Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alternative 2: Sell the old machine for ( $ 38,600 ) and buy a new one. This requires an initial investment of ( $ 310,000

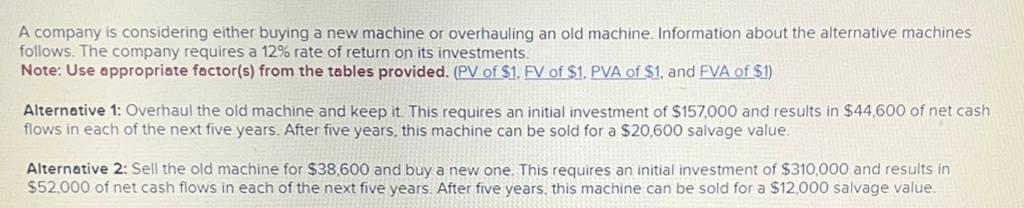

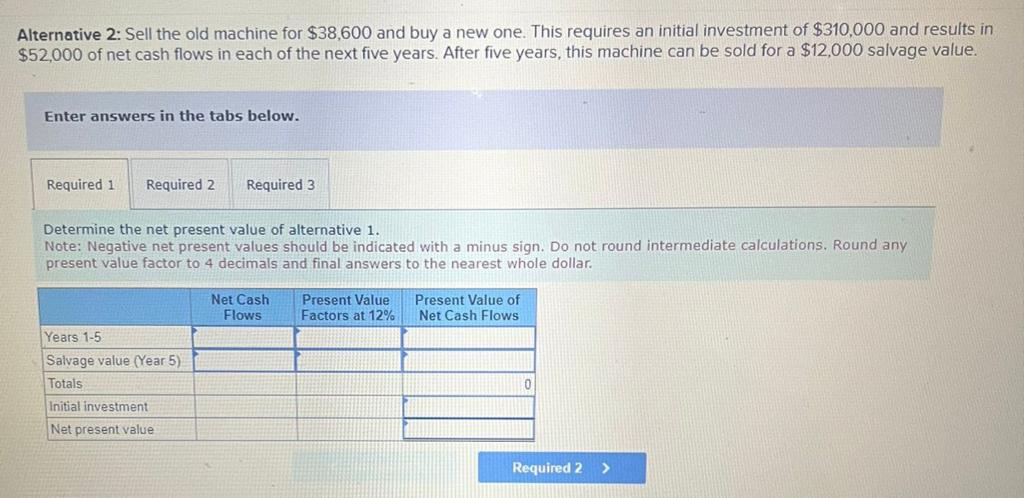

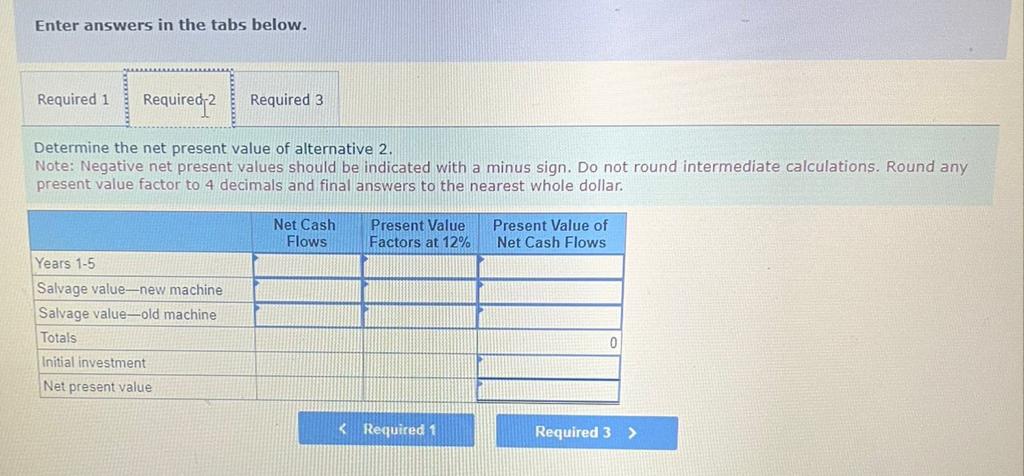

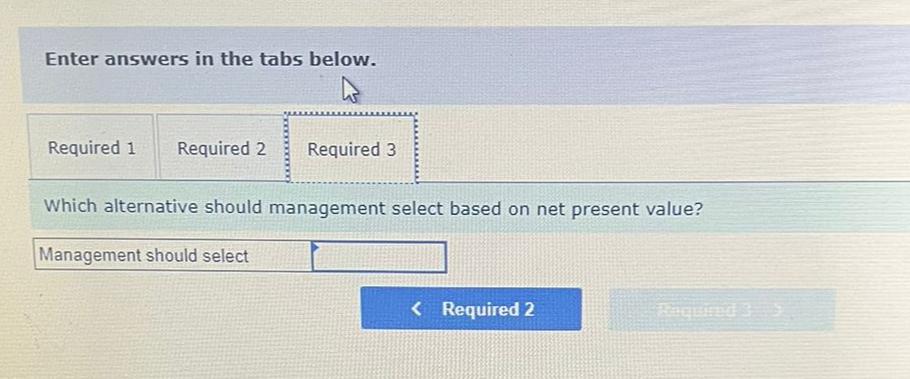

Alternative 2: Sell the old machine for \\( \\$ 38,600 \\) and buy a new one. This requires an initial investment of \\( \\$ 310,000 \\) and results \\( \\$ 52,000 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 12,000 \\) salvage value. Enter answers in the tabs below. Determine the net present value of alternative 1. Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar. Enter answers in the tabs below. Which alternative should management select based on net present value? A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a \12 rate of return on its investments. Note: Use appropriate factor(s) from the tables provided. (PV of \\$1, FV of \\$1, PVA of \\$1, and FVA of \\$1) Alternotive 1: Overhaul the old machine and keep it. This requires an initial investment of \\( \\$ 157,000 \\) and results in \\( \\$ 44,600 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 20,600 \\) salvage value. Alternative 2: Sell the old machine for \\( \\$ 38,600 \\) and buy a new one. This requires an initial investment of \\( \\$ 310,000 \\) and results in \\( \\$ 52,000 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 12,000 \\) salvage value. Enter answers in the tabs below. Determine the net present value of alternative 2 . Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar

Alternative 2: Sell the old machine for \\( \\$ 38,600 \\) and buy a new one. This requires an initial investment of \\( \\$ 310,000 \\) and results \\( \\$ 52,000 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 12,000 \\) salvage value. Enter answers in the tabs below. Determine the net present value of alternative 1. Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar. Enter answers in the tabs below. Which alternative should management select based on net present value? A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a \12 rate of return on its investments. Note: Use appropriate factor(s) from the tables provided. (PV of \\$1, FV of \\$1, PVA of \\$1, and FVA of \\$1) Alternotive 1: Overhaul the old machine and keep it. This requires an initial investment of \\( \\$ 157,000 \\) and results in \\( \\$ 44,600 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 20,600 \\) salvage value. Alternative 2: Sell the old machine for \\( \\$ 38,600 \\) and buy a new one. This requires an initial investment of \\( \\$ 310,000 \\) and results in \\( \\$ 52,000 \\) of net cash flows in each of the next five years. After five years, this machine can be sold for a \\( \\$ 12,000 \\) salvage value. Enter answers in the tabs below. Determine the net present value of alternative 2 . Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started