are simplified financial statements of Phone Corporation from a recent year: INCOME STATEMENT (Figures in millions of dollars) Net sales 14,000 Cost of goods sold 4,510 Other expenses 4,212 Depreciation 2,788 Earnings before interest and taxes (EBIT) Interest expense 2,490 730 Income before tax Taxes (at 30%) 1,760 528 Net income Dividends 1,232 946 BALANCE SHEET (Figures in millions of dollars) End of Year Start of Year 98 Assets Cash and marketable securities Receivables Inventories Other current assets 2,832 232 912 167 2,670 283 977 Total current assets Net property, plant, and equipment Other long-term assets 4,074 20,063 4,306 4,097 20,005 3,860 Total assets 28,443 27,962 Liabilities and shareholders' equity Payables Short-term debt Other current liabilities 2,654 1,464 856 3,130 1,618 832 Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity 4,974 4,777 6,268 12,424 5,580 5,222 6,239 10,921 Total liabilities and shareholders' equity 28,443 27,962 Phone Corp.'s stock price was $93 at the end of the year. There were 214 million shares outstanding. a. What was the company's market capitalization and market value added? (Enter your answers in billions rounded to 2 decimal places.) $[ billion Market capitalization Market value added - billionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started