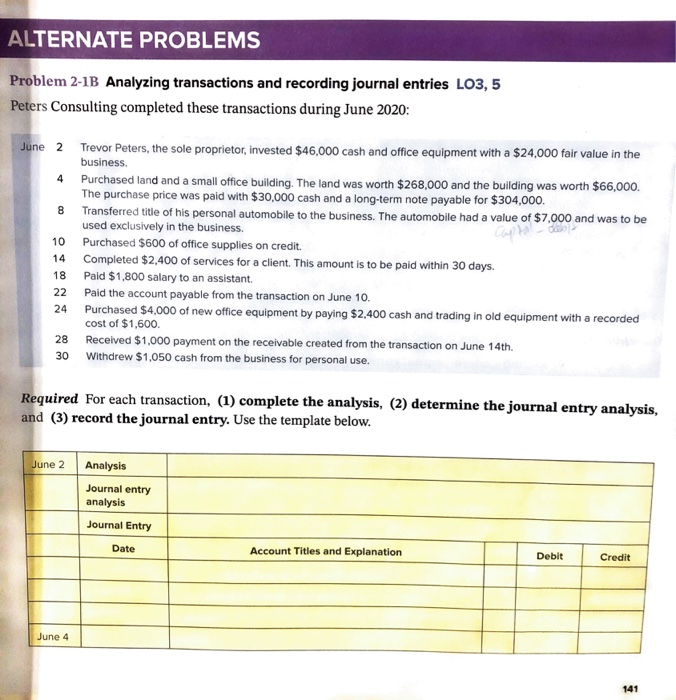

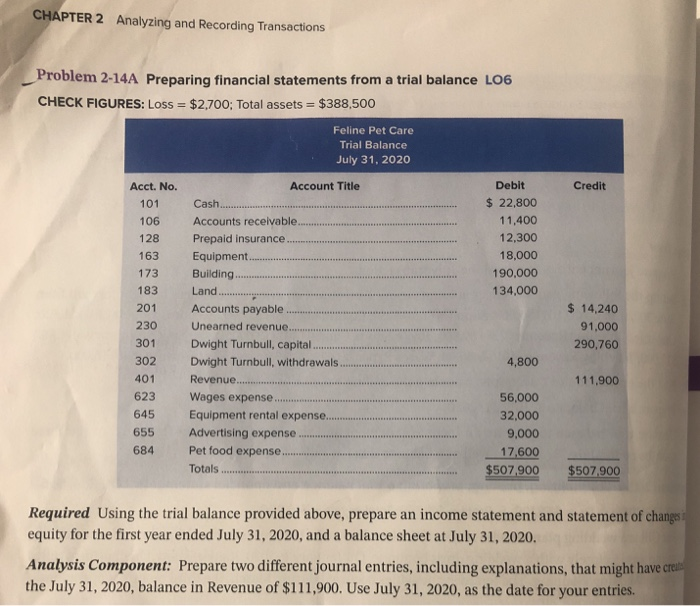

ALTERNATE PROBLEMS Problem 2-1B Analyzing transactions and recording journal entries LO3,5 Peters Consulting completed these transactions during June 2020: 8 June 2 Trevor Peters, the sole proprietor, invested $46,000 cash and office equipment with a $24,000 fair value in the business. 4 Purchased land and a small office building. The land was worth $268,000 and the building was worth $66,000. The purchase price was paid with $30,000 cash and a long-term note payable for $304,000. Transferred title of his personal automobile to the business. The automobile had a value of $7,000 and was to be used exclusively in the business. Purchased $600 of office supplies on credit. Completed $2,400 of services for a client. This amount is to be paid within 30 days. Paid $1,800 salary to an assistant. Paid the account payable from the transaction on June 10. Purchased $4,000 of new office equipment by paying $2,400 cash and trading in old equipment with a recorded cost of $1,600 Received $1,000 payment on the receivable created from the transaction on June 14th. 30 Withdrew $1,050 cash from the business for personal use. 10 14 18 22 24 28 Required for each transaction, (1) complete the analysis, (2) determine the journal entry analysis, and (3) record the journal entry. Use the template below. June 2 Analysis Journal entry analysis Journal Entry Date Account Titles and Explanation Debit Credit June 4 141 CHAPTER 2 Analyzing and Recording Transactions Problem 2-14A Preparing financial statements from a trial balance 106 CHECK FIGURES: Loss = $2,700: Total assets = $388,500 Feline Pet Care Trial Balance July 31, 2020 Account Title Credit Acct. No. 101 Debit $ 22,800 11,400 12,300 18,000 190.000 134.000 106 128 163 173 183 201 230 301 302 401 623 645 655 684 Cash. Accounts receivable.. Prepaid insurance Equipment Building Land Accounts payable Unearned revenue.. Dwight Turnbull, capital Dwight Turnbull, withdrawals Revenue.... Wages expense. Equipment rental expense. Advertising expense Pet food expense Totals .......... $ 14,240 91,000 290,760 4,800 111.900 56,000 32,000 9,000 17,600 $507,900 $507,900 Required Using the trial balance provided above, prepare an income statement and statement of changes i equity for the first year ended July 31, 2020, and a balance sheet at July 31, 2020. Analysis Component: Prepare two different journal entries, including explanations, that might have creato the July 31, 2020, balance in Revenue of $111.900. Use July 31, 2020, as the date for your entries