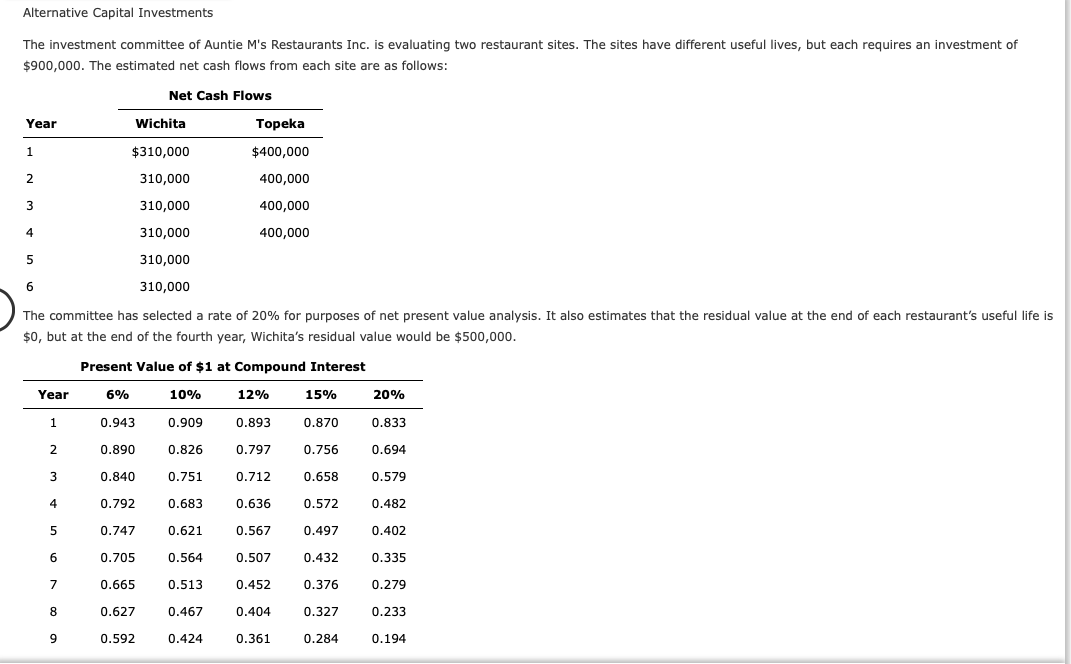

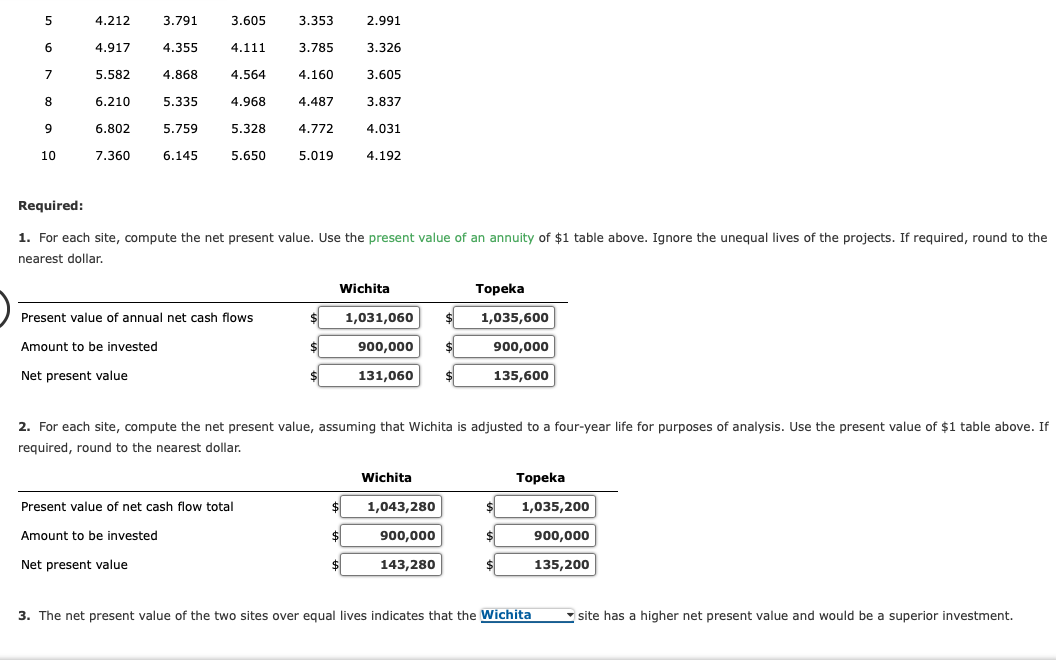

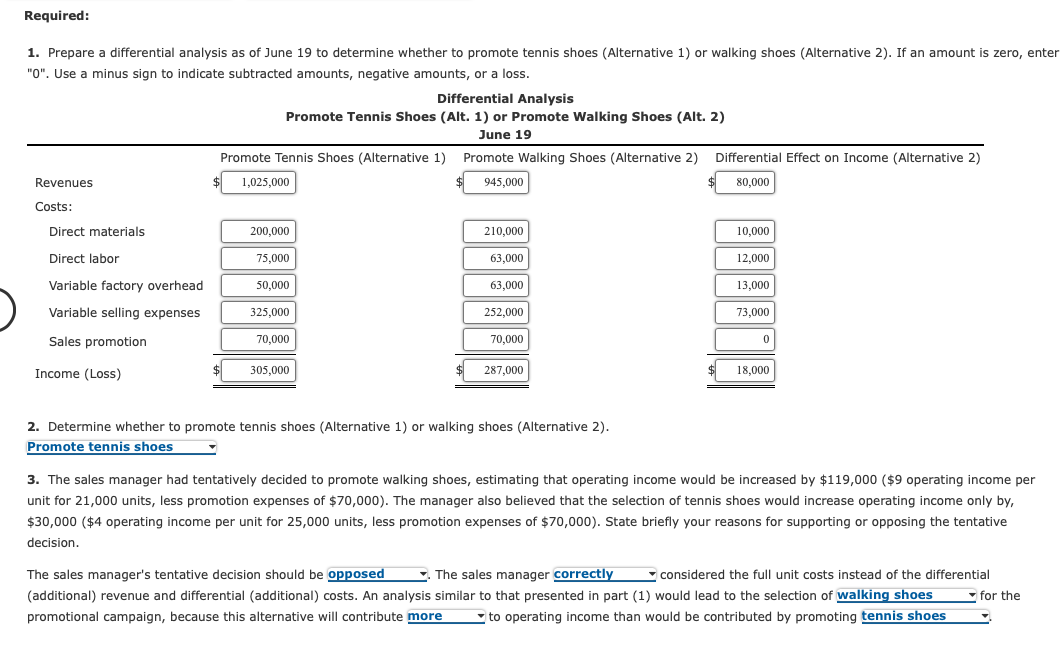

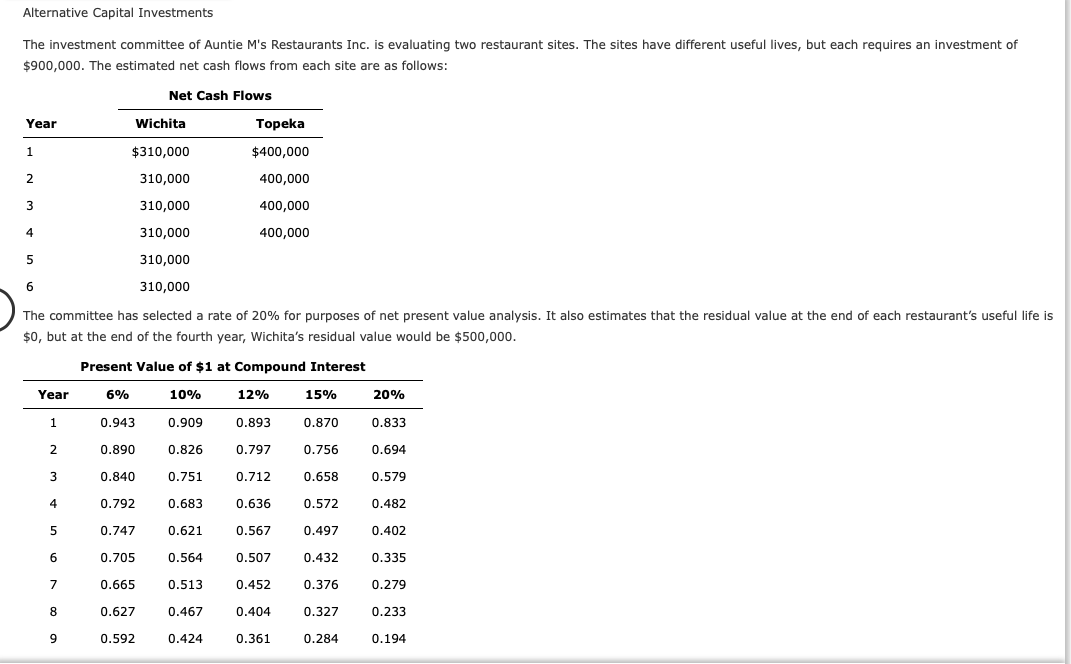

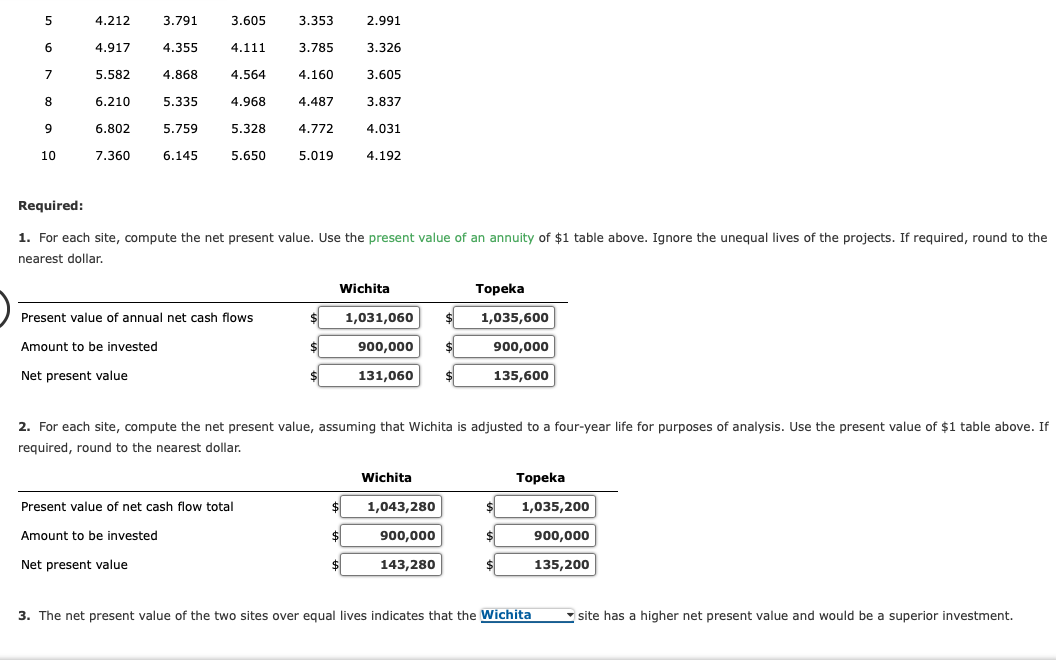

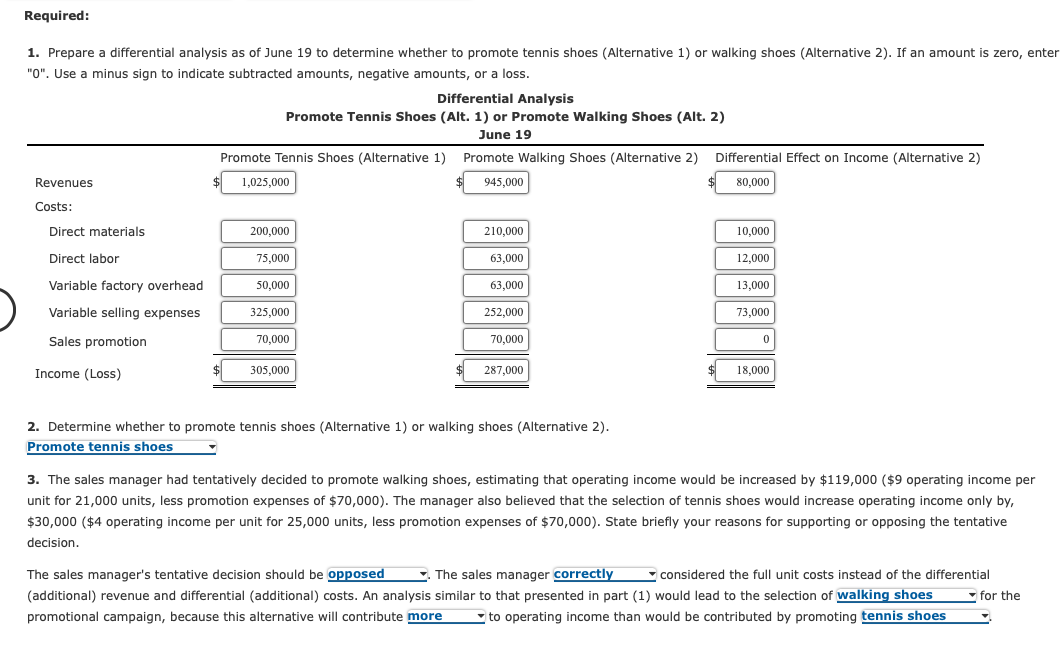

Alternative Capital Investments The investment committee of Auntie M's Restaurants Inc. is evaluating two restaurant sites. The sites have different useful lives, but each requires an investment of $900,000. The estimated net cash flows from each site are as follows: The committee has selected a rate of 20% for purposes of net present value analysis. It also estimates that the residual value at the end of each restaur $0, but at the end of the fourth year, Wichita's residual value would be $500,000. 1. For each site, compute the net present value. Use the present value of an annuity of $1 table above. Ignore the unequal lives of the projects. If required, round to the nearest dollar. 2. For each site, compute the net present value, assuming that Wichita is adjusted to a four-year life for purposes of analysis. Use the present value of $1 table above. If required, round to the nearest dollar. 3. The net present value of the two sites over equal lives indicates that the site has a higher net present value and would be a superior investment. 1. Prepare a differential analysis as of June 19 to determine whether to promote tennis shoes (Alternative 1) or walking shoes (Alternative 2 ). If an amount is zero, ente "0". Use a minus sign to indicate subtracted amounts, negative amounts, or a loss. 2. Determine whether to promote tennis shoes (Alternative 1) or walking shoes (Alternative 2). 3. The sales manager had tentatively decided to promote walking shoes, estimating that operating income would be increased by $119,000 ( $9 operating income per unit for 21,000 units, less promotion expenses of $70,000 ). The manager also believed that the selection of tennis shoes would increase operating income only by, $30,000 ( $4 operating income per unit for 25,000 units, less promotion expenses of $70,000 ). State briefly your reasons for supporting or opposing the tentative decision. The sales manager's tentative decision should be The sales manager considered the full unit costs instead of the differential (additional) revenue and differential (additional) costs. An analysis similar to that presented in part (1) would lead to the selection of ! for the promotional campaign, because this alternative will contribute to operating income than would be contributed by promotins