Answered step by step

Verified Expert Solution

Question

1 Approved Answer

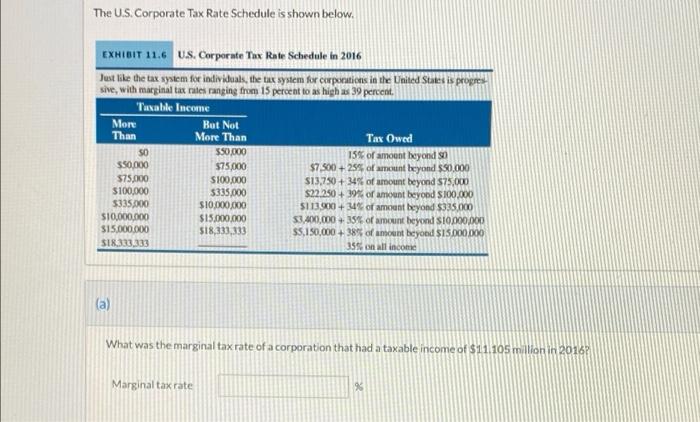

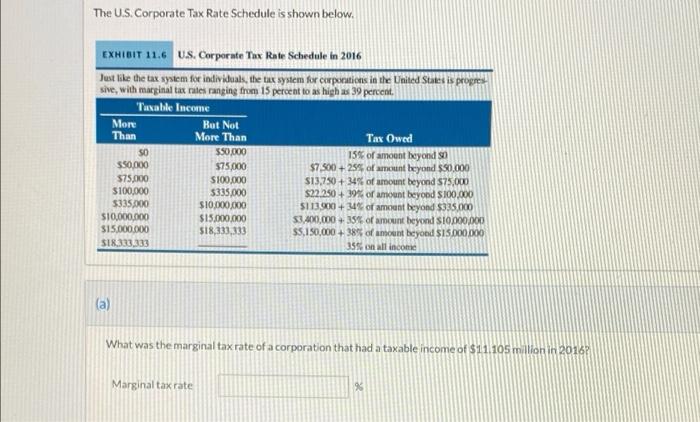

also need to know the average tax rate of a corporation that had a taxable income of 11.105 million in 2016 The U.S. Corporate Tax

also need to know the average tax rate of a corporation that had a taxable income of 11.105 million in 2016

The U.S. Corporate Tax Rate Schedule is shown below. EXHIBIT 11.6 U.S. Corporate Tax Rate Schedule in 2016 Just like the tax system for individuals, the tax system for corporations in the United States is propres sive, with marginal tax rates ranging from 15 percent to as high as 39 percent Turable Income More But Not Than More Than Tax Owed SO $50,000 15 of amount beyond so $50.000 $75,000 $7,500 + 25% of amount beyond $50,000 $75,000 $100,000 $13,750 + 34% of amount beyond $75,000 $100,000 3335,000 $22.250 39% or amount beyond $100.000 $335.000 $10,000,000 $11300+ 34 or amount beyond $335.000 $10,000,000 $15.000.000 53,000,000 of amount beyond 10.000.000 $15.000.000 $18,333,333 SS150,000+ 38% of amount beyond SIS DOO 000 $18.333,333 355 on all income (a) a What was the marginal tax rate of a corporation that had a taxable income of $11.105 million in 2016? Marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started